As of the afternoon update on December 8th, domestic gold prices surged by approximately 300,000 VND per tael today.

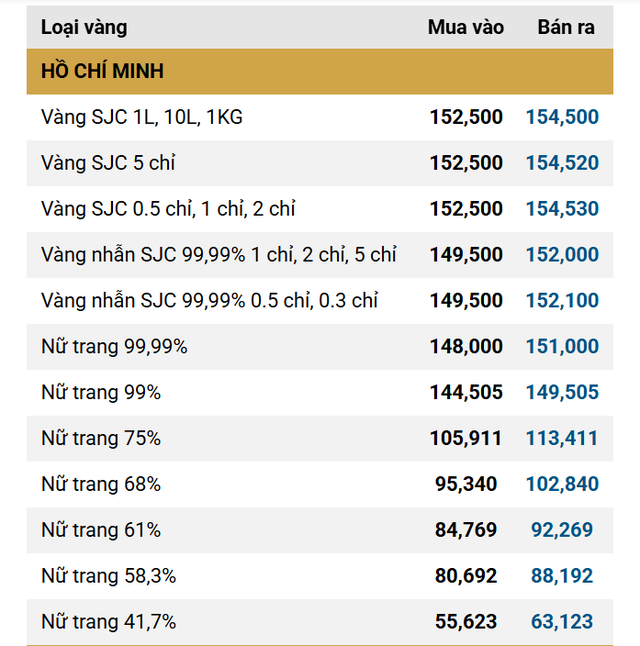

Specifically, SJC gold bars at Bao Tin Minh Chau, DOJI, PNJ, and Saigon Jewelry Company saw an increase of 300,000 VND per tael, reaching 152.5 – 154.5 million VND per tael.

Gold ring prices from major brands also rose by around 300,000 VND per tael. Notably, Bao Tin Minh Chau’s prices climbed to 150.8 – 153.8 million VND per tael. Meanwhile, SJC, DOJI, and PNJ maintained their morning rates.

——————

Early on December 8th, domestic SJC gold prices hovered around 152.2 – 154.2 million VND per tael, unchanged from yesterday.

Gold ring prices varied significantly across brands. Bao Tin Minh Chau listed these at 150.5 – 153.5 million VND per tael, while DOJI offered 150.0 – 153.0 million VND per tael. SJC Company quoted 149.5 – 152.0 million VND per tael.

Internationally, spot gold traded at $4,207 per ounce. Last week, the precious metal moved sideways, fluctuating between $4,200 and $4,250 per ounce.

Kitco News’ latest weekly gold survey revealed a split among Wall Street analysts between bullish and neutral outlooks, while Main Street investors remained largely bullish. This week’s focus will be on the Federal Reserve’s FOMC meeting.

“I’m cautious until next week’s Fed meeting,” said Adrian Day, Chairman of Adrian Day Asset Management. “Although a rate cut is highly likely, markets have anticipated this early, already reflected in gold prices. The risk lies in potential market ‘disappointment,’ triggering a short-term correction. Thus, I maintain a neutral stance.”

p>Rich Checkan, President and COO of Asset Strategies International, predicted a price rise. He highlighted last Thursday and Friday’s sharp increases in gold and silver as noteworthy. Typically, during thin holiday trading, prices exhibit significant volatility—either rising or falling. Such movements often signal investors’ long-term commitment or exit.

Checkan believes recent price action indicates investors are staying put. “The only caution is the FOMC potentially surprising by holding or even raising rates,” he noted. “Any surprise could spark a short-term sell-off in equities and precious metals.”

Adam Button, ForexLive.com’s Chief Currency Strategist, told Kitco News that Friday morning’s data clearly favored gold. “The University of Michigan’s (UofM) consumer sentiment index partly gauges inflation expectations, which have dropped sharply,” he explained. “The subsequent PCE report also showed lower inflation.” He believes the latest data gives the Fed ample reason to cut rates or at least reassure markets. The Fed might even cut more aggressively.

Gold Prices Plummet: SJC and Ring Gold Investors Face Potential $170 Loss per Tael in Just One Week

Investing in gold rings last weekend could result in a significant loss of up to 4 million VND per tael if sold today.

USD Hits One-Month Low

The US dollar’s decline in international markets persisted from late November into the first week of December 2025 (01–05/12/2025), fueled by growing expectations that the Federal Reserve will cut interest rates during its upcoming meeting next week.