With nearly 45 years of continuous growth, Thien Long stands as Vietnam’s leading stationery manufacturer, boasting a presence in 74 countries.

The announcement of Japan’s Kokuyo Group planning to invest 27.6 billion yen (approximately VND 4,700 billion) to acquire ownership stakes related to Thien Long Group (HoSE: TLG) has sparked market interest. Beyond the transaction’s scale, the spotlight falls on Thien Long’s position as Vietnam’s top stationery producer, with nearly 45 years of uninterrupted growth, a presence in 74 countries, and a dominant market share in the domestic writing instrument industry.

According to a December 4th announcement, Thien Long’s Board of Directors revealed that shareholders of Thien Long An Tam Production and Trading Co., Ltd. (TLAT) are negotiating and finalizing terms to transfer shares to Kokuyo. If successful, the Japanese conglomerate will own TLAT, a crucial link in Thien Long’s production ecosystem. Concurrently, Kokuyo announced plans for a public tender offer to acquire up to 18.19% of TLG shares. Upon completion, the Japanese investor’s ownership could reach approximately 65%, marking a significant shift in the shareholder structure of this over-four-decade-old Vietnamese enterprise.

In communications to shareholders and the market, Thien Long emphasized that ongoing negotiations have not impacted operations. Production, distribution, and services remain normal, with no changes to personnel or policies.

While Thien Long had not previously disclosed any information about the deal, a notable aspect is the consistent perspective of founder Co Gia Tho. He previously stated that the company frequently engages with foreign funds since its listing, but maintains a policy of cooperation without joint ventures or compromising its Vietnamese identity.

According to Mr. Tho, in an open market, the focus is not on “being acquired or not,” but on establishing cooperative mechanisms that expand market reach and mutually enhance technical, technological, and distribution capabilities. These insights, coupled with Kokuyo’s public tender offer announcement, indicate that Thien Long is entering a deeper phase of integration into the global value chain.

From a “Ballpoint Pen Workshop in the Subsidy Era” to a Vietnamese Brand in 74 Countries

Founded in 1981, Thien Long began as a small production facility during a time of consumer goods scarcity post-unification. The founder, from a large family, started by collecting pens from small workshops for distribution. From this small-scale trading, he accumulated capital and transitioned to self-production—the precursor to today’s enterprise. This model exemplifies the family-based economy typical of the pre-Doi Moi era.

Mr. Co Gia Tho, Thien Long’s founder, began by collecting pens from small workshops for distribution.

The real transformation occurred after 1986, when the Doi Moi policy encouraged private enterprise. In the late 1990s, the company made a decision that Mr. Co Gia Tho still considers “the right direction”—becoming one of the first to relocate its factory to Tan Tao Industrial Park after participating in Ho Chi Minh City’s capital support programs for businesses committed to expanding employment. The standardized production space included R&D zones, specialized production lines, wastewater treatment, and a quality management system. This shift propelled the company from handicraft production to an industrial approach.

Throughout its development, Thien Long continuously adapted its legal structure to align with economic phases. The company evolved from a sole proprietorship to a cooperative, then a limited liability company (LLC), before becoming a publicly traded joint-stock company listed on HoSE in 2010.

“Thien Long has navigated various economic systems, learning much along the way. I feel very fortunate to live in a country that develops daily, which motivates me to grow both personally and professionally,” Mr. Tho shared in a media interview.

Building on its domestic foundation, Thien Long expanded globally, establishing a presence in 74 countries and achieving a dominant market share in Vietnam’s writing instrument industry.

An Empire Built from Two Taels of Gold

Starting with just two taels of gold in the early 1980s, Thien Long has achieved notable capital increase milestones. From an LLC, the company successfully transitioned to a joint-stock company between 2005 and 2007 with a charter capital of VND 100 billion, later increased to VND 120 billion, and expanded its subsidiary network.

In 2008, Thien Long conducted an IPO, raising its charter capital to VND 155 billion. This new capital enabled the company to expand production lines, strengthen distribution networks, and build a more professional brand image. Two years later, Thien Long listed on HoSE and officially renamed itself Thien Long Group. The listing marked a period of strong market share growth; the company rose to lead the domestic stationery industry, capturing approximately 60% of the writing instrument market, and began exporting to regional markets.

By 2018, Thien Long’s charter capital had grown to VND 657 billion. This phase saw the company largely complete its Southeast Asian export map and shift from a domestic manufacturer to a regionally focused enterprise. In 2019–2020, the establishment of FlexOffice Pte. Ltd. in Singapore signaled a move toward an international commercial “network” model, while charter capital increased to VND 778 billion to support market expansion, distribution network development, and enhanced competitiveness.

Starting with just two taels of gold in the early 1980s, Thien Long has achieved notable capital increase milestones.

By 2023, Thien Long’s charter capital reached VND 786 billion, with its export network expanding to over 70 countries. After multiple bonus share issues and dividends, the company’s charter capital stood at over VND 877 billion as of October 2025. Thien Long’s Board of Directors has set December 12, 2025, as the dividend record date, and following the next issuance, charter capital is expected to exceed VND 965 billion.

In terms of business performance, data from 2006 shows that Thien Long consistently grew revenue and profits until the COVID-19 period and 2023. Revenue surpassed VND 1,000 billion in 2011, and profit exceeded VND 100 billion in 2012. 2024 marked a record high with revenue reaching VND 3,772 billion and profit at VND 460 billion.

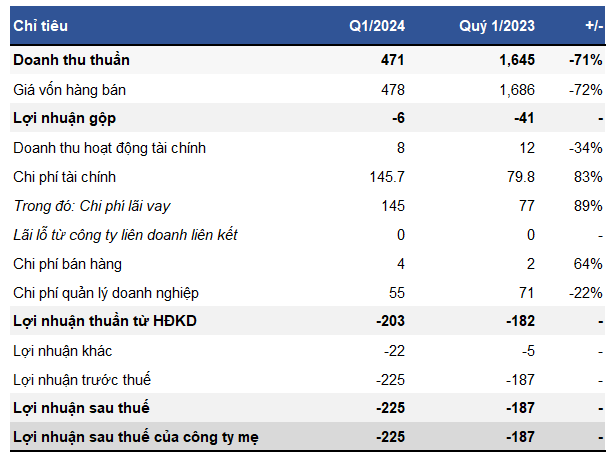

In the first nine months of 2025, Thien Long reported revenue of approximately VND 3,238 billion, up nearly 11% year-on-year. Third-quarter revenue alone reached VND 1,184 billion, a 32% increase. However, third-quarter after-tax profit was VND 75.7 billion, down 17% year-on-year; nine-month cumulative profit was VND 375 billion, down nearly 11%.

The company attributed the results to improved export markets, adding VND 59 billion in revenue after overcoming challenges in key markets. Domestically, however, increased sales expenses due to demand stimulation and distribution network strengthening reduced profits.

“Pen King” Thien Long Falls into Japanese Hands: Extending the List of Vietnamese Brands Acquired by Foreign Entities

With the announcement from Japan’s Kokuyo Group regarding its acquisition of Thien Long Group Corporation, a beloved Vietnamese stationery brand is set to come under foreign ownership.