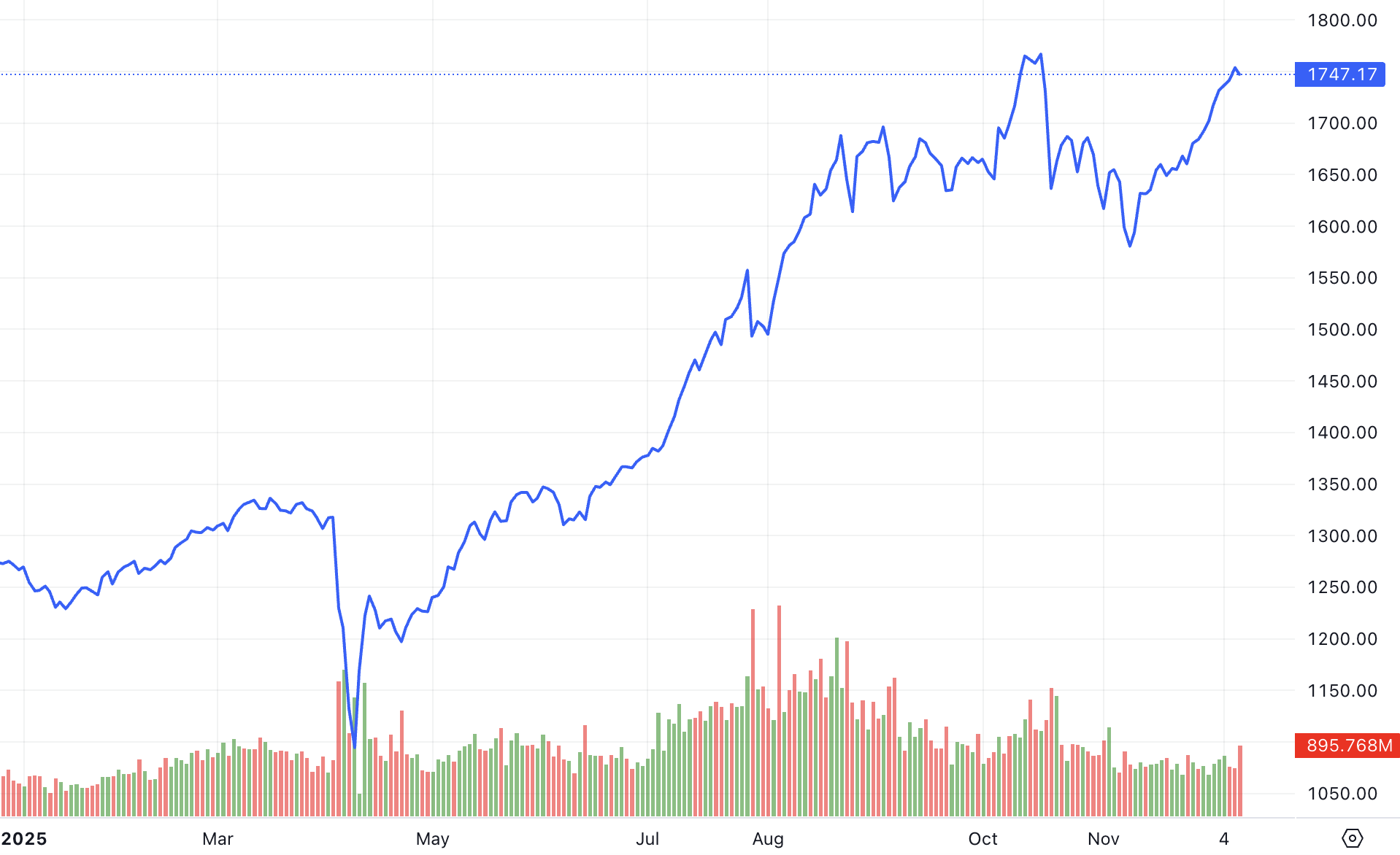

Fueled by stock market growth, domestic reforms, and positive trade developments, Vietnam captured significant attention in 2025. The VanEck Vietnam ETF (VNM ETF) surged approximately 62%, while the iShares MSCI China ETF (MCHI) lagged with a nearly 31% increase.

Vietnamese stocks even outperformed other emerging markets. The VNM ETF‘s year-to-date gain more than doubled the roughly 30% rise of the iShares MSCI Emerging Markets ETF (EEM), which tracks large and mid-cap stocks in emerging markets. Since the beginning of the year, the VN-Index has soared by 38%.

|

Performance of the VN-Index

|

“Vietnam is truly charting its own course,” said Thea Jamison, Managing Director at Change Global, in an interview with CNBC. “Emerging markets offer more than just China,” she added, calling Vietnam a “rising superstar with immense potential.”

Turnaround

Following the 2022 shock, Vietnam’s market has fully recovered and is now trading significantly higher than pre-COVID levels. Driven primarily by domestic retail investors, Vietnam’s stock market saw a surge in liquidity, with average daily trading values reaching $2 billion this year, according to Jamison. She believes Vietnam’s market remains undervalued compared to the U.S.

“Foreign investors have completely missed this rally,” she noted. “The market is becoming less reliant on volatile foreign capital. It’s genuinely growing based on the intrinsic value from its domestic investor base.”

Sentiment was further bolstered when FTSE Russell announced Vietnam’s upgrade to Secondary Emerging Market status, effective September 21, 2026. This move is a result of Vietnam’s reforms, particularly the removal of the prefunding requirement for foreign investors.

Nguyễn Hoài Thu, Managing Director and Head of Investments at VinaCapital, predicts the upgrade could bring an additional $5-6 billion in capital inflows.

“We are confident that Vietnamese authorities will effectively address remaining issues, and the upgrade will proceed as planned in September 2026,” she stated. “Becoming an emerging market is a notable milestone for Vietnam. However, the greater challenge is ensuring and solidifying this status in the long term.”

According to Thu, to maintain its new status, Vietnam needs more comprehensive reforms to “modernize and enhance the resilience of its capital market,” including greater openness to foreign investors, industry diversification, and more high-quality IPOs.

Despite Vietnam’s domestic index performance this year placing it among the best-performing markets, the rally has been concentrated in a small group of stocks. Excluding the “power trio” of Vingroup, Vinhomes, and Vincom Retail, the VN-Index‘s year-to-date gain would be only around 10%, Thu noted.

She forecasts a “more stable” environment for the market in 2026, estimating corporate earnings growth of approximately 15%, which could translate to stock market returns of 15-20%.

“Current market valuations remain reasonable, indicating room for growth as earnings materialize,” she emphasized.

“The cranes are still moving”

The stock market isn’t the only area experiencing growth. To create a more business-friendly environment, the Vietnamese government has recently implemented several structural reforms to vigorously promote economic development.

At the heart of this program is Resolution 68. Issued in May, this policy focuses on strengthening the private sector by offering incentives to companies, such as reducing bureaucratic barriers and improving access to capital.

Additionally, the government is amending the Land Law to simplify land acquisition for investors and facilitate real estate and infrastructure projects, especially those that are stalled.

However, this isn’t the first time Vietnam has launched ambitious economic reforms. Dan Kritenbrink, a partner at The Asia Group and former U.S. Ambassador to Vietnam, emphasized that Vietnam’s growth journey actually began decades ago, specifically with the groundbreaking “Doi Moi” policy initiated in 1986.

Since then, the country truly “took off” in the mid-1990s, when the U.S. trade embargo was lifted in 1994 and U.S.-Vietnam trade relations were normalized in 1995. These milestones, along with WTO accession in 2007, marked a turning point in the economic opening process.

“Vietnam’s economic development over the past two, three, four decades has been truly extraordinary, one of the greatest success stories in Southeast Asia,” Kritenbrink remarked.

This strategy appears to be paying off, as foreign investment capital is pouring into Vietnam. Disbursed FDI in the first 10 months reached $21.3 billion—a record high for the January-October period in the past five years, according to the General Statistics Office.

“The cranes are constantly moving,” observed Jamison from Change Global. “This economy is booming.”

This success is inseparable from Vietnam’s labor force strength—a factor that sets it apart from other emerging markets, noted Đặng Thanh Tùng, Chief Economist at Dragon Capital, in an interview with CNBC.

Among its standout features, he highlighted Vietnam’s “large and relatively young workforce, high labor participation rates, and low unemployment,” combined with a work culture characterized by a “willingness to work in manufacturing and services” and “quick adaptability to new technologies and processes.”

Tùng considers these traits key factors enabling Vietnam’s rapid integration into global production networks across various industries, from textiles to electronics.

“Authorities are focusing on upgrading the labor force through continuous investment in education, digital skills, and vocational training, alongside improving the labor market framework,” he said. “If these efforts are sustained, the unique combination of demographic advantages, skill development, and work culture will continue to set Vietnam apart from many other countries, maintaining its role as a key driver of growth and enhancing its attractiveness to foreign investors.”

– 08:31 10/12/2025

Vietstock Daily 12/12/2025: Falling Below the 1,700-Point Milestone

The VN-Index extended its losing streak to a third consecutive session, poised to retest the middle band of the Bollinger Bands. The Stochastic Oscillator continued its downward trajectory, reinforcing the sell signal and exiting overbought territory. Meanwhile, the MACD is gradually narrowing its gap with the Signal line, hinting at potential bearish momentum. Short-term outlook may turn increasingly pessimistic if this indicator triggers a sell signal in upcoming sessions.

21.5 Million VVS Shares Officially Listed on HoSE: Unlocking a New Era of Promising Growth

The official listing of VVS shares on the HoSE exchange comes amidst a booming logistics and transportation sector in Vietnam. Fueled by significant infrastructure investments, expanding industrial production, and surging demand for freight transportation, the industry is experiencing rapid growth. This momentum is further amplified by the activation of numerous public and key projects.

Bank Flush with Cash, Continually Slashing Interest Rates on Social Housing Loans

The disbursement rate for social housing has surged, driven by a significant improvement in the supply of social housing units compared to 2024. In Hanoi, numerous projects are on the verge of finalizing contracts, with banks actively offering attractive low-interest packages ranging from 4.8% to 5.9% per annum.

Skyrocketing Inflation, Gold Prices, and Real Estate: Navigating the Mounting Economic Pressures

After the first 11 months, the macroeconomy remains stable, inflation is under control, and growth drivers are being propelled forward. However, the economy still faces numerous challenges and difficulties.

Unlocking Digital Assets: A New Growth Catalyst

In the wake of the government’s issuance of Resolution 05, which pilots the cryptocurrency market, a pivotal moment has emerged for the digital economy and corporate governance reform. Representatives from businesses, experts, and policymakers engaged in discussions on the digital economy, exploring how these components can collectively forge a new foundation for growth.