Various regions are seeking new momentum, businesses are anticipating a more favorable investment environment, and international investors are closely monitoring Vietnam’s institutional reforms to make decisions.

|

Various regions are seeking new momentum, businesses are anticipating a more favorable investment environment, and international investors are closely monitoring Vietnam’s institutional reforms to make decisions.

In this context, the draft amended Investment Law (recently submitted by the Government to the National Assembly at the ongoing 10th Session) is seen as a strategically significant step to establish a transparent, open, and modern regulatory investment-business environment. This is not just an investment law but a crucial foundation for how the economy will operate in the coming years.

Bottlenecks from practical experience are demanding change.

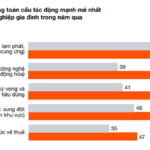

Looking back at the recent period, it’s evident that complications in investment procedures and the lack of synchronization in related legal systems have created significant obstacles to development. This is not a subjective perception but a reality consistently reflected by many localities, businesses, and research institutions.

First, procedural delays are excessive. According to feedback from many localities, some projects take 12 to 24 months to complete the investment approval process, even when legal issues are not significant. A provincial leader shared, “Our capacity is not lacking, but procedures delay progress beyond expectations. Many investors return to ask why so much time is spent on pre-inspection procedures.” The Provincial Competitiveness Index (PCI) reports in recent years also show that “administrative procedures and legal overlaps” are consistently among the top three barriers to the business environment.

Second, business conditions remain complex and outdated. Despite efforts to reduce them, some industries no longer requiring strict management are still listed as conditional businesses. This inadvertently maintains the petition mechanism, increases informal costs, and hinders new business models. The Vietnam Chamber of Commerce and Industry (VCCI) and experts have repeatedly recommended significantly reducing business conditions in many industries, as current conditions are deemed unsuitable for practical needs.

Third, the current policy framework is insufficiently attractive for high-tech industries. In the global race for semiconductors, AI, green technology, and low-carbon manufacturing, countries design flexible incentive mechanisms and legal frameworks. Many major investors state, “We highly value Vietnam’s potential but desire incentives and procedures compatible with the tech industry’s pace.” Without timely reforms, Vietnam risks missing high value-added capital flows—a critical factor for future growth.

Fourth, overlapping laws create procedural loops. An investment project must comply with the Investment Law, Land Law, Planning Law, Environmental Protection Law, Fire Prevention and Fighting Law, and Procurement Law, among others. Any inconsistency—such as delayed planning, land pricing, or environmental criteria—can stall the entire project. Some localities frankly note, “It’s not that we don’t want to move quickly, but we must wait for procedures from various laws.”

These realities are not just issues for businesses or localities but for national competitiveness. Without timely resolution, the opportunity cost to the economy will be significant. Thus, this amendment to the Investment Law is urgent: it not only addresses specific issues but also reshapes the entire investment process, creating a seamless legal foundation for the country’s new development phase.

For the first time, high-tech, digital economy, and green economy sectors are established as the focus of investment incentives.

|

Key Innovations in the Amended Investment Law

Long-standing bottlenecks highlight the urgent need to restructure the investment process, shifting focus from “input control” to “risk management and efficiency enhancement.” The draft amended Investment Law embodies this spirit with five key reform groups, fundamentally transforming the economy’s operational model.

1. Drastically reduce pre-inspection procedures, accelerating project deployment. One of the most significant innovations is significantly narrowing the group of projects requiring investment approval, retaining only those with substantial impacts on land, environment, defense-security, or strategic resources. Ordinary projects, especially in manufacturing, trade, and services, are shifted to registration and post-inspection mechanisms.

This change is foundational because: (a) Project preparation time is significantly reduced, helping businesses seize timely opportunities. Each month of procedural reduction frees up trillions of dong for production and business; (b) It avoids “opportunity delays,” the biggest risk in the context of intense FDI competition and rapid supply chain shifts; (c) It reduces petition space and limits harassment by minimizing unnecessary administrative contacts; (d) It signals stability and transparency to domestic and foreign investors—a top priority in their destination choices.

This reform not only accelerates project initiation but also reflects a crucial mindset shift: the State moves from a controlling gatekeeper to an enabler and transparent supervisor.

2. Narrow dozens of conditional business sectors—expand the space for free business. A mature economy must gradually reduce reliance on business conditions and enhance transparency, competition, and post-inspection. The amended Law is on the right track by: abolishing about 25 industries no longer needing conditions (with the Government reviewing to potentially abolish at least 50 more); narrowing the scope of 20 other industries to eliminate outdated, vague, or unsuitable criteria.

This change is highly significant. It respects the constitutional right to free business—a market economy foundation; increases creativity and competition for businesses, especially SMEs heavily affected by complex conditions; reduces “soft barriers” where informal costs and market distrust arise.

This step aligns with the international trend of less but more accurate and effective management.

3. Strongly prioritize high-tech, innovation, and green economy. For the first time, high-tech, digital economy, and green economy sectors are established as the focus of investment incentives. This reflects long-term vision: Vietnam’s future breakthroughs depend on knowledge, technology, and innovation.

These priorities enhance our appeal to leading semiconductor, AI, biotechnology, and low-carbon technology firms; open opportunities for Vietnamese businesses to deeper engage in shifting global value chains; and embrace green development—an increasingly important criterion in international trade, investment attraction, and market access.

This shifts from broad capital attraction to high value-added resource attraction, aligning with the country’s long-term development goals.

4. Facilitate foreign investors—boost Vietnam’s competitiveness. Allowing foreign investors to establish businesses before completing investment registration procedures aligns with OECD and international practices.

This reduces market entry costs, especially in technology, digital services, and e-commerce; increases administrative process predictability, helping investors plan more effectively; and enhances Vietnam’s image as an open, innovation-friendly economy.

In intense regional competition, procedural speed and clarity are strategic advantages.

5. Enhance enforcement discipline—protect public resources and market order. Alongside “opening the way,” the law “tightens” necessary steps to ensure resource efficiency. New regulations on project timelines, extensions, and transfers filter out incapable investors, prevent project speculation or prolonged land holding, enhance land and public resource efficiency, and protect genuine investors.

Balancing “input relaxation” with “enforcement tightening” creates a healthy, stable, and sustainable investment environment.

Early adoption: benefits for the next decade

Promptly finalizing and enacting the amended Investment Law not only resolves immediate issues but also creates strategic ripple effects for the 2025-2035 development phase. Reform speed can determine the nation’s ability to seize opportunities.

1. Drive short-term economic recovery and acceleration. Streamlined procedures and clarified processes will immediately “activate” numerous projects in industry, urban development, infrastructure, and services. Many localities predict that reducing investment approval procedures alone could shorten project preparation by months, creating jobs, increasing output, and significantly contributing to economic growth.

2. Simultaneously unleash private investment and FDI. A stable, transparent legal framework empowers localities in project approvals. For private businesses, legal clarity boosts confidence to expand production and launch new projects. For FDI, an improved investment environment is a “green signal” showing Vietnam’s readiness for large-scale, high-tech projects.

3. Strengthen market confidence—key to sustainable recovery. Amid global economic volatility, businesses highly value policy stability and predictability. Early National Assembly approval of the amended Investment Law will create a crucial “psychological anchor,” affirming the State’s reform commitment and bolstering business confidence in recovery prospects.

4. Boost competitiveness in attracting future tech industries. The investment shift is strongly directed toward markets offering fast procedures, transparent institutions, and clear high-tech priorities. Timely reforms position Vietnam as a top destination for semiconductor, AI, and green technology firms. Delay risks ceding opportunities to regional competitors.

A law to pave the way for the future

The amended Investment Law is not just about improving procedures or resolving immediate challenges. More importantly, it lays the foundation for Vietnam’s new development model—where speed, transparency, and business creativity drive growth.

Early adoption of this law demonstrates the State’s reform resolve, partnership with businesses, and long-term vision for the nation’s future. With a streamlined institution, capital will naturally flow; with strengthened confidence, the economy’s strength will surge.

Dr. Nguyen Si Dung

– 06:47 07/12/2025

Vietnam Plans to Establish Free Trade Zones in Three Centrally-Governed Cities by 2026

By 2026, Vietnam plans to establish free trade zones in Da Nang, Hai Phong, and Ho Chi Minh City. The vision extends to 2045, aiming for 8-10 internationally accredited free trade zones and similar models nationwide.

Prime Minister’s Critical Directive on Salaries and Allowances for Officials and Civil Servants

The Ministry of Home Affairs is tasked with urgently submitting to the competent authorities the necessary documents to implement Conclusion 206 of the Politburo regarding salaries, allowances, and the reorganization of the apparatus and local government structures at two levels, to be presented no later than December 15, 2025.