Illustrative image

Copper prices surged to unprecedented highs during the December 5th trading session, as markets reacted to global supply shortages and anticipation of a Federal Reserve interest rate cut next week. This momentum underscores the robust rally in this critical industrial metal.

In the European afternoon session, London Metal Exchange (LME) copper futures climbed 1.6% to $11,617 per ton, after hitting an intraday peak of $11,705. Year-to-date, copper has soared over 32%, emerging as one of the standout performers in the commodities market.

JPMorgan attributes the recent price surge to supply disruptions, but highlights critically low global inventories and strong U.S. demand as the primary drivers for continued upside in the coming quarters. LME warehouse stocks have plummeted below 100,000 tons—a level historically associated with significant backwardation where spot prices exceed longer-dated futures.

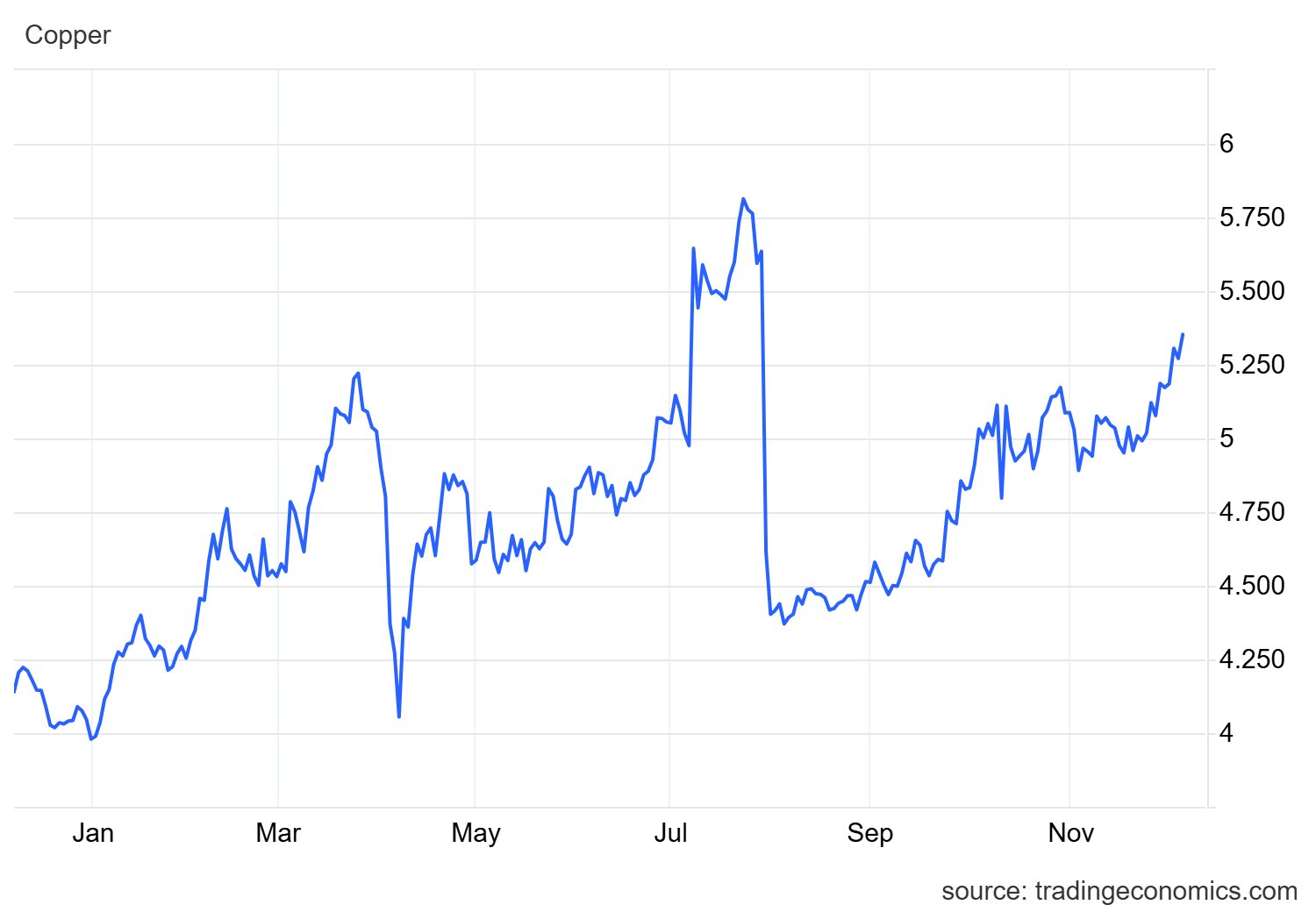

Copper price trends over the past year.

Supply pressures are further exacerbated by traders rushing to ship metal to the U.S., amid fears of potential new import tariffs under the Trump administration. This shift is depleting stocks elsewhere, intensifying global shortages.

Additional supply shocks from major mines in Indonesia, Chile, and Congo have disrupted output, raising concerns about market balance amid expanding demand.

Macroeconomic factors, including expectations of Fed rate cuts, are also supportive. Lower interest rates typically stimulate economic activity, boosting demand for industrial metals.

Citi forecasts copper averaging $13,000 per ton in Q2 2024, citing U.S. inventory builds creating deficits elsewhere, while constrained mine supply struggles to meet surging demand—particularly from AI infrastructure and energy transition sectors.

Copper demand has skyrocketed in recent years due to its essential role in electric vehicles, smartphones, power grids, and renewable energy panels. Widespread electrification and AI data center expansion are fueling a new demand supercycle, solidifying copper’s bullish outlook.

Is the Stock Market Set for a Breezier December?

The VN-Index concluded November with its second consecutive weekly gain, edging closer to the 1,700-point milestone. However, weak liquidity and a zigzagging upward trend indicate cautious investor sentiment. As we enter the final month of the year, the market is anticipated to turn more positive, yet significant volatility remains likely due to heightened pressure from portfolio rebalancing and NAV (net asset value) closures.

Gold Ring Prices Drop at Close on November 26th

A leading gold retailer has slashed the price of gold rings by VND 400,000 per tael compared to this morning’s trading session.