Moody’s has officially upgraded Sacombank’s local and foreign currency deposit ratings and issuer ratings from B2 to B1. Concurrently, the bank’s Baseline Credit Assessment (BCA) has been raised from b3 to b2, underscoring the strengthening of Sacombank’s core financial foundation. The outlook remains Stable, reflecting expectations that Sacombank will sustain its credit strengths and growth momentum over the next 12-18 months.

The rating agency highlights Sacombank’s superior profitability, robust net interest margins, optimized costs, and reduced provisioning pressures due to effective management of non-performing assets. Additionally, the bank’s strong deposit base, healthy CASA ratio, and extensive branch network enable it to maintain low funding costs and stable liquidity.

Equity continues to grow, driven by high profitability and stringent risk management, providing a solid foundation for sustainable credit expansion. Moody’s also positively assesses Sacombank’s post-restructuring capital increase plan.

This upgrade of multiple key ratings by Moody’s reinforces confidence in Sacombank’s position within Vietnam’s banking system. It clearly demonstrates the effectiveness of the bank’s restructuring strategy, its consistent efforts to enhance asset quality, strengthen internal capabilities, and bolster competitive advantages. This achievement also serves as a catalyst for Sacombank to further accelerate its growth, elevate its standing, and contribute meaningfully to the economy.

– 14:55 11/12/2025

Sacombank Joins Elite Group of 30+ Enterprises in VNCG50, Upholding International Governance Standards

Sacombank’s achievement of the VNCG50 certification—a benchmark for exemplary corporate governance among listed companies in Vietnam—marks a significant milestone, especially as the bank navigates its restructuring phase. This recognition underscores Sacombank’s unwavering commitment to enhancing operational excellence and fortifying its governance framework in alignment with international standards.

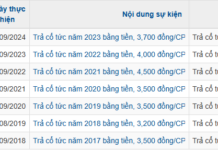

Mega Payout: Company Declares 166.66% Cash Dividend

The ex-dividend date is set for December 15th, with the dividend payment expected to be disbursed on December 25th, 2025.