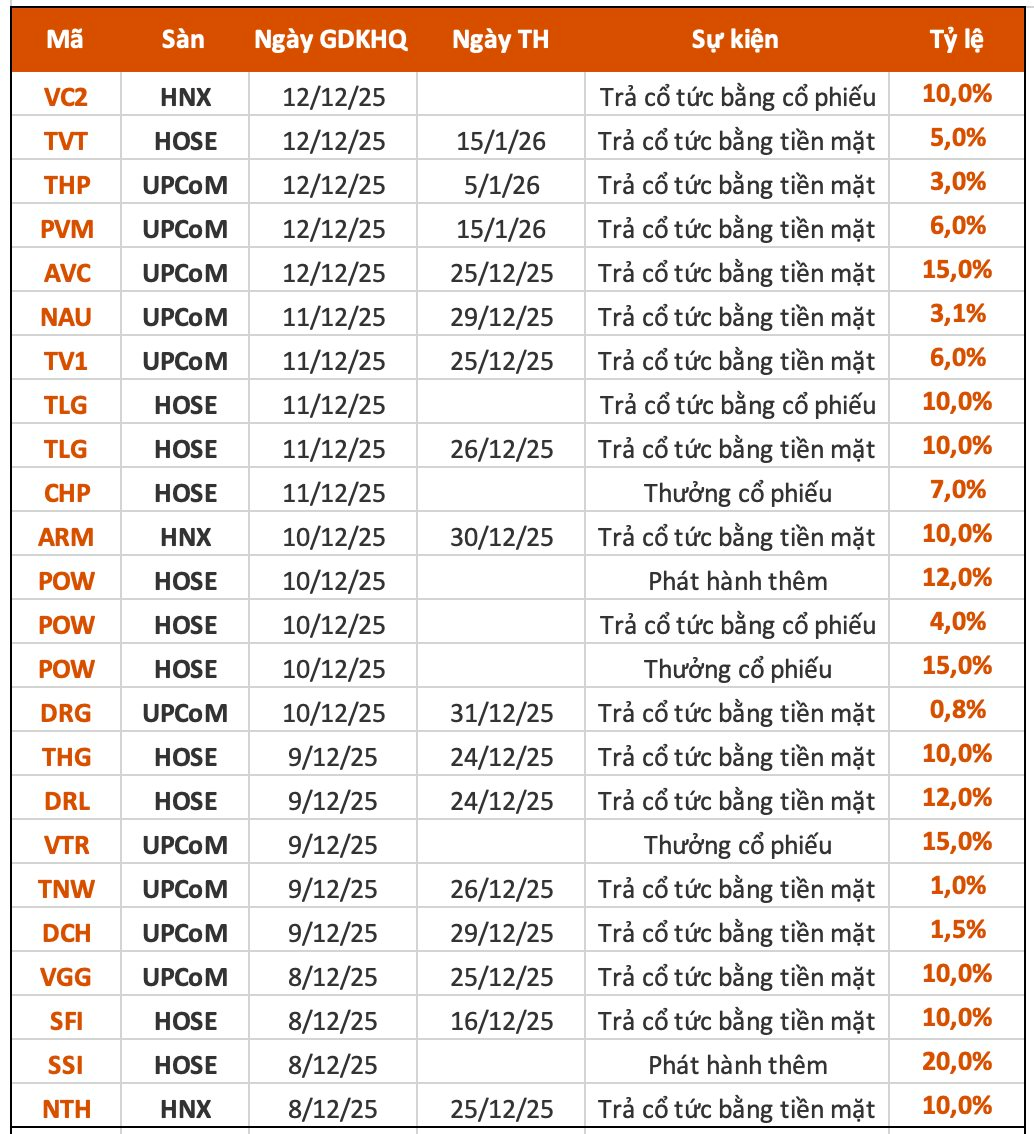

According to recent statistics, 24 companies announced dividend rights issuances for the week of December 8–12. Among these, 16 companies are distributing cash dividends, with the highest rate at 15% and the lowest at 1%.

Additionally, 2 companies are issuing new shares, 3 are offering bonus shares, and 3 are paying cash dividends this week.

A Vuong Hydropower JSC (AVC) recently announced that it will finalize the shareholder list for the remaining 2024 dividend distribution on December 15. The company will pay a cash dividend at a rate of 15% (equivalent to VND 1,500 per share), with payment scheduled for December 25, 2025.

With over 75 million outstanding shares, A Vuong Hydropower is expected to allocate approximately VND 112 billion for this dividend payment. Within the company’s shareholder structure, EVNGenco2 holds 87.45% of AVC’s capital, corresponding to over 65.6 million shares, and will receive more than VND 98 billion in dividends.

Earlier, in March 2025, the company paid an interim dividend of 5%. Combined, A Vuong Hydropower will complete a total dividend payout of 20% for the 2024 fiscal year.

Thien Long Group Corporation (TLG) announced a dual dividend distribution totaling 20%, comprising 10% in bonus shares and 10% in cash. The final registration date is December 12, 2025, with payment expected on December 26, 2025.

Specifically, the company will issue nearly 8.8 million shares as a dividend for 2024, at a ratio of 10:1. The issuance value, based on par value, amounts to nearly VND 87.8 billion, sourced from undistributed after-tax profits. Post-issuance, Thien Long’s chartered capital is projected to increase from VND 877.5 billion to nearly VND 965.3 billion.

Simultaneously, the company will allocate approximately VND 87.8 billion for an interim cash dividend for 2025. The total dividend value for this round is approximately VND 175.6 billion, equivalent to nearly half of Q3 profits.

SSI Securities Corporation (SSI, HoSE) announced that it will finalize the shareholder list on December 9 to execute the rights issue of additional shares under the Public Offering Registration Certificate No. 445/GCN-UBCK, issued by the State Securities Commission on November 21, 2025.

SSI plans to issue 415.18 million shares at VND 15,000 per share. The rights ratio is 5:1, meaning shareholders holding 5 shares can purchase 1 newly issued share. The shares are unrestricted for transfer. The registration and payment period is from December 17, 2025, to January 8, 2026, with rights transferable from December 17–30, 2025.

Upon completion of the offering, SSI’s chartered capital will increase from over VND 20,779 billion to nearly VND 24,932 billion, reclaiming the top position in chartered capital within the securities industry.

Listed Company “Goes Big” with Massive Dividend Payout of Over 16,600 VND per Share for Year-End

At the 2025 Annual General Meeting of Shareholders held in late June, the company approved a cash dividend payout plan for 2024, boasting an impressive dividend rate of up to 200%.