To achieve the GDP growth target of over 8% this year, the State Bank has set a credit growth target of around 16%. What is your assessment of the feasibility of this target at this point?

As of now, the credit growth rate across the entire system has surpassed 16%, exceeding the initial target. By year-end, credit growth could reach approximately 19–20%. However, the State Bank will adjust the target flexibly based on actual developments to support economic growth while ensuring liquidity and systemic safety.

A key driver of credit growth this year is the acceleration of public investment disbursement. The government, Prime Minister, and ministries have taken decisive actions, significantly boosting public investment progress, with many units achieving very high disbursement rates. Additionally, production and business activities in sectors like manufacturing, construction materials, consumer goods, and small and medium-sized enterprises show signs of recovery. Businesses are accessing credit with reasonable interest rates to expand operations.

Despite challenges in exports due to global market fluctuations and regional competition, agriculture, forestry, fisheries, and processing industries remain crucial in supporting economic growth, thereby driving credit demand.

Overall, amidst global economic uncertainties, Vietnam maintains relatively high economic growth and is on track to meet its targets, thanks to the leadership of the Party, Government, and the efforts of ministries. The State Bank continues to implement proactive, flexible, and harmonized monetary policies, coordinated with fiscal policies, to stabilize the macroeconomy and support growth.

With credit growing faster than capital mobilization, there are concerns about liquidity pressure and systemic safety. What is your view on this issue?

Although credit has grown strongly and there are concerns about capital mobilization lagging behind credit growth, I believe the State Bank will continue to manage flexibly and appropriately. The regulator will consider expanding credit limits for banks meeting Basel II and III safety standards while enhancing inspections to ensure compliance with safety ratios.

Credit institutions are also proactively managing risks, particularly liquidity. Thus, this issue is not currently a significant concern. However, as year-end loan demand typically rises, some banks may slightly increase deposit interest rates by 0.5–1% depending on actual conditions.

The banking system operates with multiple capital layers and asset classes, providing reasonable confidence in ensuring liquidity and systemic safety.

What about non-performing loans (NPLs)? Are they still a pressing issue for credit institutions?

NPL pressure is significant at year-end, and the NPL ratio is expected to rise. However, banks are now much more proactive in NPL management, starting with early risk identification. Credit institutions actively work with customers to handle collateral, restructure loans when necessary, and use their own resources through provisioning. This proactive approach is a positive development in NPL prevention and management.

While NPL pressure exists, the banking system has measures to control risks, including using internal financial resources. I believe the NPL ratio can be managed, even if absolute NPL volumes increase amid credit expansion.

Importantly, banks must meet international safety standards, particularly Basel III. Many banks are actively aligning with international practices, a notable achievement this year.

Some experts worry that cheap capital could flow into real estate, creating asset bubbles and risks for the banking system. What is your perspective?

Banks have warned that real estate credit growth exceeding 20% is relatively high, with real estate debt surpassing 4 million billion VND. In my view, if growth remains around 22–23% and accounts for about 23% of total system debt, it is acceptable under current conditions, provided capital is well-controlled and directed toward genuine needs.

Recently, the State Bank’s Ho Chi Minh City branch issued a warning about real estate credit. This is a wise move, encouraging banks to self-assess, not just those in Ho Chi Minh City. All banks nationwide must review their investment structures and lending practices to ensure alignment and make necessary adjustments. This serves as a wake-up call for banks to focus on healthy sectors, avoiding negative market impacts.

The State Bank has repeatedly issued warnings and directives to control risks in this sector, steering credit toward real housing needs and limiting speculative and inefficient projects. While many focus on real estate credit, a significant portion of capital is directed toward public investment projects, creating jobs, increasing incomes, and boosting related industries. Public investment disbursement this year has been highly positive, reflecting the government’s strong leadership.

Bank credit also extends to FDI, domestic businesses, and manufacturing for domestic consumption and exports.

Another notable trend this year is the recovery of consumer credit. Consumer lending inherently serves people’s livelihoods, with specific borrower profiles and capital uses. As a result, consumer credit quality has improved, addressing past issues.

Many predict that lending rates will rise by year-end. Is this a concern?

Interest rates may adjust upward, but I believe they will remain within acceptable limits, as current rates are reasonably low, supporting production and business lending. If rates rise further, lending rates will likely adjust, prompting banks to restructure portfolios, select borrowers carefully, and limit risky sectors.

How do you evaluate the digital transformation progress of banks, particularly in enhancing operational efficiency and customer experience?

Digital transformation is a critical focus. We are moving toward a digital government. When all levels and sectors align and master operational processes, digital transformation will yield significant benefits. Initial stages may involve challenges and complaints, but any country or enterprise undergoing digitalization faces such phases. Once systems stabilize, citizens will clearly see the benefits.

The banking sector is an early beneficiary of digital transformation, evident in payments, health insurance, administrative procedures, and other social transactions, reducing time and costs. Previously, transferring money or making payments required considerable waiting; now, a few phone taps suffice for convenient transactions.

What are the main challenges for Vietnamese banks in their digital transformation journey?

Digital transformation carries risks, but its positive impact is evident. The banking sector is thriving due to digitalization. Complaints from some citizens do not negate its effectiveness; it is a gradual process. Integrated systems simplify operations significantly. Data protection and management are crucial, as data underpins digital transformation.

Banks are streamlining operations, reducing traditional branches, and reallocating staff to more suitable roles. Bankers must meet new digital era demands or risk obsolescence. Banks must invest heavily in technology and AI. However, AI effectiveness depends on clean data; poor data yields poor results. Effective technology utilization is key.

Observing regional countries, including advanced Asian economies, many view Vietnam as a rapid digital transformer, especially in banking, with notable achievements. Many international partners seek cooperation with Vietnam.

Besides digitalization, ESG is a global trend. What are the highlights of green credit growth this year?

Following Decision 21, the banking sector has actively engaged in green finance. Numerous seminars and forums on green finance and credit have been held. Banks are preparing to invest in green projects, enterprises, and environmental protection, while piloting green bond issuance.

Many banks lead in “greening” operations, from workplaces to branding. Even uniforms and brand identities reflect a green focus.

How can we accelerate the “greening” process?

A unified vision and direction are essential: achieving net-zero emissions by 2050. This is not just the banking sector’s goal but the entire economy’s, involving businesses and society. All must move in the same direction.

The State Bank has issued environmental and social risk guidelines for credit institutions, especially for environmentally sensitive projects.

If businesses invest without caution, producing non-green products, they risk exclusion from global supply chains. Businesses must “wake up” to avoid being left behind.

Green transformation seminars attract many businesses and banks, a positive sign. However, challenges remain, such as resource availability, criteria, and support mechanisms.

Decision 21 provides a policy framework, but ministries must specify clear criteria. Independent green certification bodies are needed for banks to confidently offer preferential loans.

Australia’s structured approach, with clear policies and legal frameworks, is a model. Vietnam is moving in this direction.

Banks have policies to support green growth. Authorities must define green projects and enterprises for targeted implementation.

Green growth requires stable, long-term policies, as green investments are costly with long payback periods. Policy consistency is crucial for business confidence.

Greening efforts must span public and private sectors, from offices to factories. Farmers must adopt clean production practices to meet international standards, ensuring export market acceptance. This is not optional but mandatory.

Ministries must enhance awareness and guidance for businesses and citizens. Failure to adapt risks exclusion from global green standards, limiting access to major markets.

Many banks are expanding financial ecosystems, establishing insurance, securities, and fund management companies. What are the impacts on the financial market and banks?

Becoming a multi-sector financial conglomerate with banking, insurance, and securities is common regionally. The key is ensuring safety. Each sector must operate independently to avoid cross-risks. Banks must have sufficient resources, strong governance, and meet safety standards before expanding.

State regulations encourage financial services while ensuring strict control. Only qualified banks can expand, and they must manage each sector effectively to prevent risks.

What are the prospects and challenges for the banking sector in 2026?

2025 credit growth lays the foundation for 2026. High growth targets reflect strong commitment but must be sustainable. A comprehensive economic assessment is needed to identify strengths and weaknesses.

Public investment will remain a key driver in 2026, creating jobs and raising incomes. Domestic businesses, especially in agriculture, forestry, and fisheries, need support for expansion and exports.

Banks will focus on key sectors like exports, high-tech, tourism, and services. Sustainable tourism development is essential. FDI attracts production and employment.

Digital transformation will enhance economic efficiency, reduce costs, and improve livelihoods. Alongside growth, banks must strengthen asset quality, develop green credit, and expand financial ecosystems with discipline and safety.

Credit growth should target value-creating sectors, ensuring macro stability and long-term growth.

FChoice is CafeF’s annual awards program, launched in 2021. It is not just a typical award but a “map of achievements” highlighting breakthrough stories impacting the national economy, especially in finance. In 2025, FChoice returns with the theme “Vietnam Rising,” featuring four major categories.

Vote now for inspiring stories of resilience, innovation, and national pride in this new development phase HERE.

For inquiries, contact the FChoice organizers at [email protected]

OCB Secures Double Victory: Corporate Governance Award and Top 10 Sustainable Business Recognition

In a rapidly evolving market landscape, regulatory standards in the financial sector are becoming increasingly stringent. Amidst this challenging environment, Orient Commercial Bank (OCB) has once again distinguished itself through its exceptional performance. OCB stands as the sole bank to be honored with the “Outstanding Progress in Corporate Governance” award at VLCA 2025, while also securing a place in the Top 10 Sustainable Enterprises in Vietnam (CSI 2025). These accolades underscore OCB’s unwavering commitment to excellence and sustainability in the financial industry.

Streamlined Land Data Access: Hanoi Launches Fully Digitalized Land Information Services

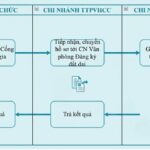

Experience the future of land data management in Hanoi with our 100% online, full-process system. Access and submit all land information and procedures digitally, transcending administrative boundaries, and eliminating the need for in-person submissions.