According to a newly released report by Maybank IBG Research (MSVN), retail sales in October 2025 increased by 9.3% year-on-year in nominal terms and 7.0% in real terms, continuing the recovery trend observed since 2024. However, consumer spending remains below pre-COVID average growth rates of 11-12%, primarily due to lingering consumer caution.

In recent years, both external and internal pressures have made consumers more sensitive to information, leading to heightened and shorter-lived fluctuations in sentiment. A Q2/2025 survey by Kantar revealed that consumer confidence dropped to its lowest point since mid-2021, driven by: i) global trade uncertainties; and ii) domestic news surrounding campaigns against counterfeit and substandard goods.

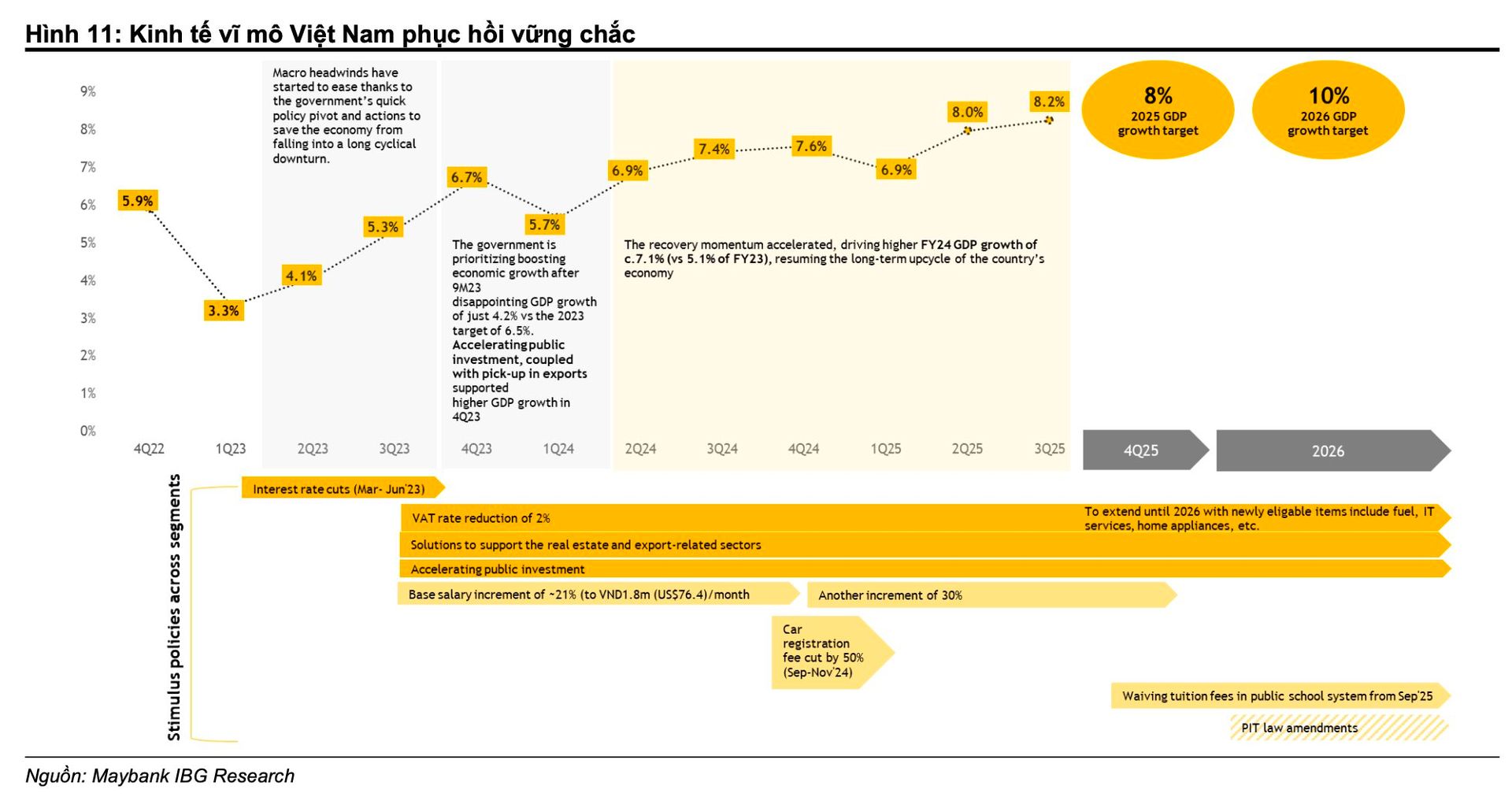

MSVN anticipates an improvement in consumer sentiment and stronger spending in 2026, supported by: i) improved macroeconomic conditions (reduced tariff risks, accelerated GDP growth); government stimulus measures and policies boosting domestic demand; ii) better employment conditions and eased constraints on small businesses; and iv) positive wealth effects.

With an ambitious GDP growth target of 10% annually for 2026–2030, MSVN expects the government to continue implementing demand-side support policies to stimulate consumption—a key growth driver for Vietnam.

These measures, building on existing programs, include: i) accelerating public investment disbursement and targeted support for real estate and tourism; ii) extending VAT reductions until the end of 2026 (covering transport, logistics, and ICT goods/services); iii) waiving public school tuition fees; iv) personal income tax reforms to increase disposable income.

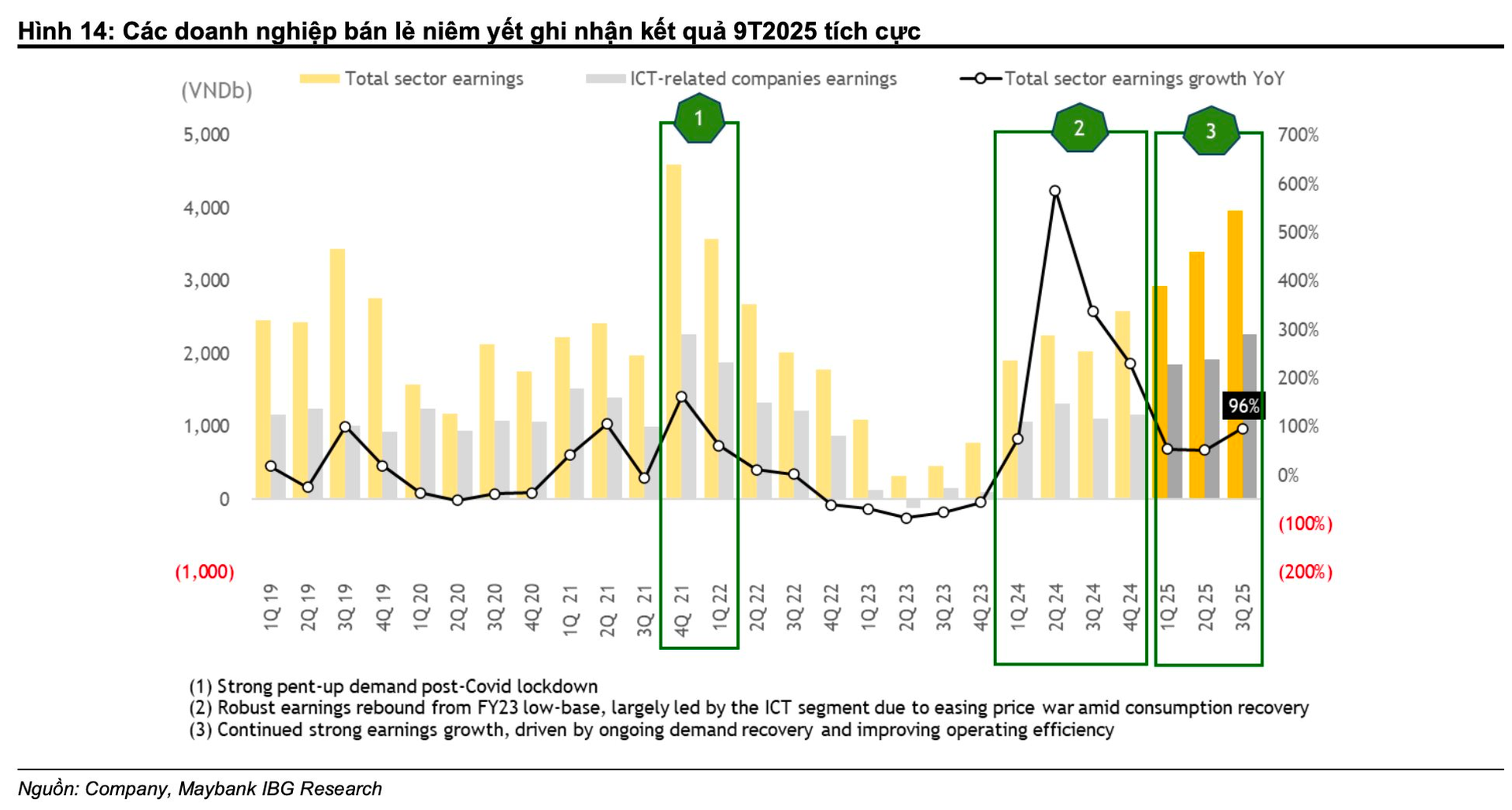

Listed retail companies continued their strong performance in Q3/2025, with consolidated net profit attributable to parent company shareholders rising 96% year-on-year, following robust growth in Q1 and Q2 (+53% and +51%, respectively). This performance was driven by improved consumption, expanding market share for modern retail, and increased operational leverage.

These results reaffirm the sector’s profit sustainability, as all major players exceeded expectations despite the gradual recovery in consumer demand. MSVN forecasts sustained high profitability, with 2025/2026 earnings growth estimated at 55%/26% year-on-year.

According to MSVN, growth is driven by: i) continued improvement in consumption; and ii) structural support from tightened regulations on informal retail. Leading companies like MWG and MSN are expected to remain key growth drivers.

Market Shift Toward Modern Retail

Additionally, ongoing regulatory tightening in Vietnam is reshaping the retail landscape, creating structural advantages for large, compliant operators. Traditional retail channels, dominated by small, informal retailers and wholesalers, are most affected, with many stores temporarily closing or scaling down operations.

Previously, these stores relied on lump-sum tax payments and often sold cheap, unverified, or counterfeit products without receipts. The shift to revenue-based taxation and stricter enforcement is expected to reduce price competitiveness for informal retailers, allowing modern retail channels to gain market share through more competitive pricing and higher consumer trust.

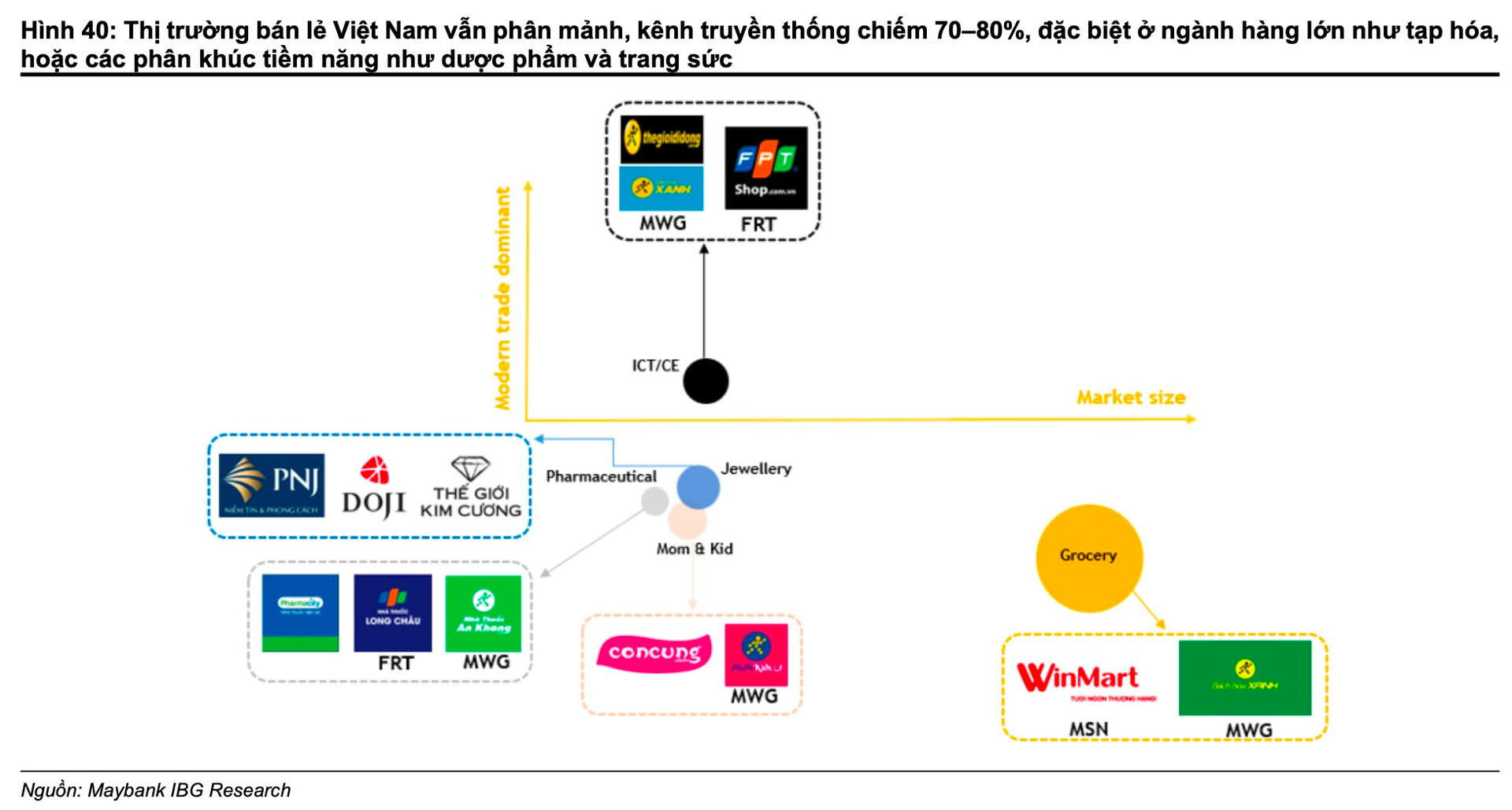

While the shift to modern retail is underway, Vietnam’s retail market remains fragmented. Outside the consumer electronics/IT sector, modern retail penetration in other segments remains low. This highlights significant growth potential for leading companies driving the transition to modern retail, particularly in groceries, pharmaceuticals, and jewelry.

Key trends include: i) crackdowns on informal retail and counterfeit goods; ii) stricter tax compliance, mandatory e-invoicing, and digital record-keeping requirements; and iii) government promotion of e-commerce, modern trade, and supply chain transparency.

These reforms foster a more formal market, benefiting leading companies like MWG, MSN, PNJ, and FRT, which have large-scale operations, trusted brands, strong compliance records, and professional supply chain management.

Overall, MSVN maintains a positive outlook for the sector, supported by robust earnings growth prospects and attractive long-term potential. Analysts expect sustained high profitability, with potential upgrades to Emerging Market status serving as key catalysts for improved sector valuation.

Dr. Nguyen Quoc Hung: “Credit Growth Could Reach 19–20% by Year-End”

Accelerated credit growth, transformative digital banking, and the rise of green finance are set to dominate the banking sector this year. Dr. Nguyễn Quốc Hùng, Vice Chairman and Secretary-General of the Vietnam Banking Association, shares insights into the banking industry’s performance in 2025 and forecasts for 2026.

No Bubble in Vietnam’s Stock Market: SSI Recommends 3 Construction Material Stocks to Ride the Public Investment Wave, Crowns “Steel King”

SSI Research’s strategic report forecasts a 2026 P/E ratio of 12.7x, below historical averages, indicating the market remains undervalued without signs of overheating. Additionally, the allocated public investment capital of VND 1,080 trillion is poised to be the primary growth driver for the Construction – Materials sector in the coming year.

Retail Sales and Consumer Service Revenue Surge by 9.1% in the First 11 Months of 2025 Compared to the Same Period Last Year

In the first 11 months of 2025, total retail sales and consumer service revenue surged by 9.1% compared to the same period last year. Notably, accommodation and food service revenue grew by 14.6%, while travel tour revenue soared by 19.9%, highlighting the success of consumer stimulus initiatives and intensified tourism promotion programs.

Economic Growth Surge: 20 Out of 34 Localities Achieve 8% Expansion

In November 2025, the Government’s regular meeting assessed the socio-economic situation and results for the month and the first 11 months of the year. The overall trend remains positive, with each month showing improvement over the previous one. Cumulatively, the 11-month performance has surpassed that of the same period in 2024 across nearly all sectors, highlighted by 10 standout achievements.