I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 9, 2025

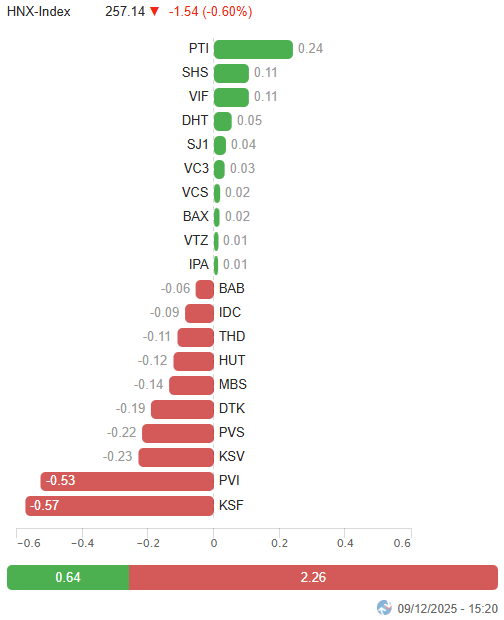

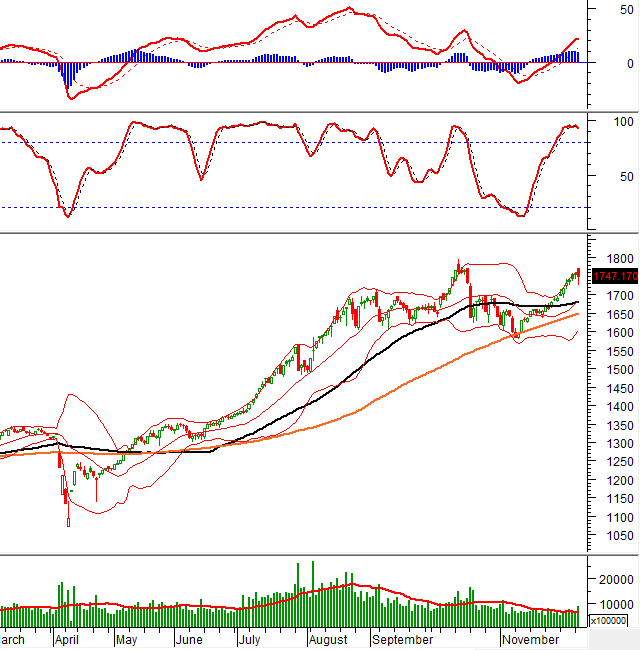

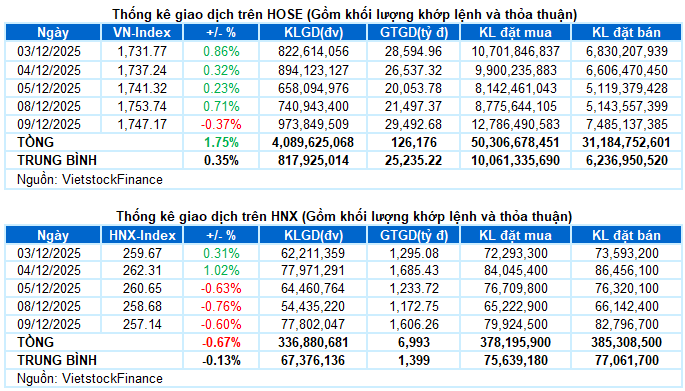

– Major indices unanimously declined during the December 9 trading session. Specifically, the VN-Index dropped by 0.37%, closing at 1,747.17 points, while the HNX-Index fell by 0.6%, settling at 257.14 points.

– Trading volume on the HOSE surged by 46.9%, exceeding 895 million units. Similarly, the HNX recorded over 70 million matched units, a 35.6% increase compared to the previous session.

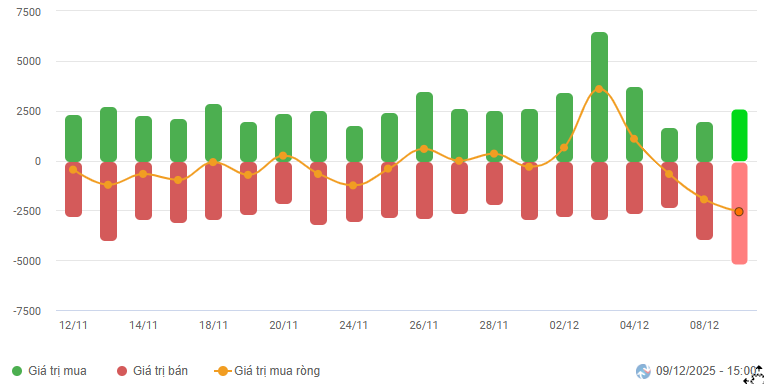

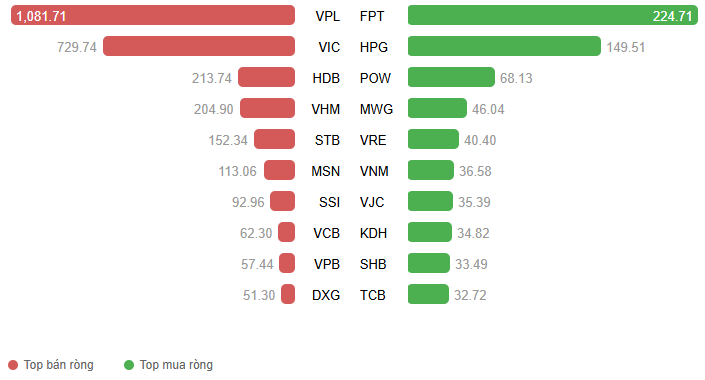

– Foreign investors continued to net sell, with values exceeding VND 2.4 trillion on the HOSE and over VND 92 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– During the December 9 session, the VN-Index faced strong selling pressure from the opening bell as cautious sentiment dominated the market, pulling the index down throughout the morning session. In the afternoon, selling pressure intensified, causing the index to briefly dip below 1,730 points. However, bottom-fishing activities helped the market recover, significantly narrowing the decline. At the close, the VN-Index settled at 1,747.17 points, down 6.57 points from the previous session.

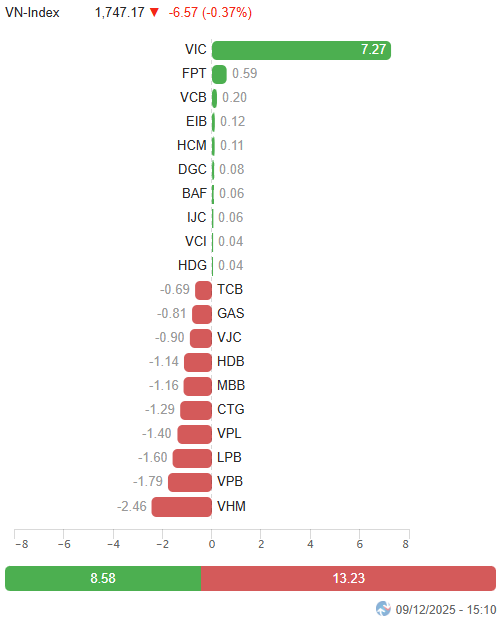

– In terms of impact, VHM was the most significant drag, subtracting 2.46 points from the VN-Index. Additionally, VPB, LPB, and VPL collectively pulled the index down by 4.8 points. Conversely, VIC remained a strong pillar of support, contributing over 7 points to the VN-Index.

Top Stocks Influencing the Index. Unit: Points

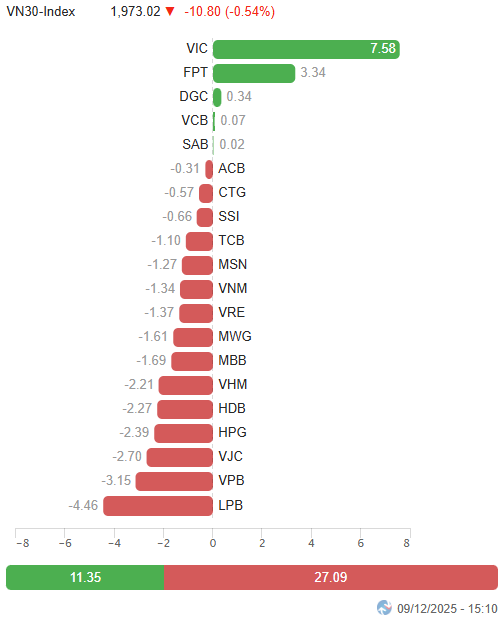

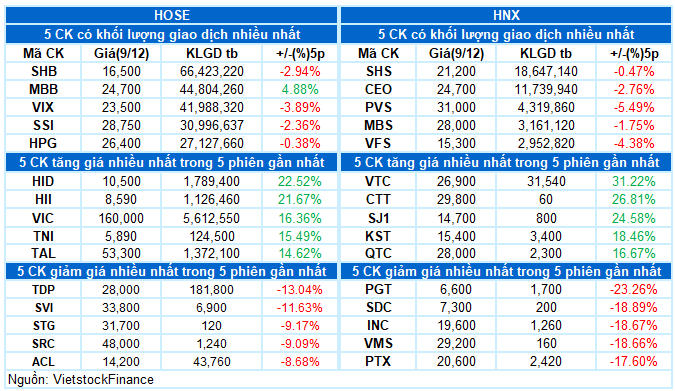

– The VN30-Index closed down nearly 11 points (-0.54%), at 1,973.02 points. Sellers dominated, with 25 declining stocks and only 5 advancing. Half of the stocks in the basket fell by over 1%, with LPB leading the decline at 5%. On the positive side, VIC stood out with a 4.8% gain, alongside FPT up 1.5%, while the rest maintained slight gains.

Red dominated most sectors. Energy and communication services were the worst performers, down 2.65% and 2.27%, respectively, with deep corrections in stocks like BSR (-3.02%), PLX (-2.91%), PVS (-2.52%), PVD (-5.42%), PVT (-1.63%), PVP (-1.74%); VGI (-1.93%), FOX (-3.83%), VNZ (-5.54%), VNB (-1.07%), and notably ICT and VTC hitting the floor.

Large-cap sectors like finance and industry also exerted significant pressure, with numerous stocks down over 1%, including CTG, TCB, VPB, MBB, LPB, HDB, TCX, VIB, SSI, TPB, BVH, MSB; ACV, VJC, GEE, VEA, GMD, VEF, VGC, VTP, CTD, TOS,…

Conversely, information technology shone brightly, up 1.32%, led by FPT (+1.47%) and ELC (+1.33%). Real estate also stayed green, primarily due to VIC‘s strong 4.78% gain, while most other stocks faced selling pressure, such as VHM (-2.27%), VRE (-2.88%), KSF (-1.46%), KBC (-1.47%), NVL (-1.7%), TAL (-2.38%), DXG (-2.17%), and SIP (-2.37%).

The VN-Index reversed its gains with trading volume surpassing the 20-day average as the index approached the October 2025 peak (around 1,760-1,795 points). Short-term risks are rising as the Stochastic Oscillator reversed, signaling strong selling in the overbought zone.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator Signals Sell

The VN-Index reversed its gains with trading volume surpassing the 20-day average as the index approached the October 2025 peak (around 1,760-1,795 points).

Short-term risks are rising as the Stochastic Oscillator reversed, signaling strong selling in the overbought zone.

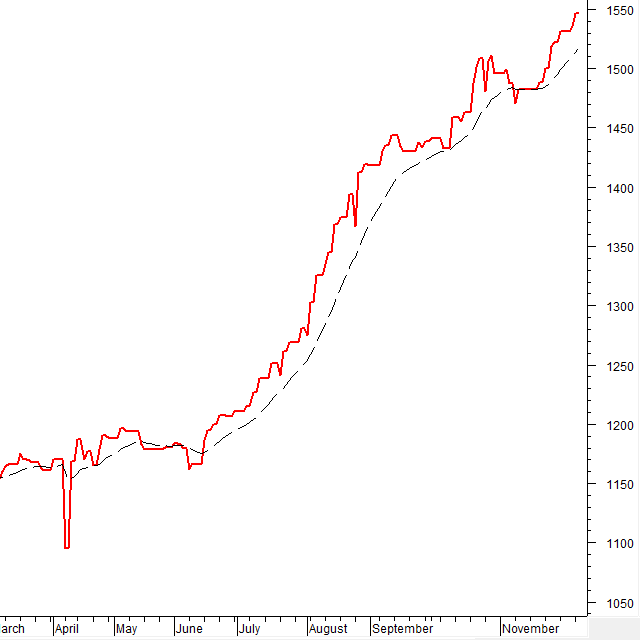

HNX-Index – Third Consecutive Decline

The HNX-Index continued its third consecutive decline, testing the November 2025 low (around 255-259 points). The outcome of this test will determine the near-term trend.

The short-term outlook is quite pessimistic as both the Stochastic Oscillator and MACD have issued sell signals.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued to net sell in the December 9, 2025 session. If foreign investors maintain this action in upcoming sessions, the situation could become even more pessimistic.

III. MARKET STATISTICS FOR DECEMBER 9, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:15 December 9, 2025

Real Estate Stock Surges as Brokerage Firms Unexpectedly Invest Hundreds of Billions Amid Market Downturn

Proprietary trading desks at securities companies recorded a modest net buy of VND 13 billion on the Ho Chi Minh Stock Exchange (HOSE) today.

Market Pulse 12/08: Foreign Investors Net Sell VPL, Vingroup Stocks Continue to Support Index

At the close of trading, the VN-Index climbed 12.42 points (+0.71%) to reach 1,753.74, while the HNX-Index dipped nearly 2 points (-0.76%), settling at 258.68. Market breadth favored decliners, with 446 stocks falling and 268 advancing. The VN30 basket mirrored this trend, as 21 constituents closed lower, 7 higher, and 2 unchanged.

Vietstock Daily 09/12/2025: Approaching Previous Peak with Caution

The VN-Index extended its winning streak to nine consecutive sessions, closely tracking the Upper Band of the Bollinger Bands. However, trading volume dipped below the 20-day average, indicating investor caution. The index is approaching its October 2025 peak (1,760–1,795 points), while the Stochastic Oscillator remains deeply in overbought territory. Should sell signals re-emerge in upcoming sessions, a corrective pullback could materialize.

Vietstock Daily 12/12/2025: Falling Below the 1,700-Point Milestone

The VN-Index extended its losing streak to a third consecutive session, poised to retest the middle band of the Bollinger Bands. The Stochastic Oscillator continued its downward trajectory, reinforcing the sell signal and exiting overbought territory. Meanwhile, the MACD is gradually narrowing its gap with the Signal line, hinting at potential bearish momentum. Short-term outlook may turn increasingly pessimistic if this indicator triggers a sell signal in upcoming sessions.