VPS Securities Corporation (stock code: VCK) has recently approved a detailed plan for a private placement of shares. The company intends to issue 161.85 million shares to professional investors at a price ranging from VND 50,000 to VND 65,000 per share.

These newly issued shares will be subject to a one-year transfer restriction. The primary goal of this issuance is to bolster VPS’s operational capital and financial capacity, specifically to support margin lending activities in compliance with legal regulations.

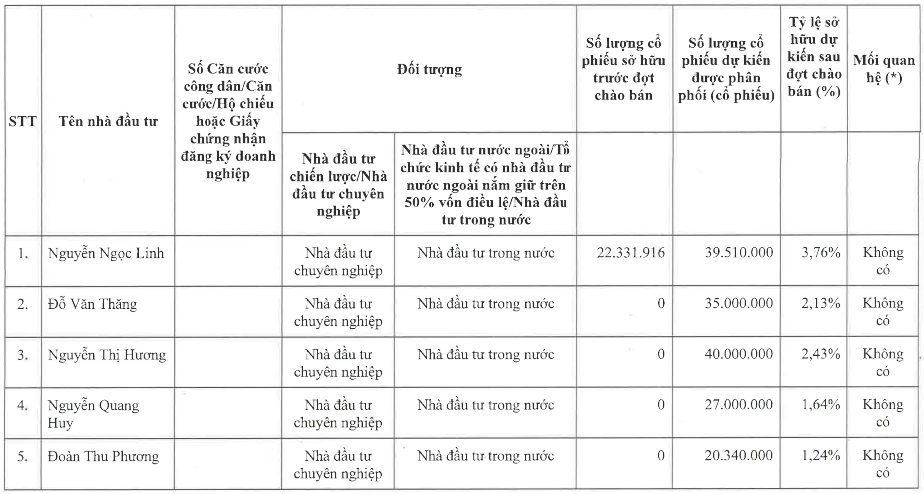

VPS has disclosed a list of five individual investors expected to participate in this private placement. Notably, none of these investors have any affiliation with VPS’s insiders. Among them, only Nguyen Ngoc Linh currently holds VCK shares prior to the offering. Post-issuance, all five investors will maintain ownership stakes below 5%.

Source: VPS

This private placement is one of three capital increase initiatives approved during the Extraordinary General Meeting held on September 29, 2025. Previously, VPS successfully completed two rounds of share issuance: a bonus share distribution of 710 million shares and an IPO of over 202 million shares, raising its chartered capital to over VND 14,823 billion.

Upon completion of this private placement, VPS’s chartered capital is expected to reach nearly VND 16,442 billion.

In related news, 1.48 billion VCK shares will officially commence trading on the Ho Chi Minh Stock Exchange (HoSE) on December 16, with a reference price of VND 60,000 per share. This values the company at approximately VND 88,939 billion upon listing.

In preparation for the listing, VPS has made key leadership adjustments. Chairman Nguyen Lam Dung will no longer serve as CEO, as per regulations for public companies. Consequently, the Board of Directors has appointed Le Minh Tai as CEO for a five-year term. Notably, Mr. Tai previously chaired the Board of Saigon Capital and was relieved of this position in October 2025.

For the first nine months of 2025, VPS reported robust financial performance with operating revenue of VND 5,900 billion, a nearly 20% year-on-year increase. Pre-tax profit reached VND 3,192 billion, and post-tax profit stood at VND 2,564 billion, both up 52% compared to the same period last year.

The Board of Directors recently revised its 2025 business targets upward. VPS now aims for full-year revenue of VND 8,800 billion, with pre-tax and post-tax profits of VND 4,375 billion and VND 3,500 billion, respectively. These targets represent a 3.5% increase in revenue and a 25% rise in profit compared to the original plan approved at the 2025 Annual General Meeting.

As of the end of Q3 2025, VPS has achieved 67% of its revenue target and 73% of its pre- and post-tax profit goals.

Unveiling the Identities: Four Foreign Funds Acquire 93.5 Million Individual Shares of Dat Xanh

Landmark has successfully completed the private placement of 93.5 million shares to four foreign investors, including one member of VinaCapital and three member funds of Dragon Capital.

Top 5 Investors Acquire 161.85 Million Individual Shares of VPS

VPS Securities Corporation (HOSE: VCK) is set to privately offer 161.85 million shares to five individuals, priced between VND 50,000 and VND 65,000 per share. This move marks the final step in a rapid series of three significant capital increase initiatives.