Elevating the Target to 1,920 Points

Vietnam’s economy sustained its growth momentum in November, supported by manufacturing, investment, and the service sector, while inflation remained under control. This favorable environment provides room for policy maneuvering. Recent liquidity management measures by the State Bank of Vietnam (SBV), including raising OMO interest rates and conducting foreign exchange swap transactions, reflect a proactive approach to stabilizing liquidity rather than signaling a policy shift.

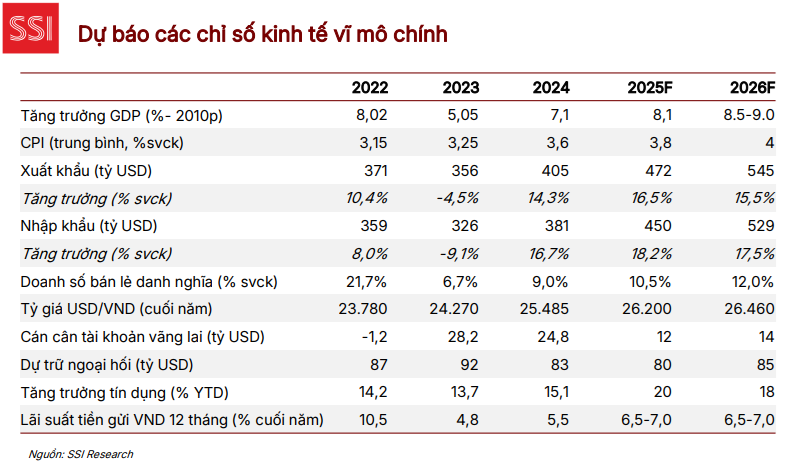

Regarding growth prospects, Q4 GDP is projected to reach approximately 8.2%, bringing the full-year 2025 growth to around 8%. In the long term, Vietnam aims for double-digit growth by 2030, driven by structural reforms, sustained FDI inflows, and infrastructure development investments.

|

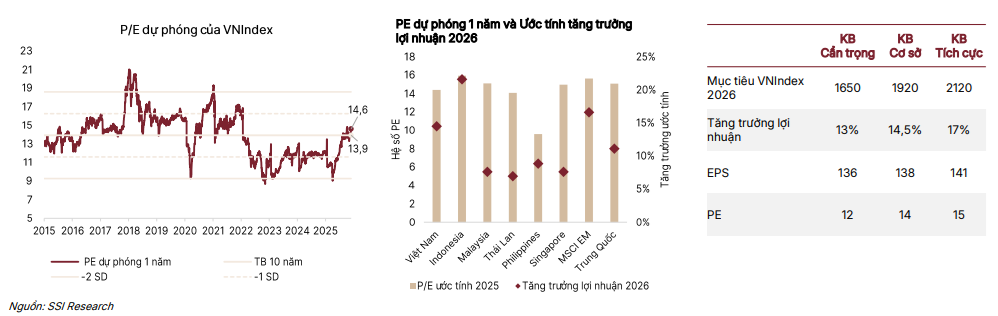

SSI Research has revised the VN-Index target for 2026 upward to 1,920 points in the base scenario. Currently, the index trades at a 2025 P/E ratio of approximately 14.5 times, in line with regional markets. However, Vietnam’s 2026 earnings growth outlook is more robust at 14.5%, compared to the regional average of 11.5%. This results in an attractive PEG ratio of 0.96 for the VN-Index, significantly lower than the regional average of 1.44.

The projected 2026 P/E ratio stands at 12.7x, below the 10-year historical average of 14x, further enhancing its valuation appeal.

In a more optimistic scenario, the market could reach 2,120 points with 17% earnings growth. Conversely, SSI Research sets a cautious target of 1,650 points.

|

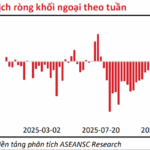

Foreign investors’ net selling pressure is easing, while capital market reforms such as streamlined account opening processes, elimination of prefunding requirements, shortened IPO-to-listing timelines, and the implementation of the KRX system will enhance market liquidity.

Notably, the expansion of global broker access through the Straight-Through Processing (STP) system automates securities trading and settlement processes, minimizing manual intervention, shortening settlement cycles, and streamlining operations to international standards.

For 2026, SSI Research forecasts 16% profit growth in the banking sector; consumer goods benefiting from tax policies and network expansion; infrastructure and construction materials supported by public investment; fertilizers and petroleum products benefiting from policy support; and a technology sector recovery. These present significant opportunities for the coming year.

2026: A Year of Breakthrough Growth and Reform

As Vietnam embarks on its most ambitious 5-year plan (2026-2030), the government targets 10% GDP growth, demonstrating strong confidence in its journey toward upper-middle-income status. With accelerating structural reforms and improved policy flexibility, 2026 could be a breakthrough year if policy implementation aligns with objectives.

In private capital mobilization, the top priority is activating this capital through PPP models and deepening the capital market. New PPP models (such as public investment-private management) promise enhanced efficiency in infrastructure, energy, and essential services. Developing large domestic enterprises and integrating SMEs into supply chains will further energize the domestic business sector.

The 2026 market outlook remains supported by reforms aimed at streamlining administrative procedures and accelerating public investment. Fiscal policy maintains an expansionary stance, with annual capital investment expenditures of approximately $63 billion, more than double the previous cycle, driving infrastructure and urban development.

In the near term, the market may witness capital rotation between stock groups and a return of foreign capital ahead of potential upgrades to Emerging Market status, given foreign investors’ thin positioning after recent net selling. Positive macroeconomic fundamentals and earnings growth are expected to sustain index momentum in 2026.

– 09:45 11/12/2025

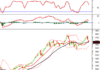

Technical Analysis Afternoon Session 09/12: Intense Volatility as Old Peak is Tested

The VN-Index experienced significant volatility as it retested its October 2025 peak (equivalent to the 1,760-1,795 point range). Meanwhile, the HNX-Index continued its decline, entering its third consecutive session of correction.

How Do Rising Interest Rates Impact the Stock Market?

The VN-Index is on an impressive 8-session winning streak, inching closer to the 1,750-point resistance level. This upward momentum fuels optimism but also heightens profit-taking pressures. Next week, investor focus will shift to monitoring cash flow dynamics amidst rising interest rates, as the market seeks a retest of its resilience before establishing a new trend.

Vietstock Daily 10/12/2025: Riding the Crest of the Windstorm

The VN-Index reversed its course, closing lower despite trading volumes surpassing the 20-day average as the index approached its October 2025 peak (around 1,760-1,795 points). Short-term risks are escalating, with the Stochastic Oscillator reversing and signaling a strong sell in overbought territory.

Real Estate Stock Surges as Brokerage Firms Unexpectedly Invest Hundreds of Billions Amid Market Downturn

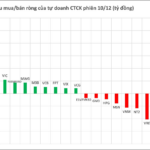

Proprietary trading desks at securities companies recorded a modest net buy of VND 13 billion on the Ho Chi Minh Stock Exchange (HOSE) today.

Market Pulse 12/08: Foreign Investors Net Sell VPL, Vingroup Stocks Continue to Support Index

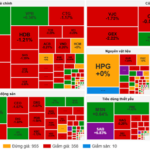

At the close of trading, the VN-Index climbed 12.42 points (+0.71%) to reach 1,753.74, while the HNX-Index dipped nearly 2 points (-0.76%), settling at 258.68. Market breadth favored decliners, with 446 stocks falling and 268 advancing. The VN30 basket mirrored this trend, as 21 constituents closed lower, 7 higher, and 2 unchanged.