On December 10, 2025, the Ho Chi Minh City Stock Exchange (HoSE) held a listing ceremony for VIMID (VVS), officially launching the trading of 21,525,000 VVS shares with a total listing value of over 215 billion VND. The reference price for the first trading day of VVS was set at 58,000 VND per share, with a price fluctuation range of ±20%.

During the listing ceremony and the first trading day celebration, VIMID received the Listing Decision and participated in the bell-ringing ceremony to mark the commencement of trading on HoSE. The event was attended by representatives from the Ho Chi Minh City Stock Exchange leadership, VIMID’s Board of Directors, shareholders, and investors.

Established in 2010, VIMID has grown over 15 years to become a leading player in the medium and heavy-duty truck market and after-sales services in Vietnam. The company specializes in distributing truck bodies, dump trucks, tractor heads, specialized vehicles, and semi-trailers. VIMID operates a network of 23 service stations and authorized dealers nationwide, playing a crucial role in the supply chain and logistics sector. Beyond business growth, VIMID has made a significant impact through its market presence, sustainable development strategies, green transportation initiatives, and numerous prestigious awards.

Prior to its official listing on HoSE, VVS shares had been traded on the UPCoM market for over three years since 2022, maintaining strong liquidity and sustainable growth. The transition from UPCoM to HoSE demonstrates VIMID’s readiness to meet higher market standards. The company has consistently shown financial transparency, robust governance, and stable operational capabilities. For the market, VVS’s listing adds a high-quality option to the transportation sector, which is attracting significant investor interest, and is expected to draw new capital inflows.

Ms. Tran Anh Dao, Deputy CEO in charge of the HCM City Stock Exchange Board, presents the listing decision to Mr. Nguyen Vu Tru, Chairman of VIMID’s Board of Directors.

Speaking at the ceremony, Mr. Nguyen Vu Tru – Chairman of VIMID’s Board of Directors, emphasized:

“The transition of VVS shares to HoSE marks a significant milestone in VIMID’s sustainable development strategy and opens up new growth prospects. It also underscores our strong commitment to transparency, standards, and efficiency. We believe VVS has immense growth potential, promising sustainable value for investors.”

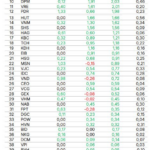

According to analysts, VIMID boasts a solid financial foundation and consistent cash flow from its truck sales and maintenance services. Notably, ahead of its listing, the company reported Q3 2025 financial results with cumulative net revenue of 5,444 billion VND and pre-tax profit of nearly 213 billion VND, a 175% increase year-over-year. Cumulative revenue for the first nine months exceeded the 2025 plan by 30%, and pre-tax profit reached 137% of the annual target. These impressive results have captured significant investor attention.

VVS’s listing on HoSE comes at a time when Vietnam’s transportation and logistics sector is experiencing robust growth, driven by infrastructure investments, industrial expansion, and increasing demand for freight services. Amid favorable macro and market conditions, VVS is positioned as one of the most promising new listings, with a unique cyclical advantage.

The HoSE listing is expected to enhance VIMID’s ability to attract domestic and international investment, enabling the company to fund strategic projects, improve operational efficiency, and drive sustainable growth.

With its strong position, long-term development strategy, and commitment to transparency, VIMID is poised to enter a new phase of growth—more robust, larger in scale, and full of market expectations.

Bank Flush with Cash, Continually Slashing Interest Rates on Social Housing Loans

The disbursement rate for social housing has surged, driven by a significant improvement in the supply of social housing units compared to 2024. In Hanoi, numerous projects are on the verge of finalizing contracts, with banks actively offering attractive low-interest packages ranging from 4.8% to 5.9% per annum.

Skyrocketing Inflation, Gold Prices, and Real Estate: Navigating the Mounting Economic Pressures

After the first 11 months, the macroeconomy remains stable, inflation is under control, and growth drivers are being propelled forward. However, the economy still faces numerous challenges and difficulties.

Unlocking Digital Assets: A New Growth Catalyst

In the wake of the government’s issuance of Resolution 05, which pilots the cryptocurrency market, a pivotal moment has emerged for the digital economy and corporate governance reform. Representatives from businesses, experts, and policymakers engaged in discussions on the digital economy, exploring how these components can collectively forge a new foundation for growth.