Deo Ca Infrastructure Investment Joint Stock Company (Stock Code: HHV, HoSE) has announced a Board of Directors resolution approving a capital increase plan for Deo Ca Urban Infrastructure LLC.

Accordingly, Deo Ca Infrastructure will raise its ownership stake in Deo Ca Urban Infrastructure from 8% to 17.8% (based on the total charter capital after the company completes its capital increase plan).

The additional capital contribution in this phase is expected to be VND 790 billion, with subsequent contributions determined by the approved capital increase plan.

HHV stated that it will increase its ownership through legal capital contribution methods in compliance with the law and aligned with Deo Ca Urban Infrastructure’s capital increase plan. The additional capital will come from existing funds, loans, and other lawful sources.

Illustrative image

The capital for Deo Ca Infrastructure’s additional investment in the aforementioned company will be sourced from existing funds, loans, and other legal sources as per regulations. The implementation timeline will follow the capital increase plan approved by Deo Ca Urban Infrastructure’s Members’ Council.

Additionally, Deo Ca Infrastructure has approved a plan to raise up to VND 680 billion in external capital to supplement its investment in Deo Ca Urban Infrastructure.

The capital will be raised from credit institutions, individuals, and other organizations in accordance with legal provisions. The maximum fundraising period is 5 years.

The loan will be secured by assets owned by HHV and assets owned by individuals or organizations (with their consent to use as collateral).

Deo Ca Urban Infrastructure was established on November 11, 2025, with its primary business being road construction. Its headquarters are located at 278 Thuy Khue, Tay Ho District, Hanoi.

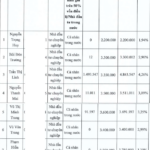

The company’s initial charter capital was VND 125 billion, with 5 contributing members. Deo Ca Infrastructure contributed VND 10 billion (8% ownership), Deo Ca Group JSC contributed VND 2.5 billion (2%), 568 Construction Investment Group JSC contributed VND 10 billion (8%), ICV Vietnam Investment and Construction JSC and Deo Ca Construction JSC each contributed VND 51.25 billion (41%).

In terms of business performance, in the first 9 months of 2025, Deo Ca Infrastructure achieved net revenue of over VND 2,595.6 billion, a 12.9% increase compared to the same period in 2025; post-tax profit reached over VND 476.7 billion, up 29.7%.

For 2025, Deo Ca Infrastructure set a business target of nearly VND 3,585 billion in revenue and over VND 555.6 billion in post-tax profit, representing increases of 8% and 12% respectively compared to 2024.

Thus, by the end of the first three quarters, the company achieved 72.4% of its revenue target and 85.8% of its post-tax profit target.

As of September 30, 2025, Deo Ca Infrastructure’s total assets increased by 2.9% from the beginning of the year to nearly VND 40,050 billion; total liabilities stood at nearly VND 28,072.6 billion, up by nearly VND 96 billion from the beginning of the year.

Becamex Group Plans to Inject Additional Capital into Two Affiliated Companies

Becamex Group plans to inject additional capital into two of its affiliates, Becamex Bình Phước and Becamex Bình Định, utilizing proceeds from a bond issuance.