Following approval from the State Securities Commission, Vietcap Securities Joint Stock Company (stock code: VCI, listed on HoSE) has finalized the timeline for the private placement of 127.5 million shares, equivalent to 17.64% of the total outstanding shares.

The offering price is set at VND 31,000 per share. As of the morning of December 9, VCI shares were trading at VND 33,500 per share. Therefore, the private placement price is 7.4% lower than the market price.

Investors can submit payment for the shares from December 9, 2025, until 3 PM on December 15, 2025. The issued shares will be subject to a one-year transfer restriction.

With the expected proceeds of VND 3,952.5 billion from this offering, Vietcap plans to allocate 80% to margin lending activities and the remaining 20% to proprietary trading.

Upon completion of this capital increase, Vietcap’s chartered capital is projected to rise from VND 7,226 billion to VND 8,501 billion.

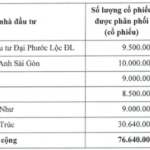

Previously, Vietcap announced a list of 69 investors expected to participate in this offering, including 13 foreign investors and 56 domestic investors.

Darasol Investments Limited is anticipated to acquire the largest portion with 12.2 million shares. Two shareholders, Nguyen Tan Minh and Le Danh Tai, are each expected to receive 11.5 million shares. ACM Global Fund VCC is set to be allocated 7.5 million shares. Shareholder Lam Binh Thanh plans to purchase 6 million shares…

Manulife (Vietnam) LLC intends to buy 5.85 million shares, while Prudential Vietnam Life Insurance Company Ltd. plans to acquire 3 million shares. Vietnam Enterprise Investment Limited (VEIL) and several members of Dragon Capital will also participate in the offering.

This capital increase plan was approved at the Extraordinary General Meeting of Shareholders held on November 7, 2025.

In the first nine months of the year, VCI reported operating revenue of VND 3,454 billion, a 28% increase; pre-tax profit reached VND 1,086 billion, and post-tax profit was VND 899 billion, both up 30% compared to the same period in 2024.

For 2025, Vietcap Securities aims for a pre-tax profit of VND 1,420 billion, a 30% increase from the previous year. The company has already achieved 76% of its annual profit target.

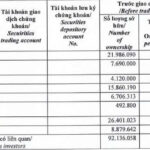

As of September 30, 2025, VCI’s total assets stood at VND 29,718 billion, an increase of over VND 3,100 billion from the beginning of the year.

Of this, margin lending and advance payments for securities sales totaled VND 13,945 billion, up more than VND 2,700 billion year-to-date, accounting for 47% of total assets.

The AFS financial assets portfolio is valued at VND 11,457 billion, exceeding the cost by over VND 1,600 billion.

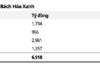

Within this, the listed equity portfolio has a cost of VND 8,874 billion, currently yielding a total unrealized gain of over VND 1,400 billion. KDH shares hold the largest proportion at VND 635 billion, down approximately VND 250 billion from the start of the year, with an unrealized gain of VND 213 billion.

The most profitable holding is IDP shares, with a cost of VND 441 billion and an unrealized gain of over VND 1,000 billion. FPT shares, with a cost of VND 570 billion, have increased by about VND 70 billion year-to-date but are currently showing an unrealized loss of over VND 82 billion.

During the period, VCI invested an additional VND 150 billion in MBB shares, bringing the total cost to VND 165 billion, with an unrealized gain of VND 47 billion.

Beyond listed equities, Vietcap’s AFS portfolio includes VND 1,458 billion in bonds, VND 4,874 billion in other listed securities, and VND 927 billion in unlisted securities.

On the funding side, the company recorded short-term borrowings of VND 15,867 billion, an increase of over VND 3,200 billion from the beginning of the year. Domestic bank loans account for more than VND 10,500 billion.

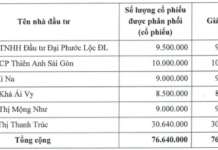

Top 5 Investors Acquire 161.85 Million Individual Shares of VPS

VPS Securities Corporation (HOSE: VCK) is set to privately offer 161.85 million shares to five individuals, priced between VND 50,000 and VND 65,000 per share. This move marks the final step in a rapid series of three significant capital increase initiatives.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.