Continuing the 10th Session of the 15th National Assembly, on the morning of December 10th, under the chairmanship of Vice Chairman of the National Assembly Nguyễn Đức Hải, the National Assembly convened in the main hall to vote on the amended Personal Income Tax Law. The law was approved with 92.6% of participating delegates in favor.

Out of 443 delegates, 438 voted in favor, accounting for 92.60%. Thus, the National Assembly passed the amended Personal Income Tax Law, comprising 4 Chapters and 30 Articles.

With 438 out of 443 delegates voting in favor (92.60%), the National Assembly has officially adopted the amended Personal Income Tax Law, consisting of 4 Chapters and 30 Articles. Photo: National Assembly

The National Assembly approved the amended Personal Income Tax Law with 92.60% of participating delegates in favor.

Based on feedback from National Assembly delegates during group and plenary discussions, the review opinions of the Economic and Financial Committees, and the conclusions of the Standing Committee of the National Assembly, the Government has thoroughly reviewed, fully explained, and submitted a detailed report on the revised draft of the amended Personal Income Tax Law to the delegates. Key adjustments include:

Regarding taxes for households and individual businesses: The amended Personal Income Tax Law aims to reduce compliance burdens and facilitate operations for households and individual businesses, particularly small and medium-sized enterprises. The Government has reviewed and revised tax regulations for these entities as follows:

(1) The tax-exempt revenue threshold for households and individual businesses has been raised from 200 million VND/year to 500 million VND/year. This threshold is deducted before calculating tax based on revenue. The corresponding VAT-exempt revenue threshold has also been increased to 500 million VND.

(2) A new tax calculation method based on income has been introduced for households and individual businesses with revenue between 500 million VND/year and 3 billion VND/year. A 15% tax rate, similar to the corporate income tax rate for companies with revenue under 3 billion VND/year, will be applied. These individuals may choose between the revenue-based or income-based tax calculation methods.

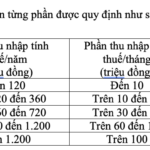

Regarding the progressive tax bracket: The tax brackets have been adjusted to reduce rates at certain levels, ensuring fairness, avoiding sudden increases, and incentivizing workers. Specifically, the 15% rate in bracket 2 has been lowered to 10%, and the 25% rate in bracket 3 has been reduced to 20%.

Regarding family circumstance deductions: The Government has incorporated the family circumstance deductions outlined in Resolution No. 110 of the Standing Committee of the National Assembly into the draft law. The deduction for the taxpayer is 15.5 million VND/month, and for each dependent, it is 6.2 million VND/month. The draft law authorizes the Government to propose adjustments to these deductions to the Standing Committee of the National Assembly, based on price and income fluctuations, to ensure adaptability to socioeconomic conditions.

Regarding taxes on gold transfers: The proposal to tax gold transfers has been thoroughly reviewed and studied, drawing on international experience and feedback from relevant agencies and National Assembly delegates. The draft law imposes a 0.1% tax on the transfer value of gold bars. The Government will specify the taxable gold bar value threshold, implementation timeline, and adjustments to the personal income tax rate for gold bar transfers, in line with the gold market management roadmap. This delegation to the Government aims to exclude individuals buying or selling gold for savings or storage purposes, rather than business activities.

As this is a new regulation with broad implications, it is a necessary step to implement directives from competent authorities on tightly managing gold trading activities, curbing gold speculation, and channeling societal resources into the economy.

Additionally, the Government has directed drafting agencies to collaborate with relevant bodies to review and refine the language, format, and presentation techniques to finalize the draft law for submission to the National Assembly as required.

According to the Government, applying the 500 million VND/year revenue threshold is expected to exempt approximately 2.3 million businesses from taxation, representing about 90% of all businesses. The tax authority estimates a total tax reduction, including both personal income tax and VAT, of approximately 11.8 trillion VND.

Vietnam’s Looming Rice Surplus: Intimex Group Chairman Voices Concerns to Prime Minister Over 4 Million Ton Excess Ahead of Winter-Spring Crop

Mr. Nam urges the government to collaborate with the Philippine government to explore reopening trade opportunities. Simultaneously, he proposes allowing major corporations and state-owned enterprises to stockpile rice for six months to prevent price declines. Additionally, he emphasizes focusing on key markets in West Asia, such as Iraq and Syria, as well as African markets.

Vingroup Launches Four Mega Projects Worth Over 100 Trillion VND in Ha Tinh on December 19th

Ha Tinh province is set to launch six major projects simultaneously on December 19th, in celebration of the 14th National Party Congress. Notably, Vingroup leads the initiative with four of these projects.