Bank Stocks Experience Flash Recovery

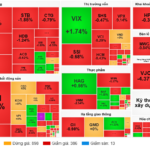

While early November saw all bank stocks lose their short-term momentum, early December brought positive signs as the VN-Index rebounded above 1,700 points. Notably, during the previous week’s session (December 4), over 80% of bank stocks regained their short-term upward trend.

However, this “flash recovery” was short-lived. By December 9, the percentage of stocks maintaining their upward momentum had dropped below 40%. The top performers were CTG, MBB, HDB, ABB, and KLB.

The breadth of the banking sector has been highly volatile over the past two weeks of trading.

|

The rapid retreat of bank stocks reflects the reality that many have yet to fully recover from the correction phase following the recent upgrade wave.

Statistics show that 25 out of 27 stocks have fallen more than 10% from their peaks, with 14 stocks like VPB, STB, VIB, OCB, and TCB dropping over 20%—equivalent to a “bear market.”

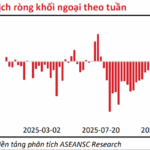

According to Mr. Bùi Văn Huy, Director of Investment Research, FIDT JSC, a notable positive in the first week of December 2025 was foreign investors reversing to net buying, with an estimated value of VND 4,490 billion, marking the first net buying week after 20 consecutive weeks of net selling.

“This capital inflow emerged just as the index approached historical highs, serving as a significant psychological boost for domestic investors,” Mr. Huy noted.

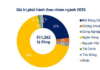

Capital flowed strongly into several large-cap stocks, notably VPL from the Vingroup, alongside leading bank and consumer stocks like MBB, VNM, MWG, and VPB. This indicates foreign investors are prioritizing large-scale enterprises with high liquidity, clear profit growth stories, and potential to become index pillars.

Secondly, this net buying occurred after many Bluechips had significantly adjusted their valuations, while exchange rate risks diminished due to flexible management measures. This can be seen as a signal-oriented capital inflow, not yet large in scale compared to year-to-date net selling, but indicative of a shift. It suggests some foreign investors have a more positive medium-term outlook on Vietnam’s market.

However, domestic investors should not view foreign capital as the sole determining factor.

“History shows foreign investors can quickly change their stance amid international volatility. The key is to interpret the message correctly: their return to buying leading stocks implies current valuations and macroeconomic fundamentals are attractive in their eyes. Individual investors can reference this direction when building portfolios but must maintain discipline in entry/exit points and portfolio management,” Mr. Huy emphasized.

Liquidity Under Strain: Short-Term Risk or Accumulation Opportunity?

Developments in the interbank market since late November have also caught analysts’ attention. Mr. Nguyễn Thế Minh, Director of Retail Research and Development, Yuanta Securities Vietnam, noted the primary cause is banks simultaneously pursuing two goals: boosting credit and replenishing liquidity at a time when corporate deposits are low and public investment disbursement is slow.

Performance of the VN-Index and Vietnam’s 5-year CDS – Source: Bloomberg

|

However, Mr. Minh noted that Vietnam’s 5-year CDS rate remains low, reflecting stable macroeconomic risks and unchanged international confidence in Vietnam’s financial market.

Mr. Bùi Văn Huy added that this shift marks a transition from the post-COVID-19 ultra-loose state to a “new normal,” similar to 2016–2019 when interest rates were moderate but credit growth remained robust.

This transition inevitably impacts market sentiment. Some speculative capital has temporarily left equities, while bank stocks face dual pressure from rising capital costs and concerns over narrowing net interest margins (NIM). This explains why, toward the end of the week, while the overall index held steady, many bank stocks showed profit-taking and adjusted more sharply than the broader market.

“For listed banks, short-term stock price pressure is real but also presents a healthy test. Banks with stable funding structures, high low-cost capital ratios, and strong asset quality will demonstrate superior resilience. As interbank interest rate concerns ease and deposit rates for individuals rise only moderately, capital will likely return to this sector in the next phase,” the Director of Investment Research at FIDT JSC commented.

– 08:00 11/12/2025

SSI Research Forecasts VN-Index to Hit 1,920 Points by 2026, Potentially Surging to 2,120 in Optimistic Scenario

Looking ahead to the stock market in 2026, SSI Securities Corporation’s Research and Investment Advisory Center (SSI Research) forecasts the VN-Index to reach 1,920 points under its base-case scenario. In a more optimistic outlook, the index could climb as high as 2,120 points.

How Do Rising Interest Rates Impact the Stock Market?

The VN-Index is on an impressive 8-session winning streak, inching closer to the 1,750-point resistance level. This upward momentum fuels optimism but also heightens profit-taking pressures. Next week, investor focus will shift to monitoring cash flow dynamics amidst rising interest rates, as the market seeks a retest of its resilience before establishing a new trend.

Tracking the Whale Money Flow on 11/12: VN-Index Drops Below 1,700, Foreign and Proprietary Trading Capital Shift Directions

The 11th/12th session witnessed a negative turn as the VN-Index fell below the 1,700-point mark, closing at 1,698.9 points—a decline of over 20 points from the previous session. Foreign investors continued their net selling streak, offloading more than 514 billion VND, contrasting sharply with the net buying activity of proprietary trading firms, which accumulated nearly 192 billion VND on the HOSE.