I. MARKET DYNAMICS OF WARRANTS

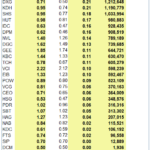

By the close of trading on December 8, 2025, the market saw 57 gainers, 183 losers, and 34 unchanged stocks.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

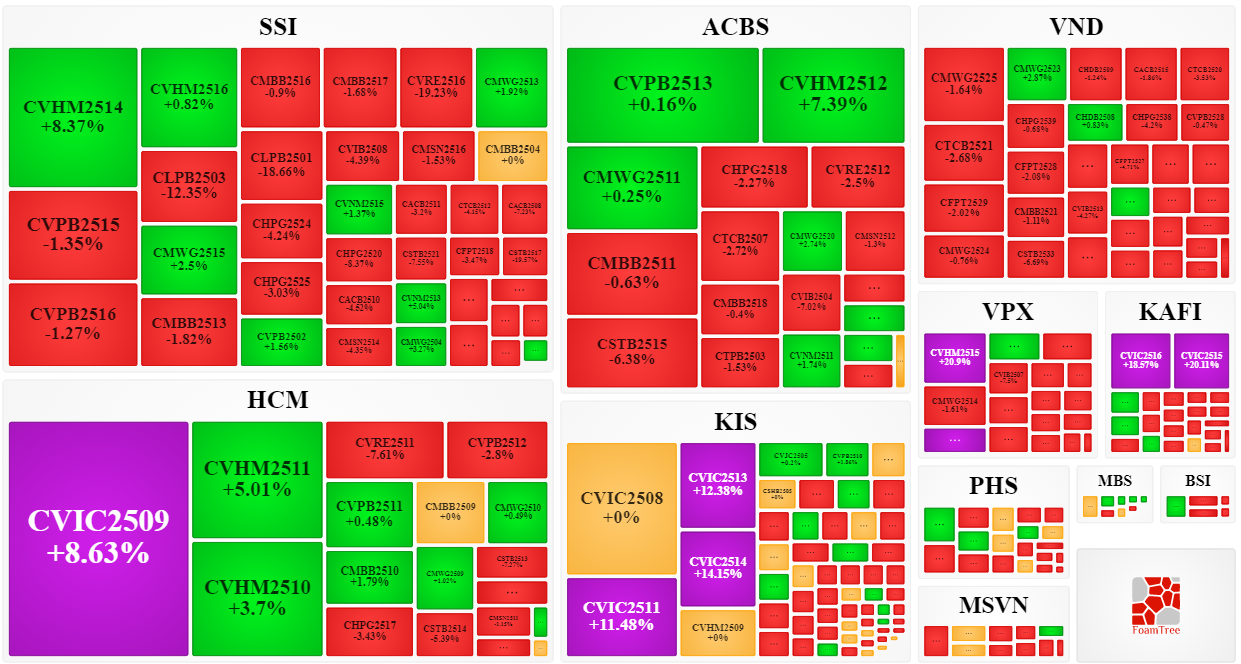

During the December 8, 2025 session, sellers continued to dominate the market, driving down the prices of most warrant codes. Notably, the major warrant codes in the declining group were CVPB2515, CMBB2511, CSTB2515, and CVRE2511.

Source: VietstockFinance

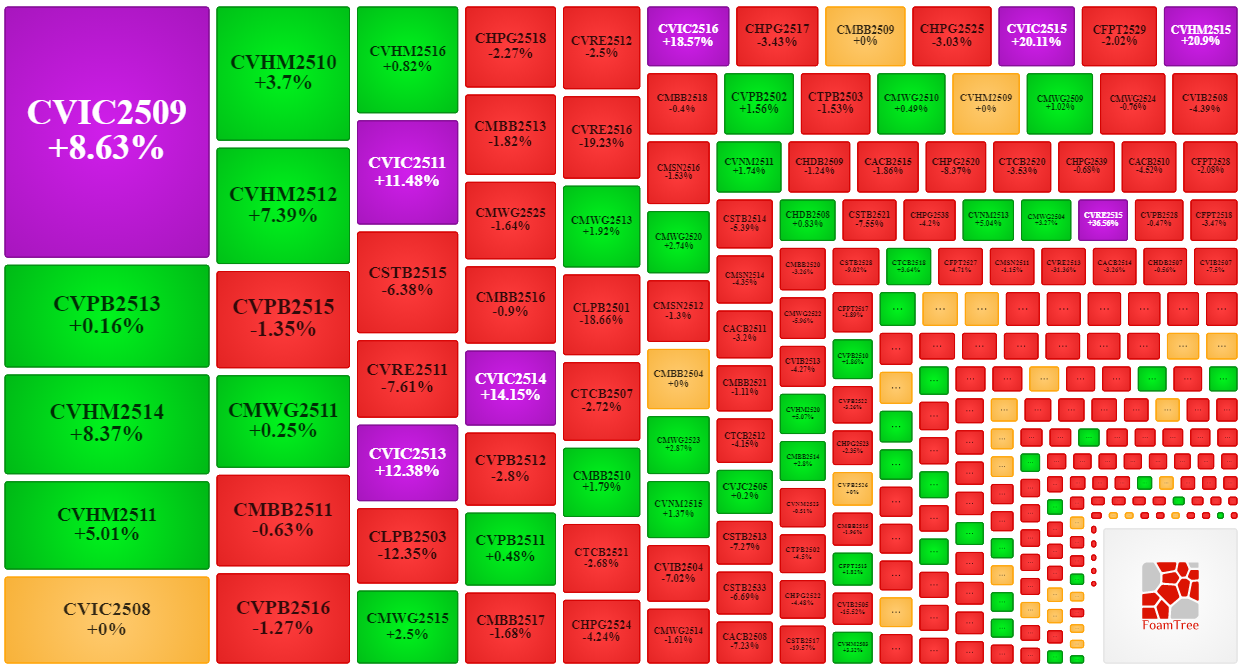

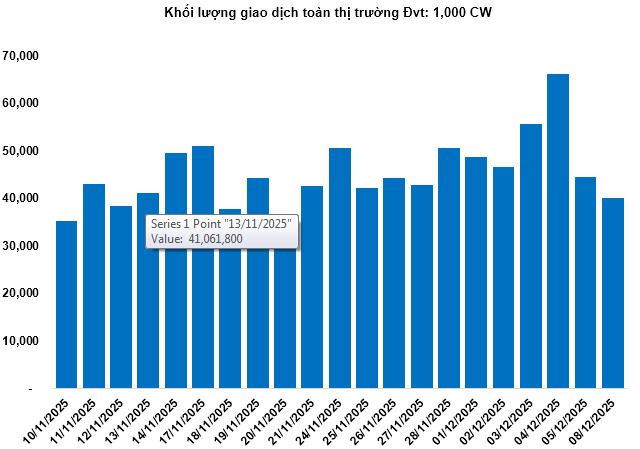

Total market trading volume on December 8 reached 39.95 million CW, down 10.18%; trading value reached 96.11 billion VND, down 2.04% compared to the December 5 session. Among these, CMSN2514 led the market in volume with 2.37 million CW; CVIC2509 led in trading value with 15.54 billion VND.

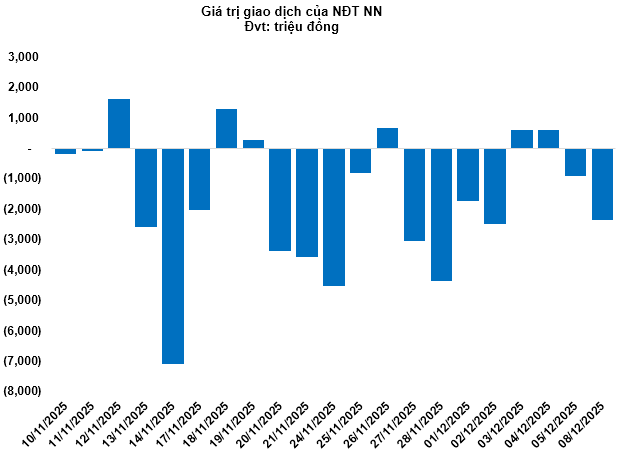

Foreign investors continued to net sell in the December 8 session, with a total net sell of 2.35 billion VND. CVPB2525 and CVRE2524 were the two most heavily net-sold codes.

Securities companies SSI, ACBS, VND, and HCM are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

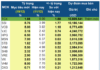

Source: VietstockFinance

III. WARRANT VALUATION

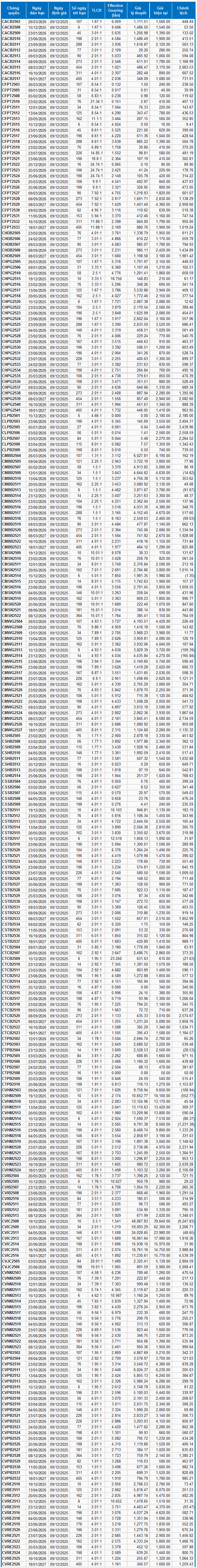

Based on the appropriate valuation method as of the starting date of December 9, 2025, the reasonable prices of the warrants currently trading in the market are as follows:

Source: VietstockFinance

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (Government Treasury Bill) will be replaced by the average deposit rate of major banks, with term adjustments suitable for each type of warrant.

According to the above valuation, CVIC2508 and CVHM2515 are currently the two most attractively valued warrant codes.

Warrant codes with higher effective gearing will experience greater fluctuations in response to the underlying securities. Currently, CTCB2509 and CHPG2515 are the two warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 08/12/2025

2025/12/05 Warrants Market Outlook: Short-Term Prospects Remain Positive

At the close of trading on December 4, 2025, the market saw 165 stocks rise, 80 decline, and 29 remain unchanged. Foreign investors continued their net buying streak, accumulating a total net purchase value of 586.54 million VND.

Amid Real Estate Frenzy, Sales Stumble for Several High-Profile Projects

As a seasoned developer, you may find yourself navigating uncharted market territories, unaware of your competitors, blind to concurrent projects, or caught off guard by the sheer volume of simultaneous fluctuations.