| VN-Index Struggles to Regain the 1,700 Mark |

|

Source: VietstockFinance

|

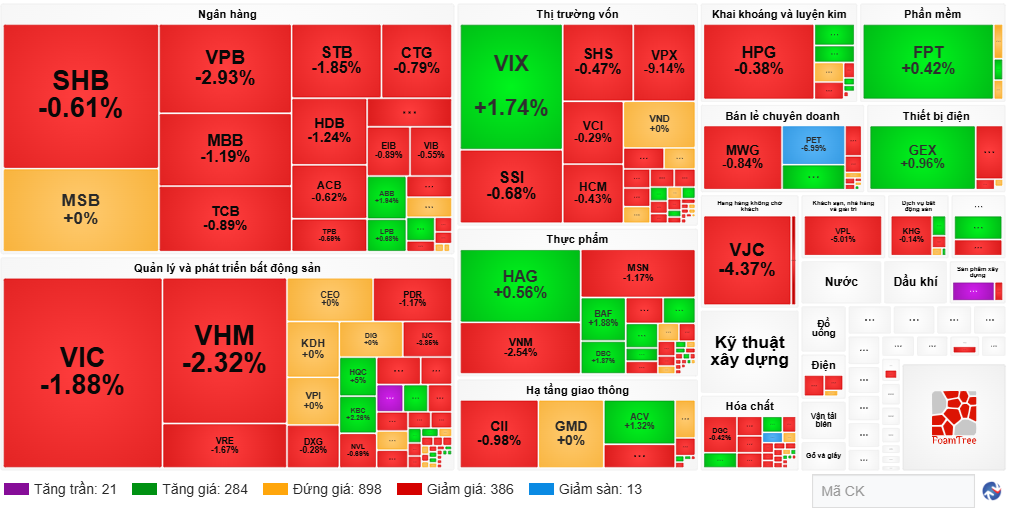

As of December 11th’s close, the VN-Index dropped 20.08 points to 1,698.9, while the HNX-Index fell 0.61 points to 255.87. The UPCoM-Index, however, edged up 0.88 points, nearing 120 points. Total market trading value reached 17,528 billion VND, generally subdued compared to recent periods.

Across the market map, red dominated most major sectors, including banking, securities, and real estate.

In the banking sector, notable decliners included VPB (-2.93%), MBB (-1.19%), STB (-1.85%), HDB (-1.24%), and VCB (-1.03%). Few gainers emerged, such as LPB (+0.68%) and ABB (+1.94%).

The securities sector also saw widespread declines, with SSI (-0.68%), HCM (-0.43%), VCI (-0.29%), SHS (-0.47%), and newcomer VPX (-9.14%) on its first trading day on HOSE. VIX (+1.74%) was among the rare gainers in this group.

In real estate, the Vingroup trio continued to weaken, with VIC (-1.88%), VHM (-2.32%), and VRE (-1.67%). Other decliners included PDR (-1.17%), DXG (-0.28%), and NVL (-0.69%). Green and yellow were scarce, with HQC (+5%) standing out.

Several stocks weakened notably, including VJC (-4.37%), MSN (-1.17%), VNM (-2.54%), MWG (-0.84%), and PET (-7%, hitting the floor).

|

Red dominates today’s session

Source: VietstockFinance

|

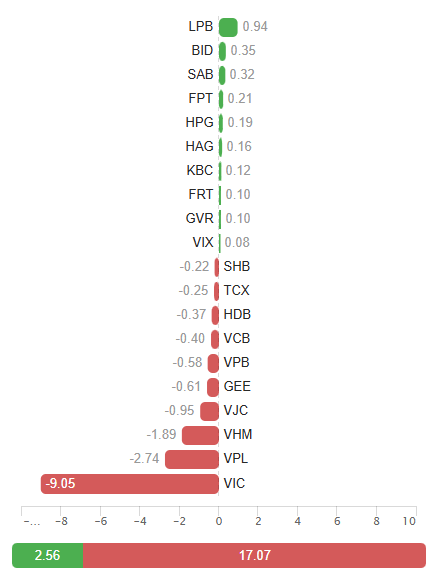

Amid widespread pressure, few drivers emerged to lift the market. The top contributor to the VN-Index was SAB, adding just 0.26 points. Conversely, MBB subtracted 0.59 points, enough to rank among the top 10 negative influencers.

Among today’s influential stocks, three Vingroup shares—VIC, VHM, and VPL—led, erasing 2.62, 2.37, and 2.01 points from the VN-Index, respectively.

| Top Stocks Influencing VN-Index on December 11th |

Foreign trading remained subdued, with net selling extending to the fifth consecutive session. Today’s net sell-off totaled over 537 billion VND, with VIC (192 billion VND), STB (158 billion VND), VHM (105 billion VND), and GMD (102 billion VND) leading. On the buying side, FPT dominated with over 240 billion VND.

Opening: Efforts to “Pull Back”

After intense pressure pushed the VN-Index below 1,700, it unexpectedly rebounded to 1,706.34 by midday, reducing losses to 12.64 points.

Among sectors, consumer services plunged 6.77%, driven by VPL‘s floor drop. Real estate followed with a 1.34% decline, led by VIC (-2.22%), VHM (-1.84%), and VRE (-1.33%), though the sector remained mixed.

VIC‘s rebound from a 7% drop to just over 2% loss was pivotal, reducing its negative impact from 9 points to 3 points, aiding the index’s recovery.

Beyond VIC, no significant market shifts occurred. Fourteen declining sectors outnumbered nine gainers. Aside from real estate and consumer services, no sector moved more than 1%.

Other sectors pressuring the market included banking (SHB (-0.91%), HDB (-1.4%), EIB (-1.11%), VPB (-1.21%), CTG (-0.4%)), food (VNM (-1.27%), SBT (-1.01%)), aviation (VJC (-3.36%)), electrical equipment (GEX (-1.2%)), and retail (MWG (-0.36%)).

On the positive side, several stocks lifted the market, including LPB (+2.26%), BID (+0.4%), SAB (+1.55%), FPT (+0.63%), GVR (+0.75%), HPG (+0.38%), and GAS (+0.31%).

Foreign trading pressure eased slightly, with net selling at 455 billion VND, concentrated in GMD (96 billion VND), VIC (80 billion VND), and STB (74 billion VND). Market liquidity remained weak, below 7 trillion VND.

10:40 AM: Growing Pressure from Vingroup Stocks

By 10:40 AM, Vingroup stocks accounted for 13.68 of the VN-Index‘s 24.54-point decline, keeping the index below 1,700.

As of 10:40 AM, four Vingroup stocks underperformed: VIC (-6.85%), VHM (-1.93%), VRE (-1.33%), and VPL (floor drop). VIC, VHM, and VPL topped the list of negative influencers, erasing 13.68 points collectively.

|

Vingroup Group Pressures VN-Index

Source: VietstockFinance

|

Overall, 254 stocks gained (14 at ceiling), while 282 declined (11 at floor). Excluding Vingroup’s impact, the market might have been more balanced.

Banking struggled, while securities, industrials, essentials, non-essentials, and materials showed mixed trends. Market liquidity reached 4,806 billion VND, low compared to recent periods. Foreigners maintained mild net selling.

9:20 AM: Green Dominates, but VIC, VPL Weigh on VN-Index

The market opened lower on December 11th, extending yesterday’s decline. By 9:20 AM, the VN-Index fell over 8.5 points to 1,710.

Pressure came from VIC and VPL, both Vingroup stocks down over 3% and 5% early. Despite buying dominance, the index remained red.

By 9:20 AM, nearly 280 stocks gained versus 130 decliners. Green prevailed in finance, real estate, industrials, IT, and energy. The VN30 group was mostly green.

ACV surged over 3% in the morning. In real estate, QCG hit the ceiling early. In construction, HBC neared its ceiling.

After two tense days, the Fed cut its key rate on December 11th (Vietnam time) but signaled caution on future cuts. This likely boosted investor sentiment early today.

– 15:30 11/12/2025

SSI Research Forecasts VN-Index to Hit 1,920 Points by 2026, Potentially Surging to 2,120 in Optimistic Scenario

Looking ahead to the stock market in 2026, SSI Securities Corporation’s Research and Investment Advisory Center (SSI Research) forecasts the VN-Index to reach 1,920 points under its base-case scenario. In a more optimistic outlook, the index could climb as high as 2,120 points.

How Do Rising Interest Rates Impact the Stock Market?

The VN-Index is on an impressive 8-session winning streak, inching closer to the 1,750-point resistance level. This upward momentum fuels optimism but also heightens profit-taking pressures. Next week, investor focus will shift to monitoring cash flow dynamics amidst rising interest rates, as the market seeks a retest of its resilience before establishing a new trend.

Vietnamese Stocks: A Rising Star with Untapped Growth Potential

Vietnam is rapidly emerging as a shining star in the Asian region, capturing the spotlight with its dynamic growth and vibrant culture.

Vietstock Daily 10/12/2025: Riding the Crest of the Windstorm

The VN-Index reversed its course, closing lower despite trading volumes surpassing the 20-day average as the index approached its October 2025 peak (around 1,760-1,795 points). Short-term risks are escalating, with the Stochastic Oscillator reversing and signaling a strong sell in overbought territory.