Illustrative image: SAB shares hit the ceiling

The trading session on December 8, 2025, witnessed a positive development for Saigon Beer-Alcohol-Beverage Corporation (Sabeco, stock code: SAB), as its share price surged dramatically by 6.83%, trading at 53,200 VND per share. The stock’s liquidity also exceeded 2 million units matched, propelling the market capitalization of this beverage industry giant to recover beyond 68.2 trillion VND.

This remarkable performance followed a crucial meeting between Minister of Industry and Trade Nguyen Hong Dien and Mr. Thapana Sirivadhanabhakdi, Chairman of ThaiBev Group, on the morning of December 5. During the meeting, the Minister emphasized a clear message, urging ThaiBev to shift its strategy and view Vietnam not merely as a consumer market but as a strategic supplier of raw materials and production base.

Minister Nguyen Hong Dien in discussion with ThaiBev Group. Photo: Can Dung, Cong Thuong Newspaper

In response, the Chairman of ThaiBev reaffirmed the group’s long-term investment commitment, focusing on enhancing competitiveness and technology rather than mere commercial exploitation.

The appeal of the leading beer stock extends beyond short-term capital flows. According to Yuanta Securities’ Q4 2025 portfolio restructuring report, the VanEck Vectors Vietnam ETF is expected to purchase approximately 5.6 million SAB shares, the second-highest in its portfolio, providing robust liquidity support in the coming period.

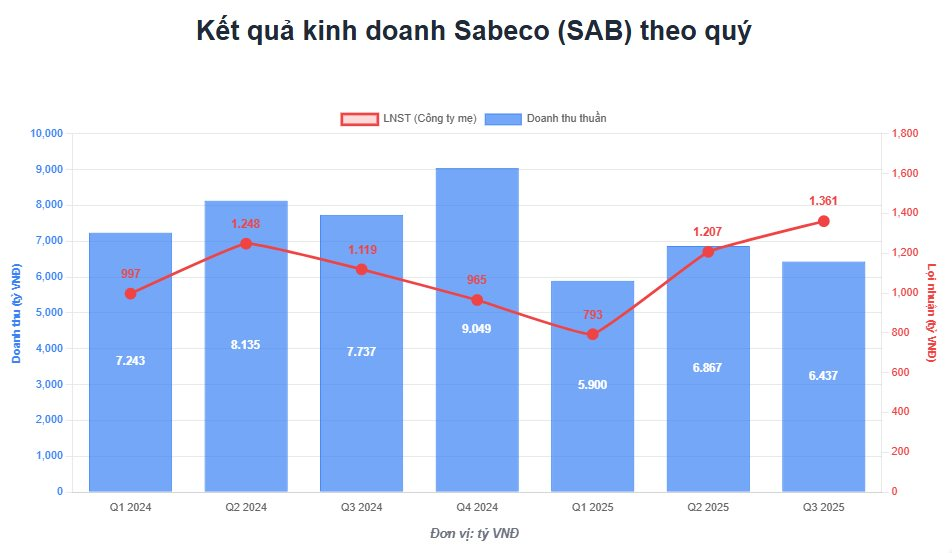

SAB’s upward momentum is further bolstered by its significantly improving financial foundation. Despite a 16.1% decline in Q3 2025 net revenue to 6,437 billion VND due to weak consumer demand, Sabeco still reported a 21.6% increase in post-tax profit attributable to the parent company’s shareholders, reaching 1,360.5 billion VND—the highest in the last 13 quarters.

Analysts forecast an optimistic business outlook for the upcoming period, driven by seasonal factors and policy adjustments. DSC Securities predicts that the gross profit margin in Q4 2025 will remain favorable, as Sabeco locked in raw material prices (hops, malt) at low levels earlier in the year. Additionally, the adjusted roadmap for the special consumption tax increase (5% annually from 2027 instead of immediate implementation), coupled with expectations of major sporting events and a late Tet holiday in 2026, will create growth opportunities for the company.

As of September 30, 2025, Sabeco’s financial health remains robust, with cash and bank deposits totaling 20,027 billion VND, accounting for 64% of total assets. Interest income from deposits in the first nine months generated 741 billion VND for the company, averaging over 2.7 billion VND daily. This solid foundation enables the company to maintain its position as a “cash cow” with consistent cash dividend policies.

Most recently, SAB announced a shareholder list closure on January 13, 2026, for an interim cash dividend payment for 2025 at a 20% rate (2,000 VND per share). With nearly 1.3 billion outstanding shares, Sabeco is estimated to disburse approximately 2,570 billion VND, scheduled for payment on February 12, 2026. Vietnam Beverage, a ThaiBev subsidiary holding 53.59% of the capital, is expected to receive nearly 1,375 billion VND.

Thai Tycoon Pledges Commitment to Vietnam

At the morning meeting on December 5th, the Minister of Industry and Trade emphasized the desire for ThaiBev Group to engage more deeply in sustainable value chains, rather than merely focusing on market exploitation.