|

Source: VietstockFinance

|

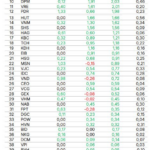

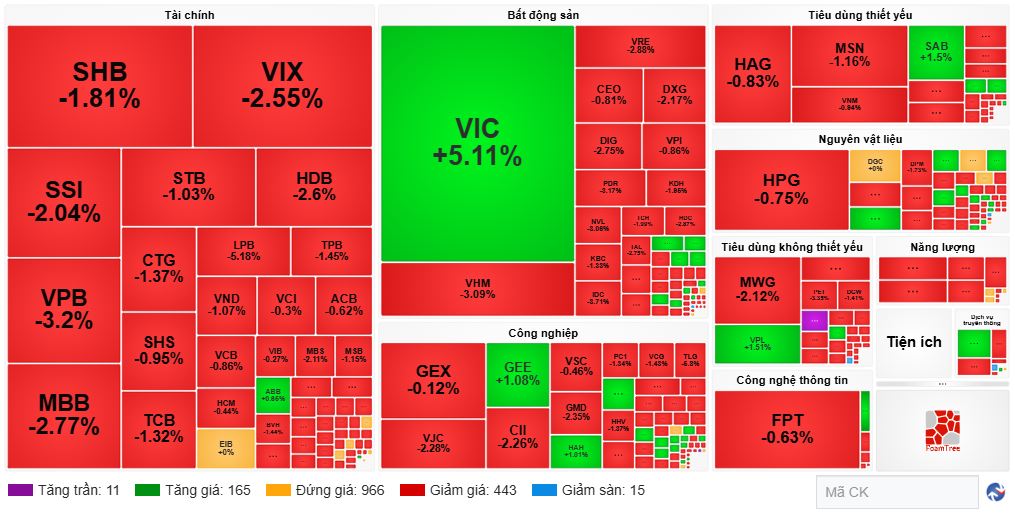

Sellers dominated today’s session, evident in the market breadth with nearly 500 declining stocks versus 260 advancing ones. Red dominated most sectors. Compared to the morning session, financial stocks showed less negativity, with some turning green, including SHS, VCI, HCM, VCB, and EIB. However, red remained prevalent.

Essential consumer stocks improved from the opening, led by SAB, BAF, ANV, NAF, HNG, and PAN. Conversely, non-essential consumer stocks plunged, with VPL, MWG, FRT, and HUT leading the decline.

Late in the session, technology stocks surged, with FPT, ECL, and CMG posting solid gains.

VIC single-handedly supported the index, contributing over 7 points to the VN-Index. Other Vingroup stocks underperformed: VRE fell 3%, VHM dropped 2.2%, and VPL declined 3%.

Market liquidity reached 31.5 trillion VND, with 3.8 trillion VND in block trades. VPL saw the heaviest net selling, exceeding 1 trillion VND.

| Top 10 Foreign-Traded Stocks on 09/12/2025 |

Morning Session: Red Dominates, VIC Heavily Sold

Red prevailed as indices closed the morning below reference levels. VN-Index ended at 1,743 points (-10 points), and HNX-Index fell nearly 3 points to 255.75. Market breadth favored sellers with 520 decliners and 160 advancers.

Only 4 of 23 sectors remained green: Consumer Services, Auto & Components, Real Estate, and Household Products. Real Estate’s green was driven by VIC, though the sector overall declined.

Banking stocks pressured the market, with VPB, MBB, CTG, LPB, VCB, and HDB among the top decliners. In the VN30, only VIC and SAB advanced.

| Top 10 VN-Index Influencers (Morning, 09/12/2025) |

TTF hit its ceiling in the morning, marking its second consecutive gain. Trading volume surged in recent sessions.

Foreign investors net sold 1.2 trillion VND, with VIC leading at 530 billion VND.

10:40 AM: VIC Struggles to Support Index

VIC surged, but red dominated, pulling indices below reference levels. By 10:30 AM, 450 stocks declined versus 180 advancers.

Financials (banks, securities, insurance) and Real Estate plunged. Energy, telecom, and entertainment led declines.

Green persisted in VIC, GEE, HAH, HAG, VPL, SAB, and AAA.

Chemicals and rubber outperformed, with DGC, AAA, GVR, VTZ, NHH, PCH, and DHA staying green amid market red.

Liquidity surged to 10 trillion VND by 10:40 AM, driven largely by VIC.

Source: VietstockFinance

|

Opening: Financials in Red, Vingroup Leads

VN-Index opened strong, driven by Vingroup stocks. VIC contributed over 10 points, nearing its ceiling.

Real Estate and Essential Consumer stocks outperformed. In Real Estate, VIC led with a 5-6% gain and 2.6 million units traded. VRE rose 1%, VHM gained slightly, and HQC, KBC, NRC, HPX, and VCS advanced.

VPL (Vingroup) rose 1.6%, leading the market. Essential Consumer stocks like HAG, SAB, and PAN also advanced.

Financials opened in red, with SSI, VIX, MBB, HDB, SHB, VPB, SHS, TCB, STB, and VCB declining, pressuring the index.

– 15:40 09/12/2025

Vietnam’s Stock Market Shows No Signs of a Bubble, with a 75% Probability of Gains in December

SSI Securities has revised its 2026 forecast for the VN-Index upward to 1,920 points, reinforcing its stance that Vietnam’s stock market is not in a bubble.

Foreign Investors Net Sell Nearly VND 400 Billion in Vietnamese Stocks on December 10th: Which Stocks Were Targeted?

In the afternoon trading session, MBB stocks led the net buying list, with foreign investors pouring approximately 241 billion VND into this ticker.