On December 9th, the State Securities Commission (SSC) held a conference to disseminate regulations related to listing and trading registration for foreign-invested enterprises.

Conference on disseminating regulations for listing and trading registration of foreign-invested enterprises – Photo: VGP/HT

|

Diversifying Listed Products

Speaking at the conference, SSC Chairwoman Vu Thi Chan Phuong stated that 2025 marks the 25th anniversary of Vietnam’s stock market development, highlighted by two significant milestones: the launch of the KRX trading system and Vietnam’s upgrade to secondary emerging market status by FTSE effective October 8th.

According to Ms. Phuong, these achievements reflect the government’s and regulators’ efforts in institutionalizing, upgrading infrastructure, and standardizing market operations. The quality of services provided by securities companies, clearing mechanisms, and transparency of listed companies have all seen notable improvements.

However, she emphasized that the upgrade is just the beginning. The greater challenge lies in maintaining this status and deepening market development, with product diversification being a critical requirement. The quality of stocks will determine the market’s attractiveness, especially for foreign investors.

Currently, the market’s product structure remains concentrated in banking, finance, and real estate. The participation of large-scale foreign-invested enterprises (FIEs) with global supply chains is expected to bring fresh momentum to the market. Although only 10 FIEs are currently listed or registered for trading, many long-established FIEs in Vietnam meet the criteria and express interest in going public.

Ms. Phuong believes there is no reason for FIEs to remain outside the market as long as they comply with regulations and supervisory requirements. Stronger FIE participation will enrich the market’s sectoral diversity and balance the structure of listed companies.

Ms. Vu Thi Chan Phuong, SSC Chairwoman, speaking at the conference – Photo: VGP/HT

|

Addressing Legal Hurdles for FIEs to Go Public

From a legal perspective, Tran Tien Dung, Head of the Public Company Supervision Department at SSC, noted that FIE participation in Vietnam’s stock market remains limited, with only about 1.2 billion shares, equivalent to 0.17% of the total market. As the market enters a new development phase, promoting FIE listings is crucial for enhancing market structure and attracting international capital.

Policy-wise, Vietnam maintains a non-discriminatory approach between domestic and foreign enterprises. This principle is evident in Resolution 50-NQ/TW on perfecting institutions to attract foreign investment and Resolution 68-NQ/TW on private sector development. Legally, the 2019 Securities Law and its 2024 amendments uniformly apply public company regulations, regardless of capital source or enterprise nationality.

However, Mr. Dung advised that FIEs preparing for listing must address technical requirements such as operational model conversion, handling foreign shareholder equity, transfer conditions, and disclosure obligations. For IPOs, enterprises must comply with capital verification audit reporting as per Circular 19/2025/TT-BTC. When registering as a public company or for trading, Articles 32, 33, and 34 of the Securities Law apply.

During the conference, regulators addressed practical questions from enterprises. SSC Vice Chairman Hoang Van Thu noted that while securities laws provide a general framework, FIEs must also consider sector-specific regulations, particularly Decree 31 on restricted sectors for foreign investors. In real estate, foreign ownership ratios must be determined by business type, not a single industry code.

“If the law does not restrict, foreign investors can own up to 100%,” Mr. Thu emphasized, recommending that enterprises consult the Ministry of Construction for complex cases.

From an investment perspective, Bui Thu Thuy, Deputy Director of the Foreign Investment Agency, explained that the current Investment Law clearly defines FIEs: any enterprise with foreign investor capital contribution is classified as a foreign-invested economic organization. Cases where foreign investors hold over 50% equity or control operations are determined at specific times due to continuous capital fluctuations. She stressed the principle of equality between FIEs and domestic enterprises, except in sectors related to national security, defense, or those restricted by international commitments.

Some FDI projects from the 1990s with transfer or compensation conditions upon listing require thorough review to ensure investor rights and avoid legal risks. These are special cases demanding tailored approaches.

Representatives from Ho Chi Minh City Stock Exchange (HOSE) provided guidance for enterprises. According to HOSE, listing applications must include audited financial reports for the past two years, without requiring fiscal years to align with the calendar year. For mergers, acquisitions, or restructuring, enterprises should refer to Decree 155 and 245, particularly regarding transaction value criteria and filing deadlines.

Regarding audit qualifications, SSC stated that reports must generally be fully accepted, but if qualifications do not affect offering conditions, IPOs can proceed with confirmation from independent auditors. Converting FIEs to joint-stock companies follows the Enterprise Law and Decree 125, consistent with domestic enterprises.

– 19:45 09/12/2025

How Do Rising Interest Rates Impact the Stock Market?

The VN-Index is on an impressive 8-session winning streak, inching closer to the 1,750-point resistance level. This upward momentum fuels optimism but also heightens profit-taking pressures. Next week, investor focus will shift to monitoring cash flow dynamics amidst rising interest rates, as the market seeks a retest of its resilience before establishing a new trend.

Vietnam’s Stock Market Shows No Signs of a Bubble, with a 75% Probability of Gains in December

SSI Securities has revised its 2026 forecast for the VN-Index upward to 1,920 points, reinforcing its stance that Vietnam’s stock market is not in a bubble.

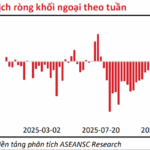

Foreign Investors Net Sell Nearly VND 400 Billion in Vietnamese Stocks on December 10th: Which Stocks Were Targeted?

In the afternoon trading session, MBB stocks led the net buying list, with foreign investors pouring approximately 241 billion VND into this ticker.