Why Are Condo Prices Rising Slightly?

At the Vietnam Real Estate Summit (VRES 2025) held on December 9th, Mr. Đinh Minh Tuấn, Sales Director of an online property listing platform, stated that condominiums and single-family homes remain the most promising real estate segments for the first half of 2026. The condominium market is projected to grow by 42%, while single-family homes and landed properties are expected to grow by approximately 31%.

In Hanoi, the supply of condominiums is concentrated along the ring roads, particularly Ring Road 3.

In Q4 2025, condo prices around Ring Road 1 range from VND 100–132 million/m², Ring Road 2 from VND 78–123 million/m², and Ring Road 3 from VND 74–106 million/m².

The condominium segment is forecast to grow by 42% in the first half of 2026.

Some luxury condo projects are listed at VND 180–210 million/m².

A 2026 condo market survey reveals: 44% predict slight price increases, 17% expect significant rises, 27% foresee stable prices, 11% anticipate slight declines, and 2% predict sharp drops.

According to Mr. Tuấn, the slight price increase in 2026 is driven by rising demand for high-end condos, increased real housing needs, higher land and construction costs, supply shortages, a shift from private homes to condos, improved infrastructure, and economic growth.

Insights on Rising Mortgage Interest Rates

Dr. Cấn Văn Lực, Chief Economist at BIDV, emphasizes that mortgage rates are now a “decisive factor” shaping the real estate market’s recovery cycle.

From 2023–2025, interest rate trends directly influenced buyer behavior, market absorption, and developer performance. As rates dropped from 2022 highs, the market rebounded: interest surged, transactions recovered, and prices stabilized. This was most evident in HCMC and Hanoi, where mortgage demand is high.

Dr. Cấn Văn Lực, BIDV Chief Economist, speaking at the December 9th conference.

Lower rates stimulate genuine demand—the market’s primary driver today. With slow income growth and rising home prices, affordable credit enables buyers to act. Reduced rates ease financial pressure, encouraging real buyers to commit. This explains the 2024–2025 recovery in demand and transactions as rates normalized.

Developers also benefit from lower rates, restructuring debt, adjusting prices, accessing capital, and completing projects. Many listed firms returned to profitability in late 2024 and early 2025.

Dr. Lực notes that while rates are key, sustainable recovery requires transparent policies, adequate supply, and market confidence. Low rates maximize impact when paired with a clear ecosystem and demand-aligned supply.

From 2023–2025, rates proved a vital “soft lever” for Vietnam’s real estate, supporting real demand, aiding developers, and fostering stable, speculation-free recovery.

Dr. Lực predicts rates will remain a critical market factor in 2026 and beyond.

Mr. Nguyễn Quốc Anh, Deputy Director of Batdongsan.com.vn, notes that rising bank rates impact home prices.

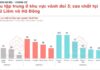

The market now focuses on sustainable, real-demand properties. November 2025 interest in condos rose 3%, single-family homes 1%, while land plots fell 22%, townhouses 3%, and villas 8%.

Surveys show 64% buy for living, 36% for investment.

Agora City: The Epicenter of Investment in Ho Chi Minh City’s Western Hub

In a fiercely competitive real estate market poised for a new cycle, Agora City stands out with its dual advantages: immediate pink book ownership and a master-planned urban lifestyle. This unique combination positions it as a magnet for secure year-end investments, offering investors the promise of sustainable value appreciation.

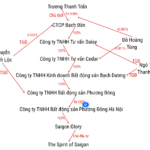

The Fierce Race of Mega-Cities: Vingroup, Sungroup, and Other Titans Shake Up the Real Estate Market with Bold All-In Moves

A wave of colossal real estate projects, spearheaded by industry titans, is reshaping Vietnam’s property landscape. These ambitious developments are redefining the nation’s real estate map, signaling a new era of growth and transformation.