According to the Board of Directors’ Resolution No. 26/2025/NQ-HĐQT, announced on December 5, 2025 (replacing the previous Resolution No. 18/2025/NQ-HĐQT dated October 13, 2025), Coteccons plans to issue 14 million bonds with a face value of 100,000 VND per bond.

The total maximum capital mobilization is 1.4 trillion VND with a 3-year term. The interest rate for this bond issuance is fixed at 9% per annum. The issuance is expected to take place in Q4/2025 or Q1/2026, following approval from the State Securities Commission. SSI Securities Corporation will act as the issuing agent, bondholder representative, and advisor for this transaction.

Regarding the payment method, the company will pay interest semi-annually. The principal will be repaid in full on the maturity date or upon early redemption. The early redemption clause (Put/Call Option) is designed flexibly for both parties. Specifically, at 12 and 24 months from the issuance date, Coteccons has the right to repurchase, and bondholders can request partial or full redemption.

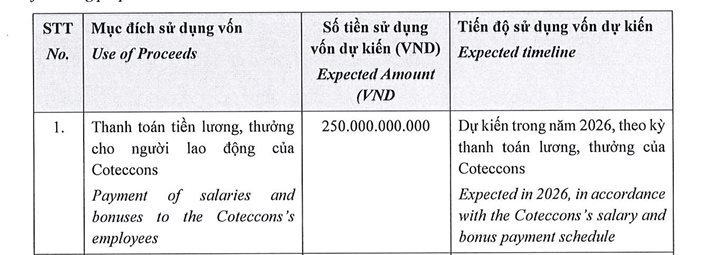

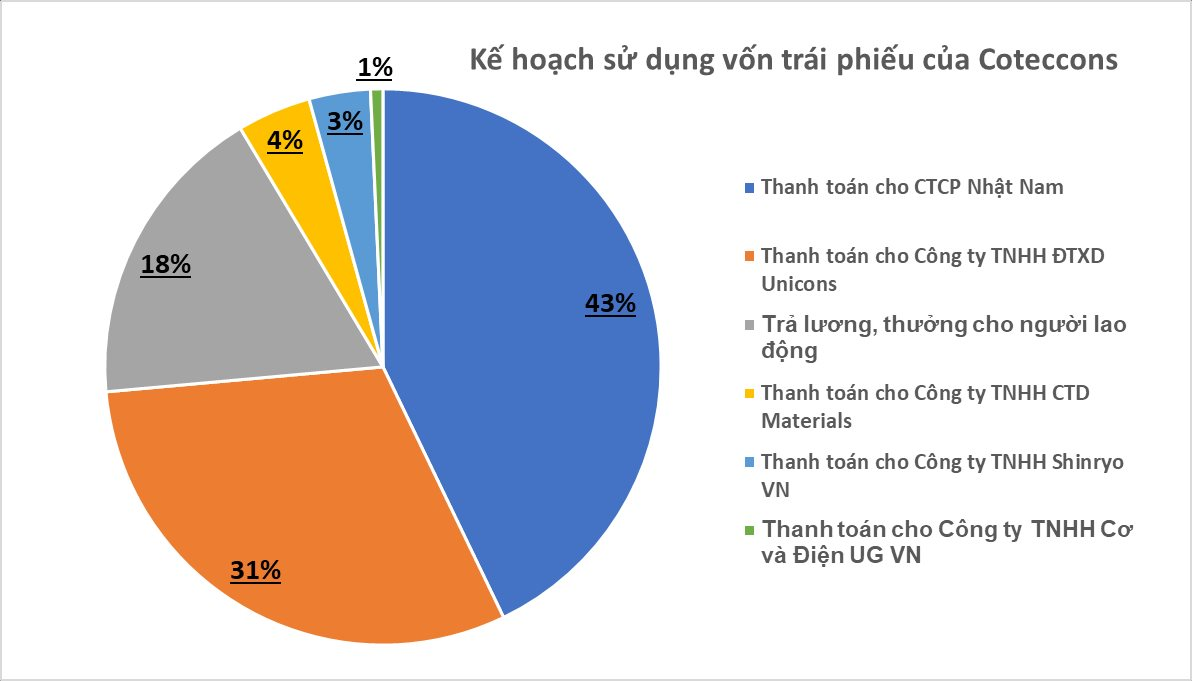

A notable aspect of the capital allocation plan is the distribution of the raised funds. Specifically, Coteccons plans to allocate

250 billion VND for employee salaries and bonuses in 2026.

This is part of the working capital needs to support business operations. The remaining

1.150 trillion VND

will be used to

settle contracts with subcontractors and material suppliers.

Among the prioritized partners for debt settlement, member units and strategic partners hold a significant share. Specifically, Coteccons plans to allocate 600 billion VND to Nhat Nam Corporation and 430 billion VND to

Unicons Construction Investment LLC.

Other payments include 60 billion VND to CTD Materials LLC, 50 billion VND to Shinryo Vietnam LLC, and 10 billion VND to UG Vietnam Mechanical and Electrical LLC. The Board of Directors has also prepared a contingency plan, where if capital disbursement is slower than payment schedules, the company will use bank loans or idle funds for advance payments and reimbursement later.

Regarding debt repayment capacity, Coteccons’ cash flow plan for 2025-2029 projects optimistic financial performance. The construction company expects pre-tax profit for the 2025 fiscal year to reach 552 billion VND, growing to 882.6 billion VND by 2026.

Net cash flow from operating activities is forecasted to be negative in 2025 and 2026 due to high working capital needs, but the period-end cash and cash equivalents balance remains high. Specifically, Coteccons expects to end the 2025 fiscal year with a cash balance of over

2.712 trillion VND,

rising to

3.800 trillion VND by the end of 2026,

ensuring the ability to meet bond principal and interest obligations when due.

Alongside the capital mobilization plan, Coteccons’ Board of Directors has approved the signing of a construction contract for the Gia Binh International Airport project. Notably, the consortium includes Unicons Construction Investment LLC, a member unit expected to receive a significant portion of the funds from the upcoming bond issuance. This move highlights the flexible capital flow within Coteccons’ ecosystem to optimize financial resources for key projects.

Becamex Group Plans to Inject Additional Capital into Two Affiliated Companies

Becamex Group plans to inject additional capital into two of its affiliates, Becamex Bình Phước and Becamex Bình Định, utilizing proceeds from a bond issuance.

G Kitchen Chain Owner Reports 2.5x Surge in Half-Year Profits

According to its periodic financial report submitted to the Hanoi Stock Exchange (HNX), Greenfeed Vietnam JSC recorded a significant surge in profits during the first half of 2025. However, the company’s total liabilities also saw a notable increase during the same period.