Two Investors Fall Short of Expected Share Purchases

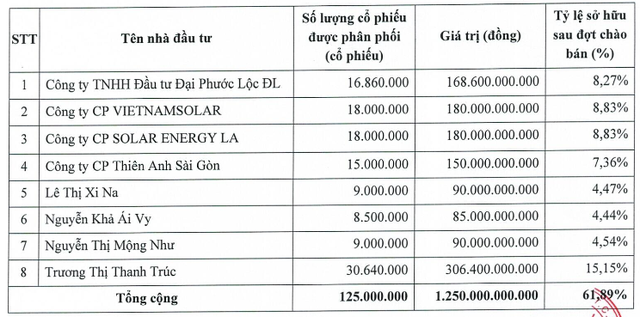

Baominh Securities JSC (BMSC, code: BMS, UPCoM) has announced the payment results for the private placement of 125 million shares at an offering price of VND 10,000 per share.

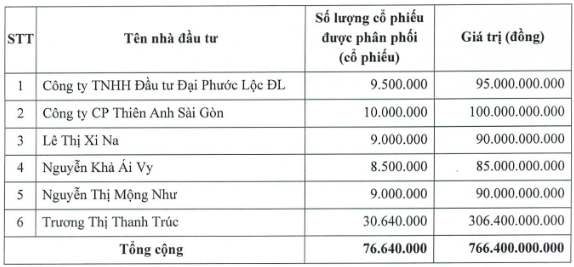

As of December 8, 2025, only 6 out of 8 investors paid VND 766.4 billion to purchase 76.64 million shares out of the total 125 million offered. Mrs. Truong Thi Thanh Truc led with the purchase of 36.64 million shares.

Source: BMS

The reason Baominh Securities has not completed the offering is due to investors purchasing fewer shares than anticipated. Compared to the previously announced figures, Dai Phuoc Loc DL Investment LLC bought 7.36 million fewer shares, and Thien Anh Saigon JSC purchased 5 million fewer shares. Meanwhile, Vietnamsolar JSC and Solar Energy LA JSC did not participate in the offering.

List of expected investors announced in August 2025. Source: BMS

Five Entities to Acquire Remaining 48.36 Million Shares

For the remaining 48.36 million shares, the BMS Board of Directors approved their sale to five entities. Vina Green Energy LA LLC and Solar City LLC each plan to buy 10 million shares; Cosmo Medical Hub LLC will purchase 9.86 million shares; Blue Ocean Resort NT LLC will acquire 9.5 million shares; and Nhat Phuong NT LLC will buy 9 million shares.

Source: BMS

These five entities are expected to collectively own 23.7% of Baominh Securities’ charter capital after the offering. None of them will hold more than 5%.

Cosmo Medical Hub LLC, established in May 2024, initially registered as a hospital and health station operator with a charter capital of VND 5 billion.

In its shareholder structure, CEO Tran Viet Bao Hoang holds 10%, Le Cong Huyen Dieu holds 10%, and Nguyen Thi Kim Phuong holds 80%. Notably, Tran Viet Bao Hoang is also the CEO of Miss Cosmo – Miss Universe International.

In May 2025, the shareholder structure changed, with Le Cong Huyen Dieu increasing her ownership to 70% and becoming CEO; Nguyen Hoang Gia holds the remaining 30%.

By June 2025, the company registered advertising as its primary business and increased its capital to VND 105 billion. Vo Quoc Tin replaced Le Cong Huyen Dieu, holding 70% of the capital and serving as CEO; Nguyen Hoang Gia retains 30%.

Vina Green Energy LA LLC, established in October 2018, operates in electricity transmission and distribution. With a charter capital of VND 250 billion, it is 80% owned by Diamond Nha Trang LLC (represented by Tran Thi Truc Linh) and 12% by Hoan Cau Long An JSC (represented by Duong Tien Dung). Truong Cao Hai serves as CEO and company representative.

Truong Cao Hai also represents Hoan Cau Trading JSC, Hoan Cau Solar LA JSC, and AQ Construction and Infrastructure LLC.

Blue Ocean Resort NT LLC, established in late 2017, is registered as a travel agency. Initially, it had a charter capital of VND 100 billion, with Van Phuoc Dat LLC holding 30% and Hoang Quoc Thien LLC holding 70%.

As of August 2025, the company is headquartered at 5th Floor, Nha Trang Center Building, 20 Tran Phu Street, Nha Trang Ward, Khanh Hoa Province.

At this time, the company’s charter capital is VND 771.8 billion, with Van Phuoc Dat LLC owning 45% and Southern Landscape Design and Construction LLC owning 55%. Nguyen Thuan serves as CEO and company representative.

Nhat Phuong NT LLC, established in November 2017, is registered as a sports club operator. Initially, it had a charter capital of VND 100 billion, with Director Le Tuan Khanh owning 70% and Tran Ngoc Diep holding 30%.

As of December 2023, the company’s charter capital exceeds VND 433 billion. Blue Diamond NT LLC owns 85.46%, and Golf Paradise LLC owns 14.53%.

Currently, Tran Ngoc Diep serves as Director and company representative. The company is also headquartered at 5th Floor, Nha Trang Center Building, 20 Tran Phu Street, Nha Trang Ward, Khanh Hoa Province.

Regarding Blue Diamond NT LLC, as of December 2024, it is a shareholder of Hoan Cau Long An LLC. In August 2025, Hoan Cau Long An received investment approval from the Tay Ninh Provincial People’s Committee for the Binh Hoa Nam 1 Industrial Zone project, covering over 322 hectares with a total investment of VND 3.9 trillion.

Top 5 Investors Acquire 161.85 Million Individual Shares of VPS

VPS Securities Corporation (HOSE: VCK) is set to privately offer 161.85 million shares to five individuals, priced between VND 50,000 and VND 65,000 per share. This move marks the final step in a rapid series of three significant capital increase initiatives.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.