Amid the global silver frenzy, the world’s largest silver fund, the iShares Silver Trust ETF (SLV) managed by BlackRock, has reached an unprecedented milestone with assets surpassing $30 billion, equivalent to approximately 514 million ounces of silver (16,000 tons). This achievement is driven by two key factors: rising silver prices and robust capital inflows.

Since the beginning of the year, silver prices have surged over 100%, surpassing the $60 per ounce mark for the first time in history. This growth outpaces other popular assets like stocks, gold, and Bitcoin.

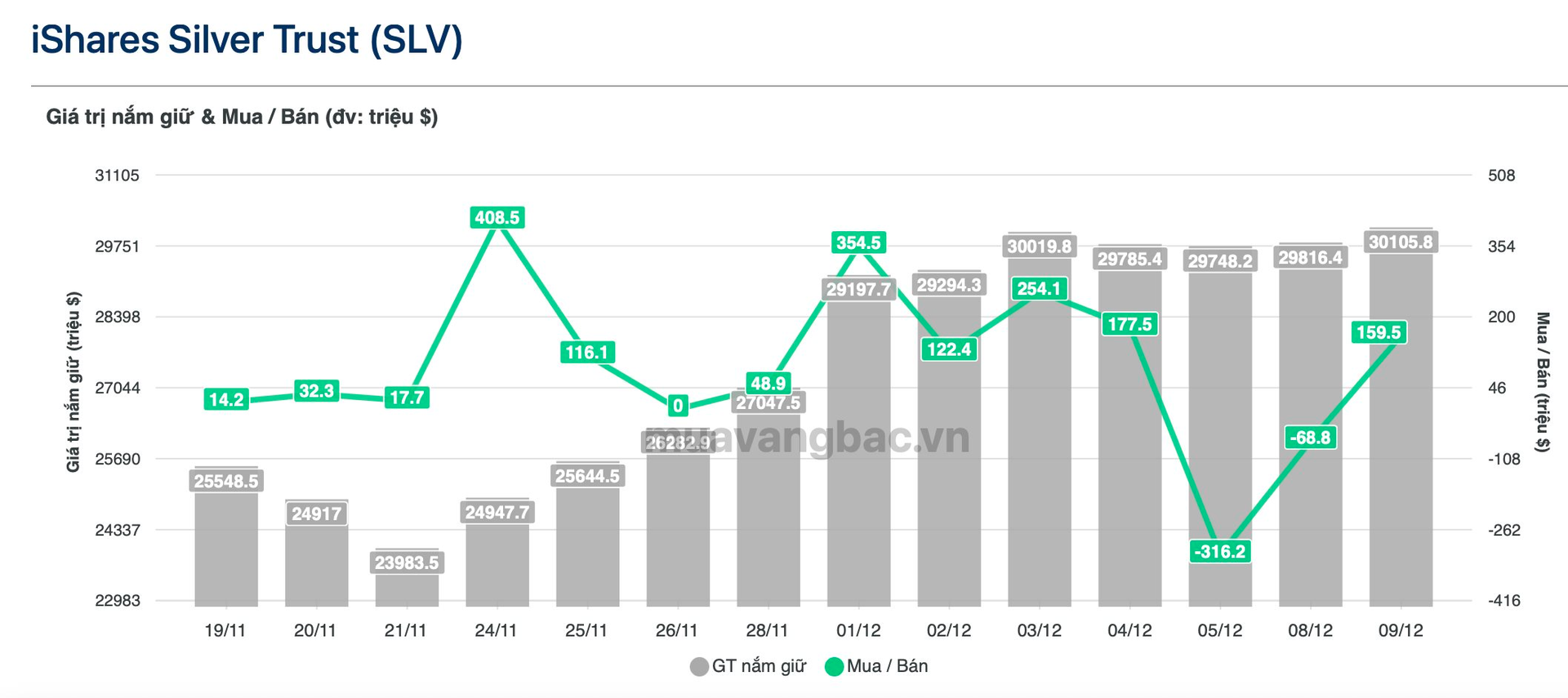

During this period, the iShares Silver Trust has attracted a record net inflow of nearly $2.3 billion, acquiring almost 50 million ounces of silver (1,600 tons). In December alone, the fund has drawn over $500 million to purchase an additional 8 million ounces (250 tons).

Meanwhile, another major silver fund, the Sprott Physical Silver Trust USD (PSLV), holds nearly 206 million ounces of silver (~6,400 tons), valued at approximately $12 billion. Since the start of the year, PSLV has added 25 million ounces (750 tons). As one of the world’s largest physical silver funds, PSLV embodies Sprott Asset Management LP’s commitment to “real silver.”

The continuous capital inflows into major silver funds have been a significant driver of physical silver price increases. Conversely, rising silver prices have boosted fund performance, further enhancing their ability to attract capital, especially amid global uncertainty and heightened demand for safe-haven investments.

Beyond capital flows, silver’s extensive industrial applications are a critical price driver. Silver is widely used in sectors such as solar energy, electronics, and green technologies. The physical demand for silver in these industries is substantial, leading the U.S. Department of the Interior to designate silver as a strategic metal in 2025.

Strong investment demand and concerns over tightening physical supply have combined to push silver prices beyond previous cycle peaks. Global mined silver supply remains stagnant, with some producers reporting output declines. Recycling volumes have also failed to keep pace despite higher prices.

In recent years, physical silver has faced an annual supply deficit of 6–7 million ounces. Analysts warn of a potential prolonged supply-demand imbalance, which could trigger more significant price shocks if left unaddressed.

While silver reserves in major global vaults are recovering—with LBMA London stocks up 1,500 tons and Comex reserves rising 4,300 tons since January—the market remains relatively tight as much of this supply is locked in ETP funds.

Maria Smirnova, CIO of Sprott Asset Management, maintains a bullish outlook on silver in the medium term. Technical models suggest targets of $63 per ounce, with some analysts projecting $100–200 per ounce in the coming quarters.

In addition to structural supply-demand dynamics, silver’s dual role as both an industrial metal and a monetary asset ties its price movements closely to gold. Expectations of Federal Reserve rate cuts or a return to quantitative easing (QE) have bolstered both gold and silver.

Simultaneously, a weakening U.S. dollar and declines in digital assets like Bitcoin have redirected defensive capital into precious metals. Given the silver market’s modest $60 billion annual value, Smirnova notes that even small capital inflows can significantly impact prices.

A Powerhouse Holding Over 22,000 Tons of Silver Amid Soaring Prices

The influx of capital from this influential force has been a key driver behind the recent surge in silver prices.