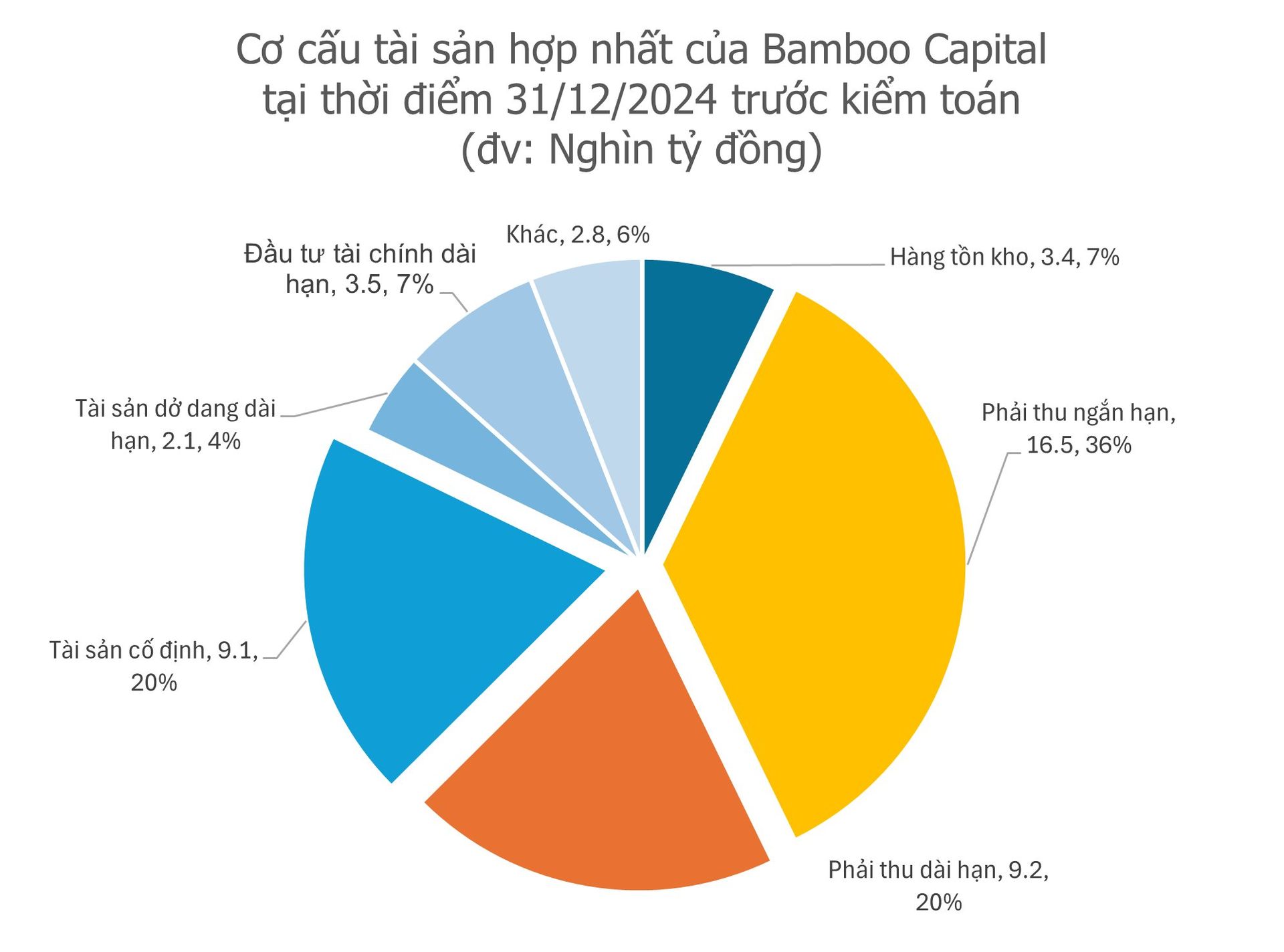

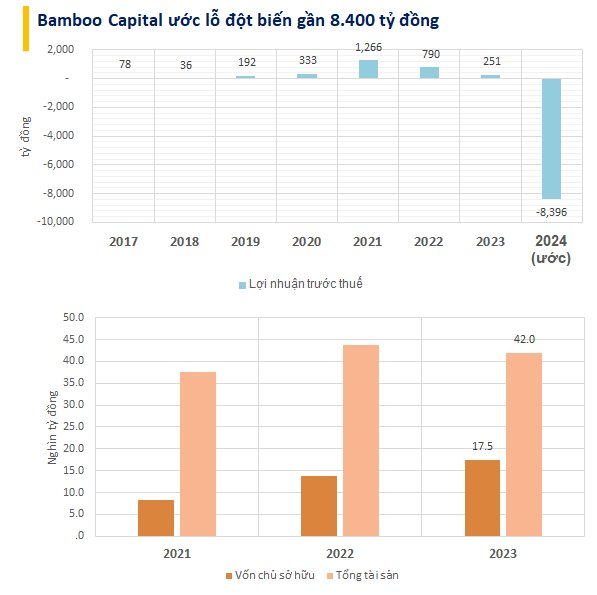

According to the recently announced extraordinary shareholders’ meeting documents of Bamboo Capital Group Joint Stock Company (stock code: BCG), one of the key agenda items was the approval of the audited financial statements for 2024.

The adjustments and provisions made will significantly reduce the company’s after-tax profit for the fiscal year 2024.

Preliminary estimates indicate that the company’s standalone audited financial statements may record a loss equivalent to approximately 71% of total assets as of December 31, 2023, amounting to around VND 7.5 trillion.

For the consolidated audited financial statements, the expected loss is approximately 20% of consolidated total assets as of December 31, 2023. With total assets at the end of 2023 standing at VND 42 trillion, BCG’s consolidated loss for 2024 is estimated at VND 8.4 trillion.

Meanwhile, according to the self-prepared report, BCG recorded a pre-tax profit of VND 999 billion in 2024.

To date, the company has not released its audited financial statements for 2024, resulting in the suspension of trading for BCG shares since October 2025 due to violations of information disclosure obligations.

Explaining the delay, Bamboo Capital cited adverse factors affecting its operations in 2024 and early 2025, particularly the prosecution of former leaders. This event disrupted transactions with financial institutions, investors, and partners, creating significant cash flow pressure and delaying project implementation, capital raising, and debt recovery.

In this context, the company applied a cautious approach when preparing the 2024 financial statements, including reviewing and provisioning for investments at risk of devaluation, uncollectible debts, and potential financial liabilities.

As of December 5, 2025, the company has 51,424 shareholders, including 51,350 individual shareholders and the remainder being institutional shareholders.

Bamboo Capital also proposed the dismissal of board members for the 2020-2025 term and the election of new board members for the next term, as well as the dismissal of audit committee members for the 2020-2025 term and the election of new members. Additionally, the company approved governance and restructuring measures, as well as related-party transaction policies.

According to the leadership, rebuilding trust among shareholders, bondholders, partners, and customers is a prerequisite for the success of any recovery plan. BCG acknowledges that changing market perceptions may take several quarters or even years. During this period, capital raising costs will increase, partners will be more cautious, and many collaboration opportunities may be missed.

Auditor Suspended for Signing Financial Statements of Media Company

The State Securities Commission has announced plans to suspend the auditor responsible for signing off on the 2024 financial report of ODE Group Joint Stock Company (ODE Group, UPCoM: ODE). This decision follows a quality review of the auditing services provided.

IDICO Announces 15% Cash Dividend Advance Payment

IDICO Group (HNX: IDC) has announced the dividend payment for its shareholders, offering a 15% cash dividend for the first phase of 2025, equivalent to 1,500 VND per share. The ex-dividend date is set for December 3rd, and shareholders can expect to receive their payments starting from December 23rd.

Who Spent Over $56 Million to Acquire 24.5% Stake in Postal Insurance?

Over three consecutive trading sessions from November 6th to 10th, the market witnessed the transfer of 29.5 million shares of Post and Telecommunication Joint Stock Insurance Corporation (HNX: PTI) via negotiated transactions. This volume represents 24.5% of PTI’s outstanding shares, with a total value nearing VND 1,328 billion. The average negotiated price stood at approximately VND 45,000 per share.