Loan Halts and Rising Interest Rates

Agribank has recently announced the suspension of several loan programs and preferential policies for individual customers, including the home loan program tailored for young buyers. The bank has also halted its preferential loan scheme for purchasing, transferring land use rights, constructing, renovating, and completing residential properties.

Previously, Agribank launched a preferential loan package for individuals under 35, offering home loans starting from April 2, 2025. The maximum loan amount was 5 billion VND, with a repayment period of up to 40 years. The fixed interest rate was 6.3% for the first 18 months, and borrowers could defer principal payments for up to 5 years.

Agribank’s announcement to suspend the preferential loan program for young home buyers.

A credit officer from BIDV also confirmed that the bank’s preferential loan program for young buyers of commercial housing has been temporarily suspended. Previously, individual customers up to 35 years old could access a fixed interest rate of 5.5% per year for the first 3 years, with a loan term of up to 40 years and no principal repayment required for the first 5 years, applicable to a maximum loan amount of 5 billion VND per customer.

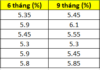

Conversely, some banks continue to offer preferential loan packages for young buyers but with adjusted interest rates. At Vietcombank, credit officers report that the interest rate for young borrowers has increased to 7.3% per year during the preferential period, up from the previous rate below 6% per year. Standard loan packages now offer a 7.5% interest rate for the first 6 months, rising to 8.3% for the subsequent 12 months.

Commercial banks such as BVBank, SHB, HDBank, and ACB still provide preferential loan packages for young buyers, but interest rates are now flexible depending on the type of property and the period, no longer maintaining the previously low interest rate levels.

The suspension of low-interest loan packages for young buyers comes amid rapid credit growth and rising input interest rate pressures. Some existing borrowers have reported receiving notifications from banks about interest rate increases.

Meanwhile, floating interest rates for home loans at many banks range from 10% to 14% per year.

Many experts argue that the prolonged situation of “credit growing faster than deposits” is putting pressure on liquidity and interest rates at the end of the year.

Warning of High Real Estate Credit Growth

Economist Nguyễn Trí Hiếu warns that housing prices are exceeding the affordability of most citizens. This has led to increasing inventory levels and poor market liquidity, yet prices remain unchanged.

According to Hiếu, the State Bank of Vietnam’s report as of the end of October showed that total credit growth across the system had increased by approximately 15% compared to the end of the previous year, with projections reaching 19-20% by year-end, the highest in many years. Real estate credit accounts for nearly 24% of the total outstanding debt in the economy. Specifically, loans for real estate business have grown by nearly 24%, double the growth rate of consumer loans.

“In the U.S., real estate credit growth is around 10-15%. If this rate reaches 15%, regulatory bodies become concerned, but in Vietnam, it has reached 24%. Rising deposit interest rates are increasing the cost of capital for home buyers. It is necessary to tighten real estate credit to reduce its proportion to below 20% of total outstanding debt,” Hiếu stated.

Recently, at the “Building a Healthy and Sustainable Real Estate Market 2025” Forum, Dr. Nguyễn Đức Kiên, a member of the National Monetary Policy Advisory Council, pointed out that credit growth this year is very high, with real estate credit growth reaching 24%, and some banks even seeing a 28% increase in real estate lending.

“To ensure stability, the State Bank of Vietnam will conduct inspections and audits of credit balances at selected banks from now until the end of the year. Some small banks with a 28% growth in lending are a cause for alarm,” Kiên warned.

Banks Suddenly Halt Housing Loan Incentives for Young Buyers

Several banks have halted preferential loan packages for young homebuyers, while others continue to offer mortgages with slightly increased interest rates.

Gold Debtor Owes 100 SJC Taels, Bank Seeks Recovery Methods

Two substantial debts, amounting to tens of billions of dong, along with a significant quantity of SJC gold belonging to two individual customers at Agribank’s Ho Chi Minh City branch, have remained unresolved for years. The bank has recently announced the continuation of the auction process for these two debts.

The Fate of the Billionaire Hứa Thị Phấn’s Mega Project

Unveiling the fate of a mega-project in Bình Chánh district (formerly), Ho Chi Minh City, once leveraged by tycoon Hứa Thị Phấn to secure bank loans, remains a compelling question that demands attention. What has become of this ambitious venture?