Ensuring Digital Assets Are Not Just a “Virtual Fad”

The Vietnam Corporate Governance Forum 2025 (VCG Forum 2025), themed “Unlocking the Potential of Digital Assets,” took place against the backdrop of the government’s issuance of Resolution 05/2025/NQ-CP on piloting the cryptocurrency market. This is considered a crucial step, laying the institutional foundation for a new sector within the digital economy and fostering expectations for new growth drivers.

In his opening remarks, Mr. Nguyen Duc Thuan, Chairman of the Vietnam Association of Corporate Directors (VACD), emphasized that Vietnam is entering a “pivotal” period toward achieving developed country status by 2045. According to him, to reach this goal, it is essential to seek new markets and capital mobilization channels, with digital assets potentially becoming a key component of the digital economy. “Digital assets are no longer just a story of virtual hype but are gradually becoming a core structure of the global digital economy,” he stated.

Mr. Thuan expressed hope that from January 1, 2026, when digital assets officially exit the “gray area,” Vietnam will gain an additional transparent and legitimate capital channel, contributing to unlocking resources for businesses. A critical aspect during this transition is finding ways to maximize the value of this sector, both technologically and policy-wise.

Drawing on over 20 years of experience in finance, Mr. Nguyen Phu Dung, co-founder of PILA and a member of the Solaris Impact Fund’s Board of Directors, believes Vietnam’s sustainable development path is closely tied to the Internet. He analyzed the shift from “Physical Vietnam” to “Digital Vietnam,” where data becomes the primary language and the digital space opens new growth frontiers.

A significant paradox, according to Mr. Dung, is that Vietnam’s capital turnover rate is only about one-third of Singapore’s. The cause lies in the fact that most capital is “locked” in collateral assets, primarily real estate, hindering innovative projects. Therefore, he proposed a three-tiered digital nation model: data, finance, and economy, to create a new structure for resource mobilization and circulation.

From a legal perspective, Dr. Tran Quy, Director of the Vietnam Institute of Digital Economy Development, argued that the core issue of digital assets lies in the word “asset,” meaning it must possess full legal attributes, while “digital” is merely the operating environment. According to him, digital assets are essentially real assets mapped in a digital environment, requiring new legal thinking and management methods.

Dr. Quy described the digital asset ecosystem as comprising two main entities: digital assets (VA) and digital asset service providers (VASP), along with supporting units such as valuation and custody. Resolution 05 allows five units to pilot, and he believes the issue is not the number but how to manage assets within a complete ecosystem to ensure trust.

He divided the market into the “submerged” part, where assets are freely created with little regulation, and the “surface” part, where legal frameworks and management exist. The goal of Resolution 05 is to bridge these two parts through trust and technology.

When a New Ecosystem Emerges: Policy – Technology – Market Convergence

The forum’s discussion also expanded to the international financial center model in Ho Chi Minh City and Da Nang. Dr. Tran Quy noted that Vietnam has the advantage of being a “latecomer at the right time,” as the On-chain trend is gaining momentum globally. According to him, future international financial center models cannot operate outside the digital asset ecosystem, with the first pillar being a sandbox—a controlled testing mechanism.

From a local perspective, Mr. Tran Anh Tuan, Director of the Hanoi Department of Science and Technology, stated that the city is concretizing development directions under the amended Capital Law 2024 and Resolution 15 of the Politburo. Hanoi is the first locality to issue a resolution on sandboxes, identifying four priority groups, including digital assets. The city has also established a Venture Capital Fund with seed capital of 600 billion VND and attracted approximately 10 strategic investors. Concurrently, Hanoi is preparing to operate a Technology Trading Floor while integrating a digital asset trading function.

From a technological standpoint, Mr. Le Thanh (Ninety Eight) emphasized that blockchain, with its decentralized, transparent, immutable, and intermediary-free characteristics, creates the core value of “digital trust.” Meanwhile, Mr. Nguyen Trung Trang, Product Director at SSI Digital, argued that blockchain is merely the foundation, while digital assets are the critical application. According to him, it is necessary to avoid viewing digital assets as a speculative channel for “multiplying returns,” as the sustainable trend should be “Tokenized Assets”—assets tokenized based on real business activities and cash flows, akin to a more flexible IPO suitable for growing enterprises.

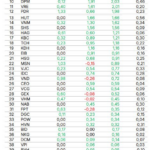

NOXH Leads with Over 9,500 Units Launched in November

Local Construction Departments’ statistics reveal that 19 projects, comprising over 11,400 units, are eligible for future home sales across 10 provinces and cities in November 2025. Social housing continues to lead with the highest number of units available for sale, exceeding 9,500.