Saigontel Chairman – Mr. Đặng Thành Tâm

|

On December 10, Saigontel’s Board of Directors approved a plan to offer over 148 million shares to existing shareholders at a price of 10,000 VND per share, with a 1:1 ratio. The issued shares will not be subject to transfer restrictions. The offering is expected to take place from Q4/2025 to Q2/2026.

As of the morning of December 11, SGT shares were trading at 16,150 VND per share. Since the beginning of the year, SGT’s stock price has declined by nearly 6.4%, with an average daily trading volume of approximately 71,000 shares.

Amid a highly active stock market, Saigontel aims to raise capital to settle outstanding debts and invest in Vietnam Green Growth JSC, a company established in May 2024.

Founded in 2002, Saigontel is a member of Saigon Investment Group (SGI). The company operates in three core sectors: telecommunications and information technology, real estate, and consulting and project development services. Saigontel’s Chairman, Mr. Đặng Thành Tâm, also serves as Chairman of Kinh Bac Urban Development Corporation (HOSE: KBC).

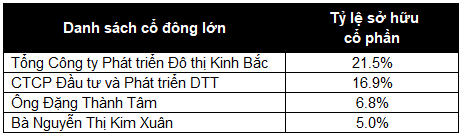

Mr. Tâm and affiliated entities such as Kinh Bắc and DTT Investment and Development JSC are the largest shareholders of Saigontel.

|

Largest Shareholders of Saigontel

Data as of March 26, 2025. Source: Saigontel Annual Report

|

– 09:33 11/12/2025

What Has Become of Kinh Bắc’s $82 Million Industrial Zone Project Focused on Electronics and Precision Engineering?

Spanning 140.34 hectares, this project is poised to become a cutting-edge, multi-sector industrial park. Strategically designed to attract investment, it focuses on high-tech industries such as electronics, electronic components, precision mechanics, and more.

The Industrial Zone Tycoon’s Shares Surprise: Samsung, Amkor, Foxconn, and More Pledge Over $5 Billion to Bac Ninh

This enterprise currently owns 6,611 hectares of industrial land, accounting for 5.1% of the country’s total industrial land area. A significant player in the market, their vast land ownership presents a unique opportunity to shape the industrial landscape and cater to a diverse range of businesses.

The Vanishing Act: When Profits Disappear Post-Audit

After a thorough review, many listed companies have seen their profits fluctuate compared to their self-prepared reports. In some cases, auditing firms have even refused to provide opinions or have raised concerns about the business operations and projects of these enterprises.