At the Vietnam M&A Forum 2025, Ms. Bình Lê Vandekerckove, CEO & Head of M&A Advisory at ASART, emphasized the critical importance of correctly understanding the nature of M&A in this phase. According to her, “mergers and acquisitions have been recognized as a distinct industry, no longer just an uncategorized financial service.” This reflects M&A’s evolution into a highly specialized field, demanding unique processes, standards, and performance metrics.

A key lever, as Ms. Vandekerckove highlighted, lies in market upgrading. “Upgrading the market initially benefits listing efforts, activating capital flow between IPOs and M&A activities.” This creates a cyclical capital mechanism, enabling companies to either list first and then pursue M&A, or vice versa, forming a closed loop that enhances market liquidity.

5 Key Factors to Distinguish Between Troubled Companies and Those in Temporary Distress

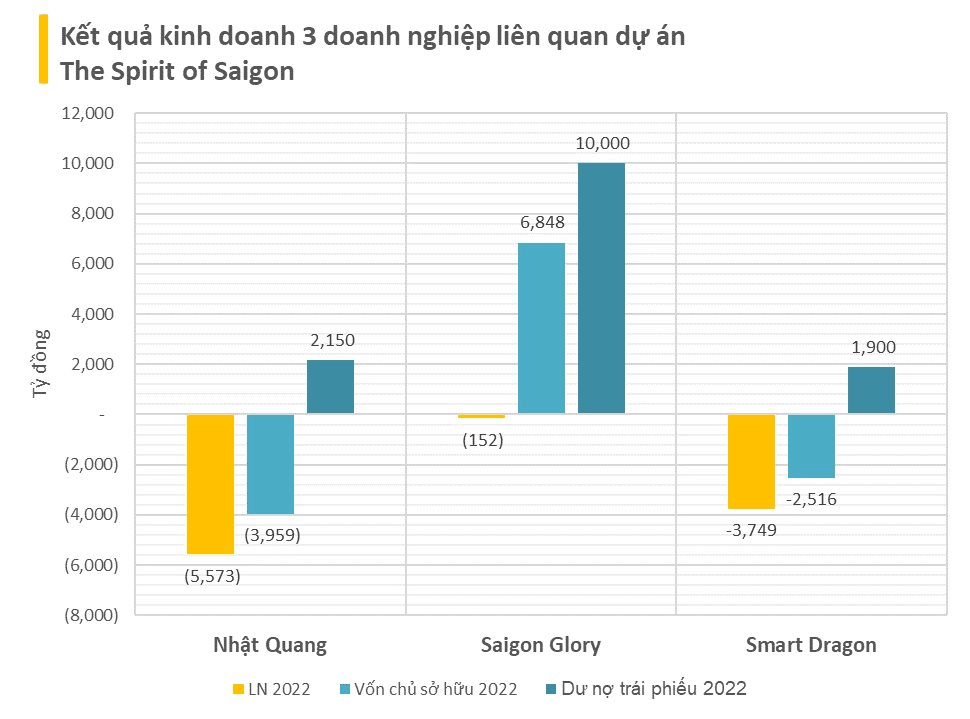

However, not all M&A deals are straightforward. In the realm of distressed M&A—deals involving financially troubled companies—Mr. Douglas Jackson, Managing Director of Alvarez & Marsal Vietnam, stressed the need to differentiate between “bad companies” and “good companies in bad situations.” This distinction is pivotal in determining the success or failure of a restructuring deal.

Based on Alvarez & Marsal’s expertise, investors focus on five key factors to make this distinction. First is market position and standing. Even if a company is unprofitable, it must maintain consistent revenue, a loyal customer base, and brand recognition. Additionally, the market it operates in should still be growing or at least stable. It’s crucial to determine whether the issue lies in the company’s operational efficiency or in a declining industry. Mr. Jackson warned that expansion strategies into adjacent sectors during times of distress often have a high failure rate.

Second is the assessment of unit economics versus fixed/overhead costs. Investors need to see that the gross margin of core products or services is at least on par with industry averages or slightly below. If management, sales, and other overhead costs are disproportionately high, it’s essential to identify whether these are fixable issues, such as a problematic contract or an unfavorable partnership agreement.

Third is the balance sheet and debt structure. Many companies face liquidity issues due to maturing debt, but this can often be restructured. The critical factor is that no obligation should be “unrestructurable.” Investors are particularly interested in whether banks remain open to dialogue and restructuring based on a feasible and credible plan. If banks are unwilling to provide working capital limits, the chances of recovery are extremely low.

Fourth is the management team and corporate governance. Mr. Jackson noted that the key lies not with top-level leadership but with the second-tier management. “The role of the second-tier management team, who deeply understand the business and can drive growth, becomes critically important.” This provides the confidence needed for buyers to proceed with a deal. For existing shareholders, dilution of ownership is a significant barrier, closely tied to valuation gaps, requiring them to accept reduced stakes.

Finally, the ability to provide reliable and timely financial data is an early indicator of a deal’s success. Investors require rigorous, detailed, and periodic post-M&A performance reports. The absence of this factor can cause a distressed M&A deal to collapse in its early stages.

Ms. Vandekerckove noted that distressed assets, while providing liquidity, are rarely favored and only attract specialized advisors, funds, and conglomerates. For liquidity-strapped companies, she advised staying calm and taking the time to consult advisors to find the right path, rather than rushing into a regrettable agreement.

The Vietnam M&A Forum 2025 took place in Ho Chi Minh City on December 9th. Photo: Organizer

|

IPO or M&A?

Ms. Đặng Nguyệt Minh, Head of Research at Dragon Capital Vietnam, stated that capital raising needs over the next 2-3 years are estimated at 30-40 billion USD, achievable through IPOs or M&A. This figure not only reflects Vietnamese companies’ capital needs but also underscores the pressure to diversify funding sources and reduce reliance on bank credit.

Drawing from experience in both M&A and IPOs, Mr. Nguyễn Hoàng Long, Deputy CEO of GELEX Group, shared insights into listing strategies. GELEX is currently IPOing major companies with long-term preparation, focusing on people, strategic partners, and long-term project portfolios. For the IPO of Gelex Infrastructure JSC, with a minimum capitalization of 100 million USD and 10% of shares offered, Mr. Long emphasized that IPOs are part of the group’s long-term capital structure strategy, supported by a solid base of strategic investors and a robust governance framework.

Analyzing IPOs, Ms. Vandekerckove questioned what companies truly seek when entering the capital market. According to her, a key factor in choosing between IPO and M&A is “privacy”—whether a company values it. An IPO means accepting shared ownership, transparency, and pressure from hundreds or thousands of shareholders.

She highlighted a reality in Vietnam’s market: some companies list without a clear purpose, leading to years of post-IPO stagnation or even violations, trapping them in a situation where delisting becomes impossible. As she put it: “An IPO is about deciding how many people should own your company.” Approximately 90% of a listed company’s activities must be publicly disclosed, with only 5-10% of strategies remaining private. Many large family-owned conglomerates, even those worth tens of billion USD, opt for M&A to maintain their private status. This is not just a legal issue but a matter of governance capability and crisis management in a highly transparent environment.

– 06:40 10/12/2025

Vinamilk Solidifies Its Leadership in ESG Excellence

Vinamilk solidifies its pioneering position with a series of prestigious awards in sustainable development and corporate governance in 2025. From the Listed Company Awards (VLCA) 2025 to the Vietnam Sustainability Index (CSI) 2025, the company consistently garners recognition across key categories, underscoring its robust ESG strategy implemented with tangible impact and aligned with long-term competitive capabilities.

OCB Solidifies Its Position as a Transparent and Sustainable Bank with a Series of Prestigious Awards

In a rapidly evolving market landscape, regulatory standards in the financial sector are becoming increasingly stringent. Amidst this, Orient Commercial Bank (OCB) has once again demonstrated its exceptional standing by securing prestigious accolades. Notably, OCB stands as the only bank to be honored with the “Outstanding Progress in Corporate Governance” award at VLCA 2025 and has also been recognized among the Top 10 Sustainable Enterprises in Vietnam (CSI 2025).

Sacombank Joins Elite Group of 30+ Enterprises in VNCG50, Validating International Governance Standards

Sacombank’s achievement of the VNCG50 certification, a benchmark for corporate governance excellence among listed companies in Vietnam, is a significant milestone, especially as the bank navigates its restructuring phase. This recognition underscores Sacombank’s unwavering commitment to enhancing operational quality and strengthening its governance framework in alignment with international standards.

VinaCapital Chief Economist: Vietnam’s Economic Growth Peak Expected by Mid-2026

Vietnam harnesses the synergy of intrinsic economic drivers and institutional reform efforts, creating robust opportunities for breakthrough growth. However, to materialize foreign capital inflows and reduce capital costs, elevating corporate governance standards to international best practices is imperative.