The December 2025 strategic report by SSI Securities Corporation reveals that Vietnam’s stock market is in a bottoming phase, with a high likelihood of entering a robust growth cycle from 2026. The report projects the VN-Index to surpass the 1,920-point milestone.

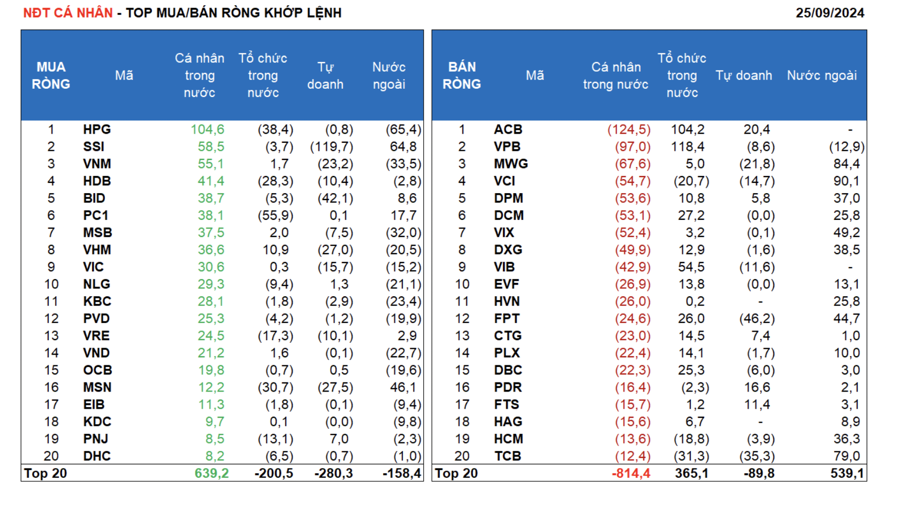

Following two consecutive months of decline, the VN-Index rebounded in November, closing at 1,690.99 points—a 51.3-point increase (3.13%) from the previous month. Notably, the rally was primarily driven by large-cap stocks, with VIC leading the charge, surging 36.3% and contributing approximately 60 points to the overall recovery. VPL also saw a 23.2% rise, while the oil and gas, and food and beverage sectors demonstrated positive momentum.

Year-to-date, the VN-Index has gained around 33%. However, excluding the impact of Vingroup ecosystem stocks, the actual increase is approximately 13%. Market liquidity remains low, with average trading value in November at about VND 20 trillion per session, down 35.5% from October.

Historical data indicates that the market typically experiences strong growth from December to March annually. The probability of an uptrend during this period is 75%, significantly higher than the 50% observed from April to November. Average monthly returns reach 1.7%, outpacing the 0.5% seen in other months.

2026 Outlook: VN-Index Targets 1,920 Points

SSI maintains a positive outlook for the market in 2026. Vietnam aims for double-digit GDP growth from 2026 to 2030, supported by economic restructuring, robust FDI inflows, and accelerated infrastructure investment. These factors are expected to underpin corporate profit growth and stock market sustainability.

Against this backdrop, SSI has raised its 2026 VN-Index target to 1,920 points. The index currently trades at a projected 2025 P/E ratio of 14.5 times, in line with regional averages, but with superior earnings growth prospects (14.5% vs. the region’s 11.5%). By 2026, the market’s projected P/E is expected to drop to 12.7 times, below the 10-year historical average of 14 times, enhancing its valuation appeal.

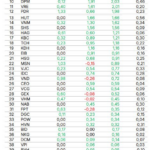

SSI also notes a significant slowdown in foreign investor net selling. Despite a fourth consecutive month of net outflows in November, totaling VND 6.8 trillion, the selling pace has decelerated. Notably, foreign capital turned net positive in the first week of December.

SSI identifies the banking sector as the most promising, particularly stocks with strong profit growth potential and attractive valuations. The consumer sector is also favorably positioned, benefiting from recovering domestic demand, retail expansion, and the increased personal income tax threshold effective January 2026, which is expected to boost household disposable income.

With a stable macro environment, attractive valuations, and signs of returning foreign capital, SSI believes Vietnam’s stock market is entering a cyclical trough, setting the stage for robust growth in the next two years.

Foreign Investors Net Sell Nearly VND 400 Billion in Vietnamese Stocks on December 10th: Which Stocks Were Targeted?

In the afternoon trading session, MBB stocks led the net buying list, with foreign investors pouring approximately 241 billion VND into this ticker.