Netflix’s recent $72 billion acquisition of Warner Bros.’ film and television division has sparked immediate market backlash. While Netflix has successfully pivoted in the past, this bold move has investors questioning whether the company is straying from the model that cemented its dominance in streaming.

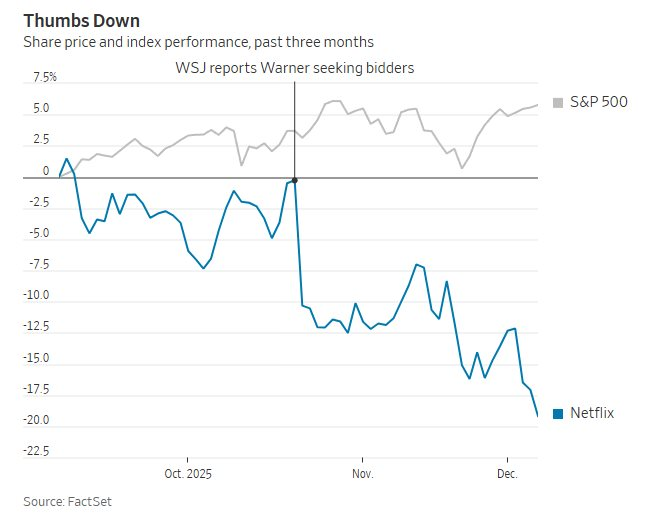

Netflix’s stock dropped nearly 3% on the announcement day, extending a 17% decline since its Q3 earnings report in late October, when rumors of the Warner acquisition first surfaced.

A Sudden Shift and a Hefty Price Tag

At $72 billion, this deal dwarfs all of Netflix’s previous acquisitions and doubles Warner Bros Discovery’s entire market cap as of early September 2025. Netflix has never spent more than $700 million on a single acquisition, and the fact that most of this deal will be paid in cash raises concerns, given the company generates only about $9 billion in free cash flow annually.

More critically, Netflix is embracing an entirely new business model. Once Warner Bros is spun off from its TV division next year, Netflix will step into the role of a traditional Hollywood studio, producing theatrical films and TV shows for rival platforms—a stark contrast to its long-standing strategy of self-producing exclusive content.

Netflix’s Stock Performance vs. S&P 500

Venturing into theatrical releases also exposes Netflix to public box office failures, a stark contrast to the closed-data model of streaming, where performance metrics remain private.

Experts argue that the acquisition shifts Netflix from a clear, consistent growth strategy to a more complex and risky path. The move to acquire rather than build also breaks from the company’s tradition. While Co-CEO Greg Peters insists past media mergers failed due to buyers’ lack of industry understanding, this does little to quell the significant questions Netflix now faces.

One major challenge lies in managing HBO and Warner’s flagship brands. Netflix vows to maintain production and licensing operations, but this creates conflicts with other streamers reliant on Warner’s content. If Netflix reserves top titles for itself, backlash from competitors and antitrust scrutiny are inevitable.

Pricing is another sensitive issue. Combining Netflix and HBO’s premium brands could justify higher subscription fees, but this would invite intense legal scrutiny.

In theatrical distribution, the risks are even greater. Warner Bros releases more films annually than any other studio, and any cuts by Netflix could alienate Hollywood’s creative community. Shares of theater chains like AMC Entertainment, Cinemark, and IMAX fell sharply on the deal’s announcement, reflecting fears for the industry’s future.

Regulatory Hurdles and Fierce Competition

Beyond business challenges, the Netflix-Warner Bros deal faces rigorous regulatory reviews, as authorities closely monitor Netflix’s growing influence. Market definitions will be pivotal: while Netflix boasts over 300 million paid subscribers, its viewing hours still lag far behind YouTube.

Competition remains fierce. Paramount Skydance, a well-connected rival with aggressive expansion plans, is unlikely to concede easily. The $5.8 billion termination fee Netflix would owe if the deal collapses underscores the agreement’s enormous risks.

Concerns over strategy, finances, competition, and regulation have led analysts to label this a perilous turning point for Netflix. Many have downgraded the stock, arguing the company is sacrificing the stability and focus that fueled its success.

While Netflix may have won the streaming wars, the Warner Bros acquisition opens a new front where even leaders can misstep. Given the deal’s size, risks, and potential political delays in approval, the market’s skepticism is clear: Netflix’s new ambition may leave deeper scars than immediate gains.

Sources: WSJ, Fortune, BI

Unveiling the Billion-Dollar Livestream Shopping Empire: Navigating the Legal Gray Area

Unleash explosive revenue growth, job creation, and the shaping of new consumer trends—the livestream economy is emerging as a multi-billion-dollar empire. Yet, its unchecked growth is pushing influencers into a legal gray area, where the line between creativity and commerce grows increasingly blurred.