National Commercial Bank (NCB) has officially launched the “Online Savings – Earn up to 1.4% Extra Interest” promotion for customers depositing savings online via the NCB iziMobile digital banking app.

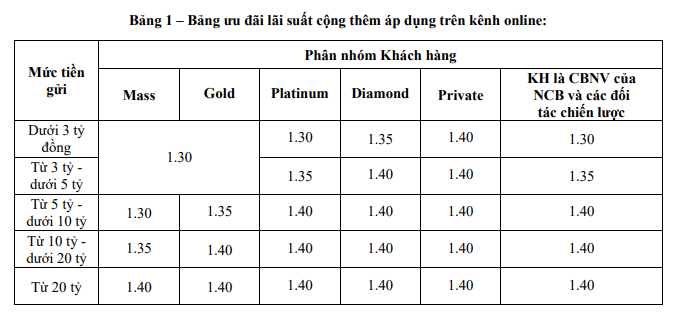

Specifically, all individual customers saving online through the NCB iziMobile app with terms of 1 month or more will receive an additional interest rate of up to +1.4% compared to the listed online savings rate.

This offer is valid until December 31, 2025, or until further notice, whichever comes first.

Private customers will enjoy a 1.4%/year bonus on online savings interest rates, regardless of the deposit amount.

Diamond customers receive a 1.35% bonus for deposits under 3 billion VND and 1.4% for deposits of 3 billion VND or more.

Platinum customers get a 1.3% bonus for deposits under 3 billion VND, 1.35% for deposits between 3–5 billion VND, and 1.4% for deposits of 5 billion VND or more.

Other customers receive a minimum bonus of 1.3%/year.

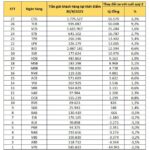

On December 8, NCB also introduced new deposit interest rates for individual customers. For online deposits, the 4–5 month term offers the maximum regulated rate of 4.75%/year. The 6-month term is 6.2%/year, and terms of 12 months or more are 6.3%/year.

Additionally, NCB offers the An Phát Lộc Certificate of Deposit with rates up to 7.1%/year for terms of 24 months or more.

Similarly, Saigon-Hanoi Commercial Bank (SHB) recently increased online savings rates significantly. Customers saving via the SHB SAHA App can earn up to 7.1%/year, 1.2% higher than the listed rate.

Earlier, over 20 banks raised savings rates in November, including Sacombank, VPBank, MB, HDBank, Techcombank, and LPBank. Increases ranged from 0.2–0.5%, focusing on terms under 12 months, with some banks raising rates by 0.6–0.8% for shorter terms.

For 3-month terms, rates are typically 3–4%/year. Some banks, like NamABank, VIB, and MBV, offer the maximum rate of 4.75%/year. Major banks like Vietcombank, BIDV, and Agribank offer only 1.9%/year for counter deposits.

For 6-month terms, rates vary widely. Major banks like Agribank, BIDV, and VietinBank offer under 4%/year, while others like VPBank, VIKKI BANK, VCBNEO, and Bac A Bank offer over 6%.

The highest rates, typically 6–6.5%/year, apply to terms of 12 months or more. Some banks offer 7.5–9%/year, but only for deposits of hundreds of billions of VND.

SGI Capital: A Major Opportunity for Value Investors May Emerge in the Coming Months

According to SGI, in the coming months, hot money flows originating from debt-financed investments during the recent era of cheap credit may retreat under the dual pressures of rising interest rates and tightening liquidity.