With approximately 7.1 million outstanding shares, the estimated dividend payout exceeds VND 36 billion. Among the beneficiaries, the parent company Vietnam Engine and Agricultural Machinery Corporation (VEAM, UPCoM: VEA) stands to gain the most, holding a direct 55% stake in FT1, translating to roughly VND 20 billion in dividends.

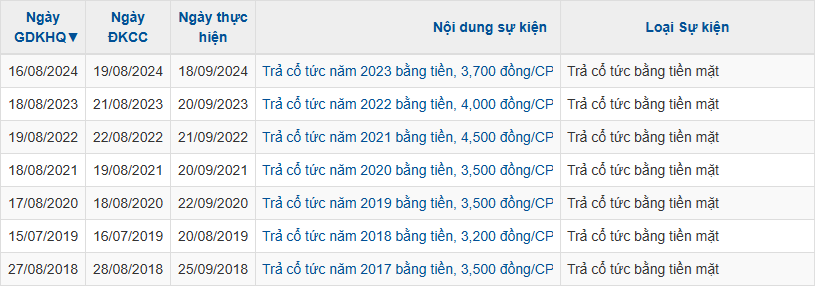

This dividend plan was recently approved by FT1’s Extraordinary Shareholders’ Meeting through a written voting process. Notably, the 2024 dividend rate marks a significant increase compared to previous years.

|

FT1’s Dividend Ratios in Recent Years

Source: VietstockFinance

|

In addition to the 2024 dividend, the extraordinary meeting also approved a dividend ratio exceeding 20% for 2025, alongside a net profit target of over VND 54 billion (22% lower than the 2024 actual figure).

| FT1’s Net Profit History and 2025 Projection |

Established in 1968 as Automobile Parts Factory No. 1, FUTU 1 (FT1) transformed into Engine and Agricultural Machinery Parts Factory No. 1 in 1991. Subsequent name changes include Machine Parts Company No. 1 (1995), Machine Parts One-Member LLC (2004), and Machine Parts Joint Stock Company No. 1 (2008).

The company operates advanced production lines equipped with diverse technologies such as casting, forging, heat treatment, and mechanical processing. Its client roster features industry leaders like Honda, Yamaha, Atsumitec, Sumitomo Heavy Industries Vietnam, Schaeffler Vietnam, and Piaggio Vietnam.

FT1 shares debuted on UPCoM on September 27, 2017. Ahead of the 2024 dividend record date, FT1’s share price remained stable at around VND 49,500 per share, showing minimal fluctuation since the year’s start.

Trading liquidity remains low, averaging just over 1,300 shares daily, with some sessions recording as few as 2 shares traded (e.g., April 23, 2025).

| FT1 Share Price Performance Since 2025 |

– 2:51 PM, December 10, 2025

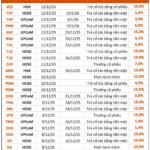

Dividend Ex-Date Schedule December 8–12: Stationery Giant Thiên Long and SSI Gear Up for Payouts

This week, 16 companies are distributing cash dividends, with rates ranging from a high of 15% to a low of 1%.

NTL Declares 10% Cash Dividend Advance Amid Plummeting Profits

Urban Development Corporation Tu Liem (HOSE: NTL) announces a 10% cash dividend payout for 2025, despite a 97% year-over-year decline in net profit to VND 21 billion for the first nine months.