From December 9-12, the State Securities Commission officially announced the revocation of the public company status of Apax Holdings Investment Joint Stock Company, Hung Vuong Seafood Joint Stock Company, and Construction Electromechanical Joint Stock Company. With this announcement, the aforementioned companies will delist from the stock exchange.

Apax Holdings (stock code: IBC), represented by Mr. Nguyen Ngoc Thuy (Shark Thuy) as the legal representative and Chairman of the Board of Directors, went public in 2017 with a share price exceeding 20,000 VND. By 2022, IBC experienced a continuous 26-session floor drop due to forced selling of shares when Shark Thuy faced controversies over capital mobilization from multiple individuals and was prosecuted for fraud, with an estimated amount of up to 7.6 trillion VND. Subsequently, the company repeatedly violated information disclosure regulations and moved to the UpCom market. With virtually no trading activity, the price of IBC fell to just 1,700 VND per share.

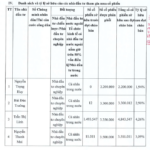

Meanwhile, Hung Vuong Seafood (HVG), once a prominent company under the leadership of Chairman Duong Ngoc Minh, known as the “Catfish King,” with annual revenues reaching 18 trillion VND. The company reported losses from 2016-2017 due to expansion into real estate and high-tech sectors, coupled with a loss of financial control. Most recently, HVG’s accumulated losses amounted to over 1.743 trillion VND (Q1/2020). In 2020, HVG entered a strategic partnership with Thadi, a subsidiary of Thaco Group, aiming for recovery. After more than a year, Thaco-related shareholders divested. Currently, HVG’s share price on the market stands at just over 1,400 VND per share.

Shark Thuy’s IBC shares lose public company status

On the same day, the State Securities Commission also revoked the public company status of Construction Electromechanical Corporation (Joint Stock Company) effective from December 8.

Previously, the Bibica confectionery brand was also delisted from the stock exchange after 24 years of listing, having its public company status revoked. Bibica is majority-owned by PAN Group, holding over 98%, which fails to meet public company regulations. Unlike many other companies, Bibica exited the stock market with a soaring share price of up to 76,000 VND.

Bibica became a target of acquisition from mid-2012, with SSI Securities and Lotte Group competing to increase their ownership stakes. By 2015, PAN replaced SSI as the second-largest shareholder with a 42.3% stake. In 2020, Lotte divested its entire 44% stake, while PAN increased its ownership to the current 98.3%. Recently, PAN has also planned to transfer its entire stake in Bibica to Sari Murni Abadi (SMA), a major Indonesian consumer goods conglomerate.

Viglacera Fined for Administrative Tax Violations

Viglacera has received a decision from the Large Enterprise Tax Department regarding administrative penalties for tax violations, as outlined in the tax inspection report.

Why Was Capital Securities Fined by Regulators?

Capital Securities has been fined VND 175 million for administrative violations in the securities and stock market sector.