According to the Hanoi Stock Exchange (HNX), KHG Group Joint Stock Company (Stock Code: KHG, HoSE) has announced the results of its bond issuance.

On December 3, 2025, KHG successfully issued a domestic bond series, KHG12502, comprising 800 bonds.

With a face value of VND 100 million per bond, the total issuance value reached VND 80 billion. The bonds have a 60-month term and are expected to mature on December 3, 2030.

Details regarding bondholders, collateral, and issuance purposes were not disclosed. However, HNX records indicate an interest rate of 13.5% per annum for this bond series.

This marks the second bond issuance by KHG since the beginning of the year, as per HNX statistics.

Illustrative image

Previously, on October 2, 2025, KHG issued another bond series, KHG12501, with a total value of VND 80 billion, also maturing on October 2, 2030.

In related news, Mr. Nguyen Khai Hoan, Chairman of KHG’s Board of Directors, acquired nearly 13.58 million KHG shares between October 24 and November 7, 2025, to increase his personal holdings.

Post-transaction, Mr. Hoan’s ownership increased from approximately 143.7 million shares (31.97% equity) to over 157.2 million shares (34.99% equity) in KHG.

Conversely, Mrs. Tran Thi Thu Huong, Mr. Hoan’s spouse, reported selling an equivalent number of shares during the same period.

This transaction reduced her holdings from nearly 58.1 million shares (12.92% equity) to 44.5 million shares (9.9% equity).

In terms of business performance, KHG recorded VND 382.4 billion in net revenue for the first nine months of 2025, a 95.1% increase compared to the same period in 2024. After deductions, net profit reached nearly VND 54.1 billion, up 23.8% year-on-year.

As of September 30, 2025, KHG’s total assets grew by 4.4% to nearly VND 6,884.3 billion. Long-term receivables accounted for 70% of total assets, amounting to over VND 4,815.6 billion.

On the liabilities side, total debt stood at nearly VND 1,610.4 billion, a 17.4% increase since the beginning of the year. Loans and financial leases constituted 74.5% of total debt, totaling VND 1,199.9 billion.

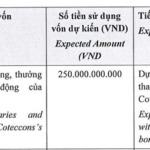

R&H Group Delays Payment of Over VND 82 Billion in Bond Interest

Due to prolonged economic challenges, R&H Group has not yet secured the necessary funds to settle the nearly VND 82.3 billion in interest payments for the bond issuance RHGCH2124005.

Bảo Minh Securities Exits Bidiphar as Shareholder

On December 3rd, Bao Minh Securities executed a block trade, offloading its entire stake of 2.81 million DBD shares. This transaction effectively ended Bao Minh’s status as a shareholder in Bidiphar.