I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 8, 2025

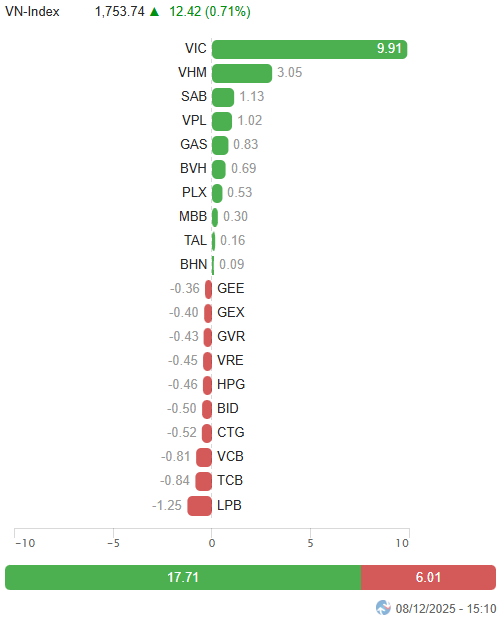

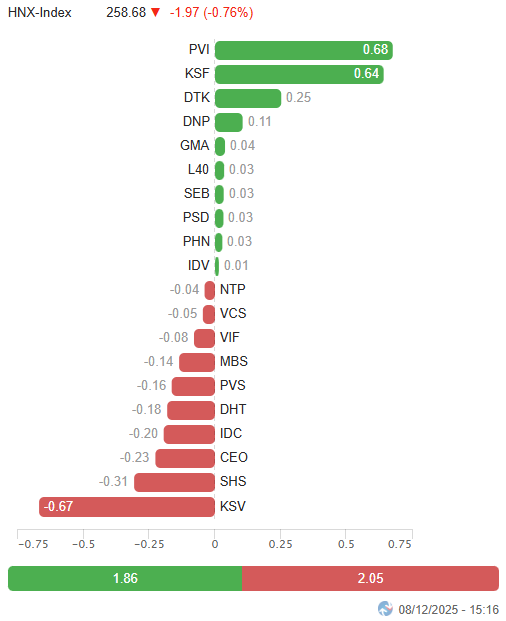

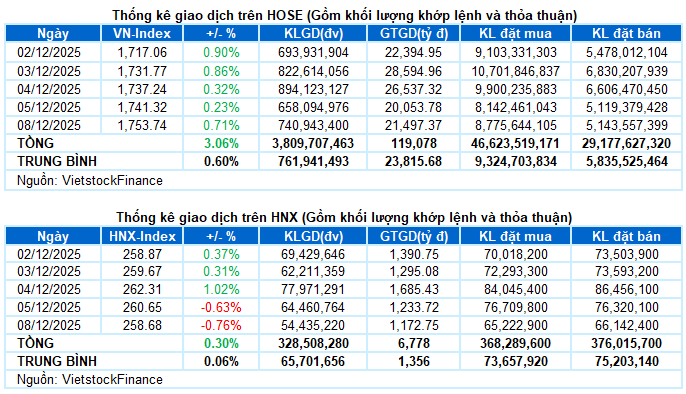

– Key indices showed mixed movements during the December 8 trading session. The VN-Index rose by 0.71%, reaching 1,753.74 points. In contrast, the HNX-Index declined by 0.76%, closing at 258.68 points.

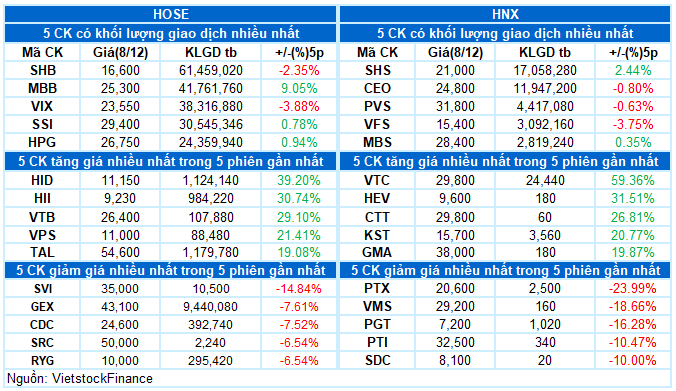

– Trading volume on the HOSE floor slightly decreased by 3.2%, totaling over 609 million units. The HNX floor also recorded only 52 million matched units, a 15.1% drop compared to the previous session.

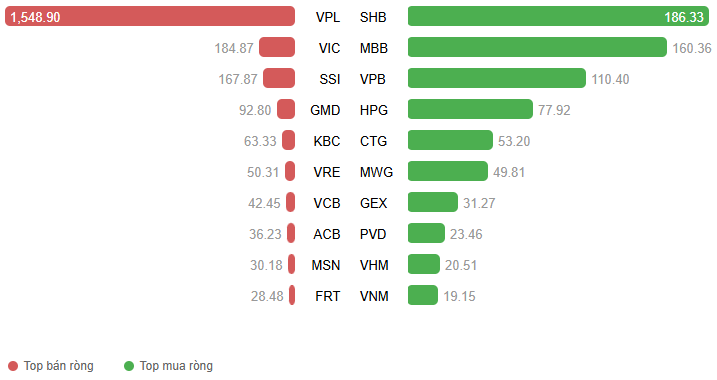

– Foreign investors continued to net sell, with a value of over 1,881 billion VND on the HOSE and 45 billion VND on the HNX.

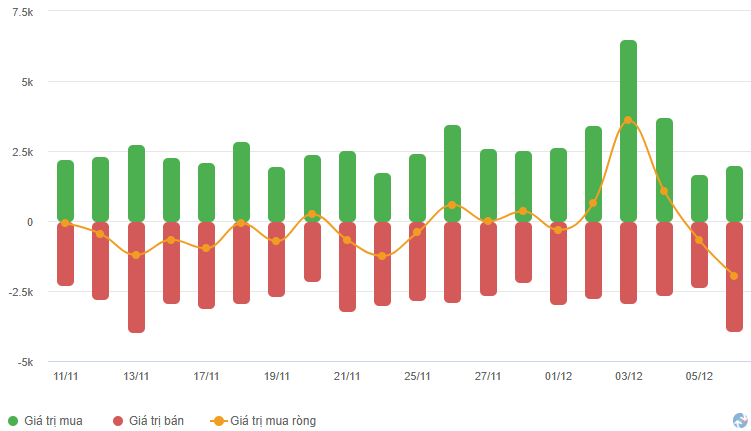

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The VN-Index started the week’s first trading session positively, quickly approaching the 1,760-point mark within an hour of opening. However, the upward momentum was primarily driven by a few pillar stocks, notably VIC, which hit its ceiling price early. The broader market faced widespread adjustment pressure, highlighting a clear divergence between the index and overall stock prices. Low trading volume reflected investors’ cautious sentiment amid the lack of widespread participation. In the afternoon session, increased selling pressure significantly narrowed the VN-Index‘s gains, but support from pillar stocks toward the end helped the index close at 1,753.74 points, up over 12 points from the previous session.

– In terms of impact, the top 10 stocks contributed a total of 17.71 points to the VN-Index‘s increase. The Vingroup trio (VIC, VHM, and VPL) alone added 14 points. Conversely, LPB, TCB, and VCB were the biggest drags, collectively subtracting nearly 3 points from the index.

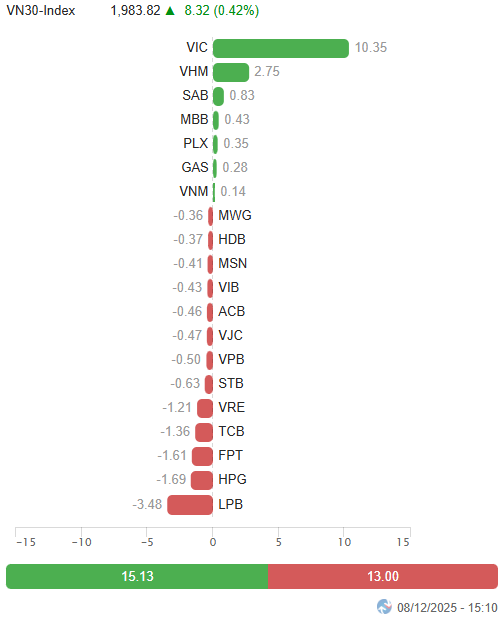

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index closed up 8.32 points (+0.42%), reaching 1,983.82 points. However, the basket’s breadth favored selling, with 21 decliners, 7 gainers, and 2 unchanged stocks. LPB was the biggest loser, down 3.7%. VRE, VIB, and GVR also adjusted downward by over 1.5%. Conversely, VIC and SAB strongly supported the index with ceiling prices, while PLX, VHM, and GAS contributed positively with gains above 2%.

Divergence continued to dominate sector performance. The communication services sector lagged, down 1.71%, primarily due to adjustments in VGI (-1.63%), FOX (-2.86%), CTR (-1.16%), SGT (-1.82%), and VNB (-5.64%).

Industrial and financial sectors also exerted significant pressure, with numerous stocks in the red, including GEX (-4.22%), GMD (-2.46%), VSC (-2.88%), PC1 (-3.03%), GEE (-1.81%); TCB (-1.44%), LPB (-3.74%), STB (-1.02%), VIB (-1.61%), TPB (-1.15%), EIB (-1.98%), and VIX (-3.48%). Insurance stocks within the financial sector bucked the trend, with notable performers like BVH hitting the ceiling, PVI (+4.84%), MIG (+2.59%), BMI (+2.69%), and ABI (+1.01%).

The real estate sector led the market with a 2.8% gain, primarily driven by VIC hitting its ceiling, VHM (+2.8%), KSF (+1.61%), VPI (+1.22%), TAL (+3.41%), SJS (+1.02%), and VCR (+4.03%). However, most other stocks in the sector faced adjustment pressure, with many declining over 1%, including VRE, KDH, KBC, NVL, TCH, IDC, DIG, CEO, and DXG.

The VN-Index continued its upward trend with the 9th consecutive gaining session, closely following the Upper Band of the Bollinger Bands. However, trading volume fell below the 20-day average, indicating investor caution. The index is approaching the October 2025 peak (around 1,760-1,795 points), while the Stochastic Oscillator remains in overbought territory. If selling signals re-emerge in upcoming sessions, correction risks may arise.

II. PRICE TREND AND VOLATILITY ANALYSIS

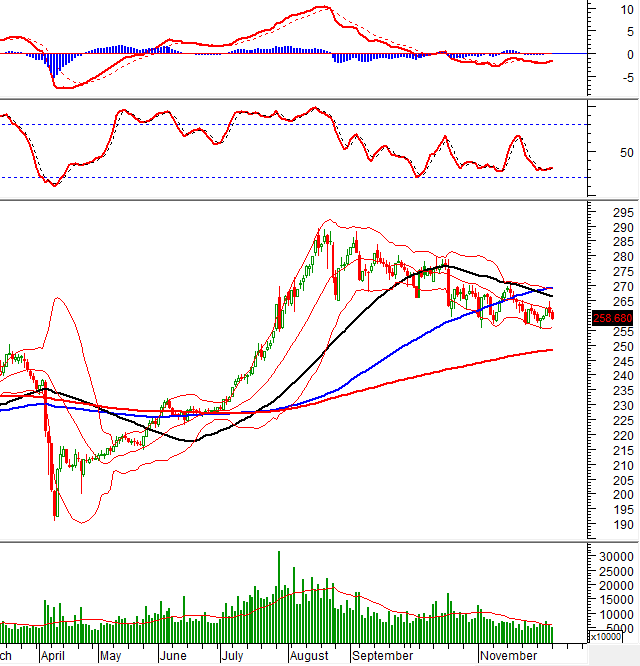

VN-Index – Stochastic Oscillator Deep in Overbought Territory

The VN-Index continued its upward trend with the 9th consecutive gaining session, closely following the Upper Band of the Bollinger Bands. However, trading volume fell below the 20-day average, indicating investor caution.

The index is approaching the October 2025 peak (around 1,760-1,795 points), while the Stochastic Oscillator remains in overbought territory. If selling signals re-emerge in upcoming sessions, correction risks may arise.

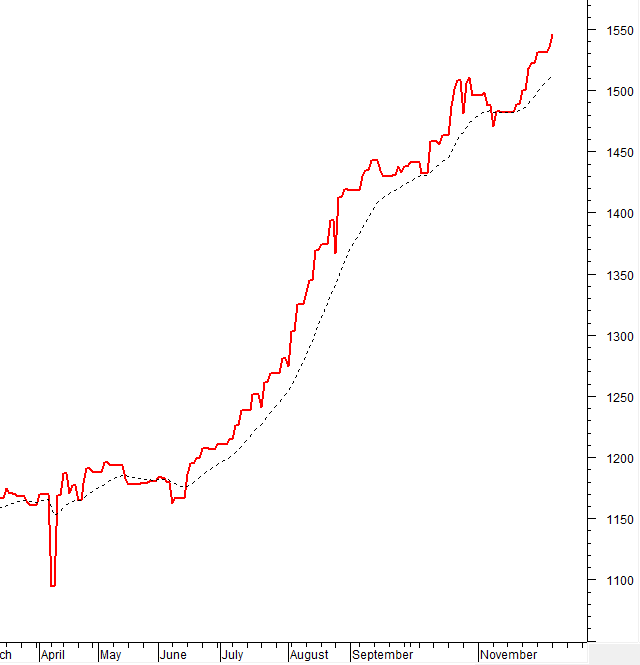

HNX-Index – Testing November 2025 Lows

The HNX-Index continued its adjustment, returning to test the November 2025 lows (around 255-259 points).

Short-term prospects remain unfavorable, as the index stays below the Middle Band of the Bollinger Bands, and a “Death Cross” between the SMA 50 and SMA 100 has appeared.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the EMA 20 line. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors net sold during the December 8, 2025, session. If they continue this action in upcoming sessions, the outlook may become more pessimistic.

III. MARKET STATISTICS FOR DECEMBER 8, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:19 08/12/2025

Tracking the Whale Money Flow on December 9th: Proprietary Traders and Foreign Investors Diverge, Vingroup Affiliates Grab Attention

The trading session on December 9th highlighted a stark contrast in the actions of foreign investors and securities company proprietary trading desks. Notably, Vingroup-affiliated stocks (VIC and VHM) took turns dominating both the net buying and net selling lists among major players.

Vietnam’s Stock Market Shows No Signs of a Bubble, with a 75% Probability of Gains in December

SSI Securities has revised its 2026 forecast for the VN-Index upward to 1,920 points, reinforcing its stance that Vietnam’s stock market is not in a bubble.