Recently, Van Dien Superphosphate Joint Stock Company (Van Dien Superphosphate, Stock Code: VAF, HoSE) has officially notified the State Securities Commission (SSC), Ho Chi Minh City Stock Exchange (HoSE), and its shareholders that the company no longer meets the criteria for a public company.

The primary reason cited by Van Dien Superphosphate is its failure to comply with the shareholder structure requirements for public companies. Specifically, the proportion of voting shares held by at least 100 non-major investors stands at only 8.47%, falling short of the mandated minimum of 10% as stipulated by law.

Illustrative image

According to the consolidated list provided by the Vietnam Securities Depository (VSD) on December 1, 2025 (with a record date of November 28, 2025), Van Dien Superphosphate has 446 shareholders, including domestic and foreign individuals and organizations.

Among these, the state-owned Vietnam Chemical Group (Vinachem) holds nearly 25.3 million shares, representing 67.06% of the charter capital; Hoang Ngan LLC owns over 9.2 million shares, equivalent to 24.47%; while the remaining 444 shareholders collectively hold approximately 3.2 million shares, accounting for 8.47% of the capital.

As a result of no longer qualifying as a public company, Van Dien Superphosphate faces the prospect of delisting from the stock exchange.

Previously, in August 2025, HoSE had issued a warning regarding the potential mandatory delisting of VAF shares if the 2025 audited financial report continued to receive a qualified opinion.

In terms of business performance, for the first nine months of 2025, Van Dien Superphosphate recorded net revenue of nearly VND 1,320.9 billion, a 26.1% increase compared to the same period in 2024; post-tax profit reached over VND 100.4 billion, up 161.5% year-on-year.

As of September 30, 2025, the company’s total assets decreased by 5.8% from the beginning of the year to over VND 1,010.1 billion. This includes cash and cash equivalents of nearly VND 279.4 billion, constituting 27.7% of total assets; inventory of approximately VND 160.4 billion; and long-term work in progress of over VND 36.5 billion.

On the liabilities side, total payables stood at over VND 432.5 billion, a 21.5% reduction from the start of the year. Of this, loans and finance leases amounted to nearly VND 100.7 billion, representing 23.3% of total liabilities.

Foreign Block’s Massive $42M Sweep: Snapping Up Bank Stocks in December 4th Trading Frenzy

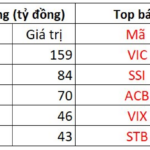

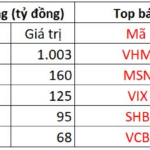

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 1.086 trillion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.

Record Foreign Inflow: Investors Pour $146 Million into Billionaire Pham Nhat Vuong’s Stocks on December 3rd

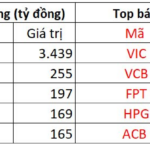

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately VND 3.745 trillion. This substantial investment demonstrates their confidence in the market’s potential and serves as a positive indicator for future growth.