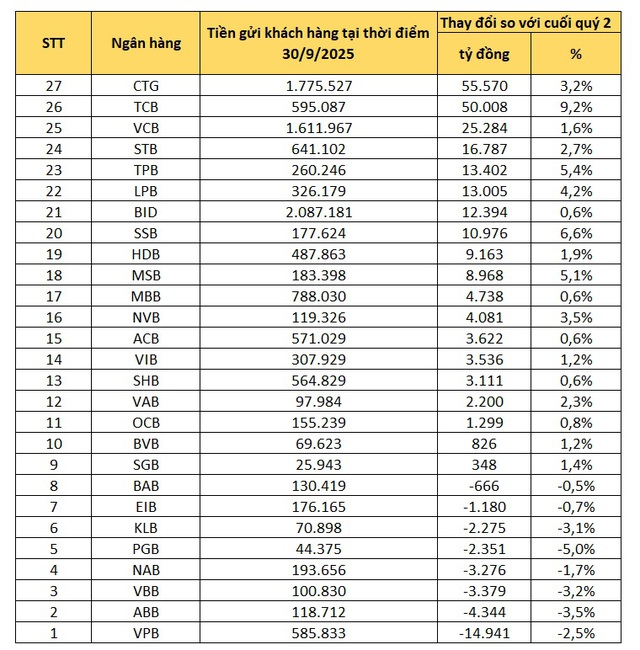

According to the third-quarter 2025 financial reports, the total customer deposits of 27 listed banks reached nearly VND 12,300 trillion as of September 30, 2025, marking a VND 207 trillion increase from the end of June, equivalent to a 1.7% growth (lower than the 2.4% in Q1 and 5.7% in Q2).

Among these, 19 banks recorded deposit growth in Q3. VietinBank led with the most significant increase, reaching VND 1,775 trillion in deposits, a surge of over VND 55.57 trillion, or 3.2%. This absolute growth further solidifies VietinBank’s position as a leading state-owned commercial bank in terms of deposit mobilization.

Techcombank demonstrated impressive growth, attracting over VND 50 trillion in additional deposits, a 9.2% increase—the highest rate among major banks.

Vietcombank maintained steady growth with a VND 25.284 trillion increase, or 1.6%, bringing total deposits to VND 1,612 trillion. Despite the moderate growth rate, given its substantial deposit base, this increase highlights Vietcombank’s strong appeal due to its leading brand.

BIDV, the bank with the largest deposit scale, recorded a VND 12.394 trillion increase, or 0.6%, reaching a record total mobilization of VND 2,087 trillion.

Other major banks also saw growth: MB increased by VND 4.738 trillion (0.6%); SHB and ACB grew by VND 3.111 trillion and VND 3.622 trillion, respectively, both at 0.6%; Sacombank reported a VND 16.787 trillion increase (2.7%), bringing deposits to over VND 641 trillion.

Several mid-sized banks also showed strong deposit growth in Q3. LPBank increased by VND 13.005 trillion (4.2%), TPBank by VND 13.402 trillion (5.4%), MSB by VND 8.968 trillion (5.1%), and SeABank by VND 10.976 trillion (6.6%).

Conversely, eight banks experienced deposit declines in Q3. VPBank saw the largest reduction, with customer deposits shrinking by nearly VND 14.941 trillion, or 2.5%, to VND 585.833 trillion—the most significant absolute decrease in the reporting period.

In percentage terms, PGBank led the decline with a 5% reduction, equivalent to VND 2.351 trillion, dropping to VND 44.375 trillion. Given its smaller mobilization scale, fluctuations in individual or large corporate customers can significantly impact PGBank’s quarterly deposit totals.

Several other mid-sized and smaller banks also recorded notable declines. ABBank decreased by VND 4.344 trillion, or 3.5%, to VND 118.712 trillion; VietBank fell by VND 3.379 trillion, or 3.2%, to VND 100.830 trillion.

Nam A Bank saw a VND 3.276 trillion deposit reduction, or 1.7%, to VND 193.656 trillion; KienlongBank decreased by VND 2.275 trillion, or 3.1%, to VND 70.898 trillion. Eximbank and Bac A Bank declined by VND 1.180 trillion (-0.7%) and VND 666 billion (-0.5%), respectively.

Overall, the latest deposit data indicates a clear slowdown in deposit growth across banks in Q3 2025, despite most still recording quarterly increases. Following robust growth in the first half of the year, bank deposits are no longer as abundant.

This deceleration, coupled with deposit declines at several banks in Q3, highlights intensifying competition in deposit mobilization. If this trend persists, credit expansion in the final quarter may face challenges due to insufficient capital growth.

In October and November, many banks raised deposit interest rates. In November alone, over 20 banks increased rates, with adjustments ranging from 0.2% to 0.5% per year across most terms. Some banks raised rates by 0.7% to 0.8% per year for shorter terms, with several pushing rates under six months to the ceiling of 4.75% per year.

Gold Prices Plummet: SJC and Ring Gold Investors Face Potential $170 Loss per Tael in Just One Week

Investing in gold rings last weekend could result in a significant loss of up to 4 million VND per tael if sold today.

Double Profits, Double Impact: The Financial Trend Revolutionizing Personal Money Management in Vietnam

Have you ever wondered, “Can idle or spent money generate returns?” The answer is a resounding yes, and this philosophy is driving a revolution in how modern individuals manage their personal finances. A prime example of this trend is VIB’s Profit Duo—a financial solution that forward-thinking users are leveraging to achieve dual profitability.