Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 609 million shares, equivalent to a value of more than 17.2 trillion VND; the HNX-Index reached over 52 million shares, equivalent to a value of more than 1.1 trillion VND.

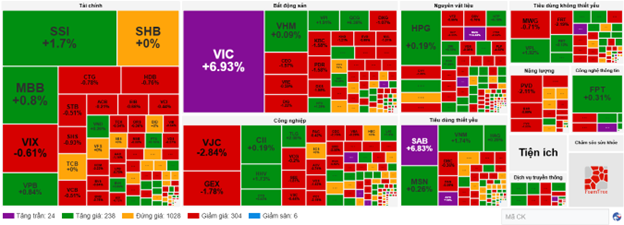

The VN-Index opened the afternoon session with selling pressure, narrowing its gains, but buyers quickly supported the index at the end of the session, helping the VN-Index maintain its green and close with a positive increase. In terms of influence, VIC, VHM, SAB, and VPL were the most positively impactful stocks on the VN-Index, contributing over 15.1 points. Conversely, LPB, TCB, VCB, and CTG faced selling pressure, taking away more than 3.4 points from the index.

| Top 10 stocks with the strongest impact on the VN-Index on December 8, 2025 (calculated in points) |

In contrast, the HNX-Index showed a rather pessimistic trend, negatively impacted by stocks such as KSV (-4.84%), SHS (-2.78%), CEO (-2.75%), IDC (-2.33%), and others.

| Top 10 stocks with the strongest impact on the HNX-Index on December 8, 2025 (calculated in points) |

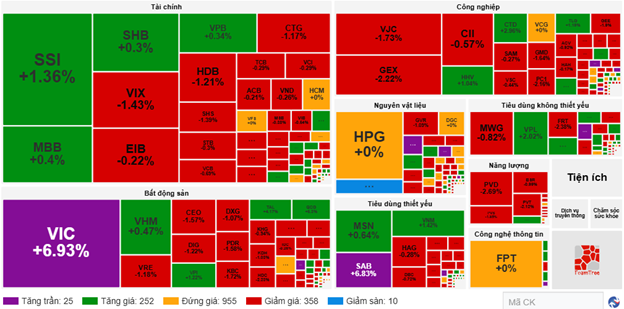

At the close, the market rose slightly with a mix of green and red across sectors. Specifically, the real estate sector recorded the strongest increase in the market at 2.8%, mainly driven by VIC (+6.93%), VHM (+2.8%), HQC (+0.96%), and QCG (+4.59%). Following the upward trend were the non-essential consumer goods and utilities sectors, with increases of 0.5% and 0.49%, respectively. Notable stocks attracting buyers included VPL (+2.21%), PET (+1.42%), PSD (+5.99%), GAS (+2.19%), ND2 (+0.28%), and VSH (+0.46%).

Conversely, the communication services sector recorded the largest decline in the market at 1.71%, primarily due to VGI (-1.63%), CTR (-1.16%), FOX (-2.86%), MFS (-0.54%), and FOC (-0.77%).

In terms of foreign trading, foreign investors continued to net sell over 1,881 billion VND on the HOSE, concentrated in stocks such as VPL (1,548.9 billion), VIC (184.87 billion), SSI (167.87 billion), and GMD (92.8 billion). On the HNX, foreign investors net sold over 45 billion VND, focusing on CEO (14.73 billion), MBS (8.91 billion), PVI (4.61 billion), and TNG (3.56 billion).

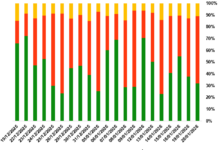

| Foreign net buying and selling trends |

Morning Session: Fluctuations around the 1,755-point mark

The VN-Index continued to fluctuate around the 1,755-point mark during the final morning session. At the midday break, the VN-Index increased by more than 14 points (+0.81%), reaching 1,755.49 points, while the HNX-Index remained close to the reference level at 260.06 points. However, the overall market breadth was not very positive, with sellers dominating as 368 stocks declined and 277 stocks rose.

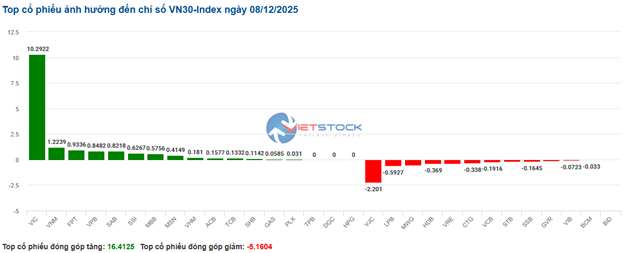

In terms of influence, the top 10 stocks contributed a total of 14 points to the VN-Index, with VIC alone contributing nearly 10 points. Conversely, VCB and CTG exerted the most pressure, taking away more than 1.5 points from the index.

| Top 10 stocks with the strongest impact on the VN-Index in the morning session of December 8, 2025 (calculated in points) |

Divergent trends continued to dominate, with sectors fluctuating within narrow ranges. The communication services sector temporarily lagged in the market with a 1.39% decline, influenced by deep adjustments in leading stocks such as VGI (-1.5%), FOX (-1.65%), and CTR (-0.92%).

The industrial sector also exerted significant pressure on the market this morning, with numerous stocks plunging into the red, including VJC (-1.73%), HVN (-1.21%), GEE (-1.9%), GEX (-2.22%), GMD (-1.64%), BMP (-1.94%), and CC1 (-2.34%).

Conversely, the real estate sector temporarily led the market with a 2.17% increase, primarily due to positive contributions from stocks such as VIC (hitting the ceiling), VHM (+0.47%), VPI (+1.22%), and TAL (+4.17%). Meanwhile, the rest of the sector faced significant selling pressure, including VRE (-1.18%), KDH (-1.03%), KBC (-1.72%), NVL (-1.35%), PDR (-1.58%), TCH (-1.47%), DXG (-1.07%), and CEO (-1.57%).

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of over 390.67 billion VND across all three exchanges. Selling pressure was concentrated in VIC with a value of 159.22 billion VND, followed by SSI with a value of 107.71 billion VND. Conversely, leading the net buying list were SHB and MBB, with values of 82.86 billion and 68.6 billion, respectively.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of December 8, 2025 |

10:30 AM: Hesitant sentiment dominates the market, breadth gradually tilts towards red

Investors showed hesitation, preventing the main indices from making strong breakthroughs. As of 10:30 AM, the VN-Index increased by more than 15.9 points, trading around 1,757 points. The HNX-Index decreased slightly, trading around 260 points.

The breadth of the VN30-Index basket showed green slightly dominating. Specifically, on the positive side, VIC increased by 10.29 points, VNM by 1.22 points, FPT by 0.93 points, and VPB by 0.84 points. Conversely, VJC, LPB, MWG, and HDB faced selling pressure, taking away more than 3.6 points from the index.

Source: VietstockFinance

|

Although the real estate sector showed divergent trends, it was the sector with the strongest growth in the market at 2.14%. Primarily on the buying side, VIC and QCG hit their ceilings, VPI increased by 1.74%, and VHM by 0.09%, leading the sector. Meanwhile, some stocks such as TCH, VRE, CEO, and DIG still faced selling pressure.

Following closely was the essential consumer goods sector, maintaining good growth with stocks such as SAB hitting its ceiling, MSN increasing by 0.26%, VNM by 1.42%, and HAG by 0.28%…

Conversely, the financial sector showed divergent trends, with a slight tilt towards red. Specifically, bank stocks still faced selling pressure, such as HDB (-1.06%), CTG (-0.97%), TPB (-0.29%), and LPB (-0.73%)… Notable stocks maintaining slight green included SSI (+1.87%), MBB (+0.6%), SHB (+0.3%), and VPB (+0.84%)…

Compared to the opening, sellers still dominated, although the breadth was largely occupied by stocks holding their prices (over 1,000 stocks). The number of declining stocks was 304 (6 stocks hitting the floor), and the number of increasing stocks was 238 (24 stocks hitting the ceiling).

Source: VietstockFinance

|

Opening: Blue-chip group supports the index at the start of the session

At the start of the session on December 8, as of 9:30 AM, the VN-Index increased by more than 10 points, reaching 1,751 points. Similarly, the HNX-Index increased slightly, reaching 261 points.

Green dominated most sectors despite strong divergent trends. Leading stocks in real estate, finance, and materials sectors increased positively from the opening, such as VIC (+5.88%), SSI (+2.21%), and HPG (+0.19%), supporting the overall index.

The essential consumer goods sector continued to grow steadily in the market. Notable increases included MSN (+0.38%) and SAB (+3.82%).

Large-cap stocks such as FPT, VPL, and VPB led the upward trend, contributing nearly 1 point. Conversely, VHM, CTG, and VJC pressured the market, collectively reducing the index by more than 1.8 points.

– 15:35 08/12/2025

Vietstock Daily 09/12/2025: Approaching Previous Peak with Caution

The VN-Index extended its winning streak to nine consecutive sessions, closely tracking the Upper Band of the Bollinger Bands. However, trading volume dipped below the 20-day average, indicating investor caution. The index is approaching its October 2025 peak (1,760–1,795 points), while the Stochastic Oscillator remains deeply in overbought territory. Should sell signals re-emerge in upcoming sessions, a corrective pullback could materialize.

Vietstock Daily 12/12/2025: Falling Below the 1,700-Point Milestone

The VN-Index extended its losing streak to a third consecutive session, poised to retest the middle band of the Bollinger Bands. The Stochastic Oscillator continued its downward trajectory, reinforcing the sell signal and exiting overbought territory. Meanwhile, the MACD is gradually narrowing its gap with the Signal line, hinting at potential bearish momentum. Short-term outlook may turn increasingly pessimistic if this indicator triggers a sell signal in upcoming sessions.

Vietnam’s Stock Market Shows No Signs of a Bubble, with a 75% Probability of Gains in December

SSI Securities has revised its 2026 forecast for the VN-Index upward to 1,920 points, reinforcing its stance that Vietnam’s stock market is not in a bubble.