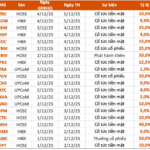

Apatit Vietnam Phosphorus JSC (stock code: PAT) has announced its plan to finalize the shareholder list for the 2025 interim dividend distribution.

The company will distribute the interim dividend in cash at a 100% rate, meaning shareholders will receive VND 10,000 for each share held. The record date for dividend eligibility is December 25, 2025, with the payment scheduled for January 15, 2026.

With 25 million shares outstanding, Apatit Vietnam Phosphorus JSC is expected to allocate approximately VND 250 billion for this interim dividend payment.

As of September 30, 2025, Duc Giang Chemicals Lao Cai LLC, a subsidiary of Duc Giang Chemical Group JSC (stock code: DGC), holds nearly 12.8 million PAT shares (51% ownership). This subsidiary is anticipated to receive over VND 127.5 billion in dividends from Apatit Vietnam Phosphorus JSC.

Additionally, Mr. Dao Huu Huyen, Chairman of Duc Giang Chemical Group’s Board of Directors and also Chairman of Apatit Vietnam Phosphorus JSC, holds more than 1.9 million PAT shares (7.69% ownership). He is expected to receive VND 19.2 billion in dividends.

Mr. Dao Huu Duy Anh, Vice Chairman of Duc Giang Chemical Group’s Board of Directors and a Board Member of Apatit Vietnam Phosphorus JSC, holds nearly 2.3 million PAT shares (9.03% ownership). He is projected to receive approximately VND 22.6 billion in dividends.

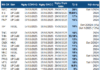

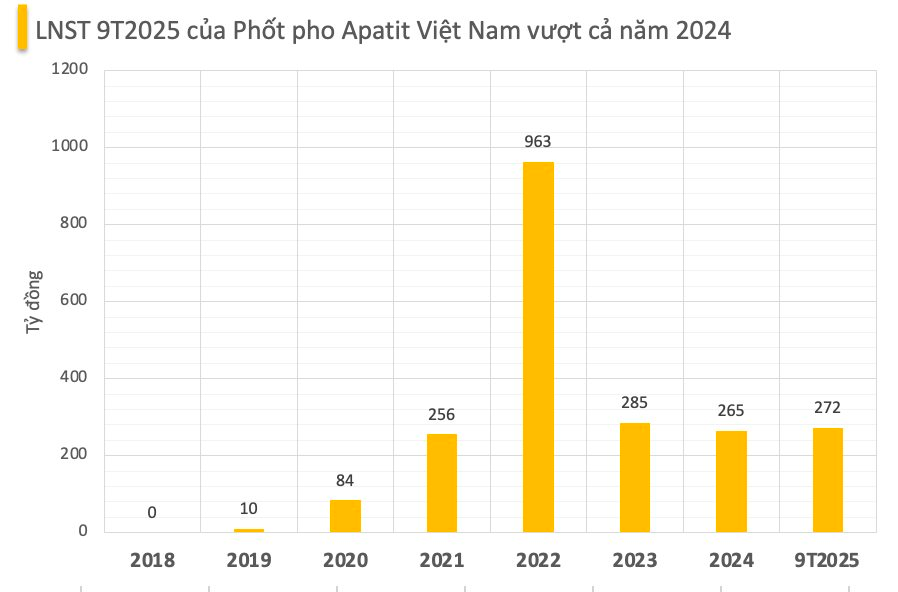

In terms of business performance, Apatit Vietnam Phosphorus JSC recorded a net revenue of over VND 1,420 billion in the first nine months of 2025, a nearly 10% increase compared to the same period in 2024. After-tax profit reached more than VND 272 billion, up 48.1%.

For 2025, the company set a business target of VND 1,818 billion in total revenue and VND 300 billion in after-tax profit.

By the end of Q3 2025, the company had achieved 78% of its revenue target and 91% of its after-tax profit goal.

As of Q3 2025, total assets increased by 23.3% year-to-date to nearly VND 1,150 billion, while total liabilities rose by 5.8% to approximately VND 385 billion.

Viconship Set to Receive Nearly VND 90 Billion in Dividends from Green Port Vip

Green Port Vip is set to distribute over VND 164.4 billion in cash dividends for 2025, offering a 20% payout ratio to its shareholders. Notably, Viconship is expected to receive nearly VND 89.4 billion from this dividend allocation.