I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON DECEMBER 11, 2025

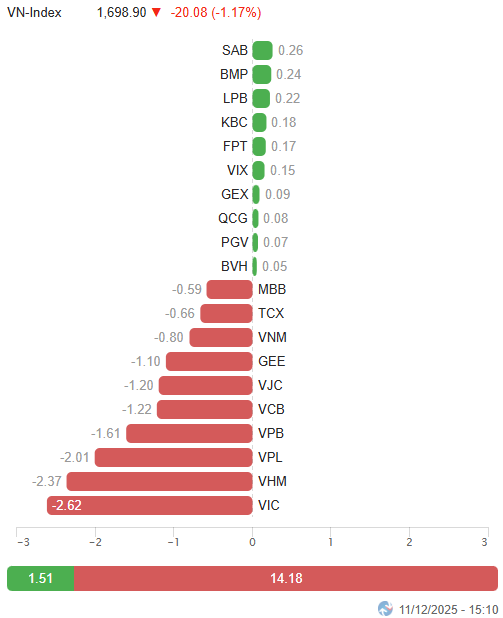

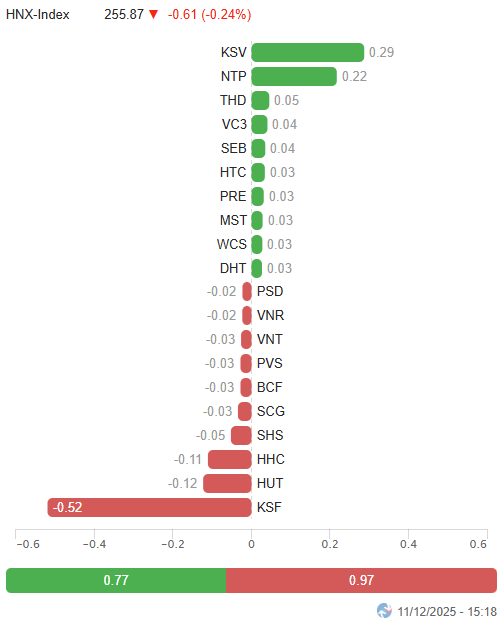

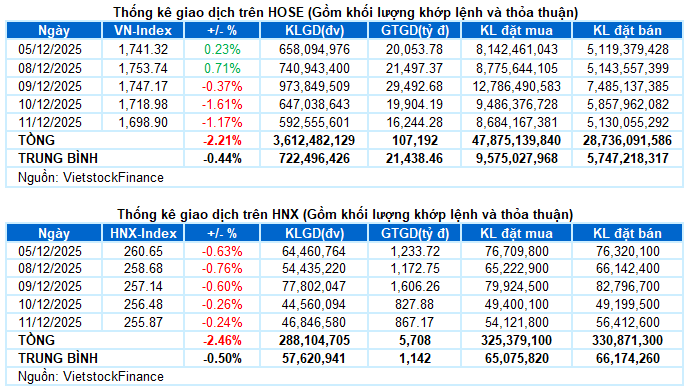

– Major indices continued to decline during the December 11 trading session. Specifically, the VN-Index dropped by 1.17%, closing at 1,698.9 points, while the HNX-Index experienced a slight decrease of 0.24%, settling at 255.87 points.

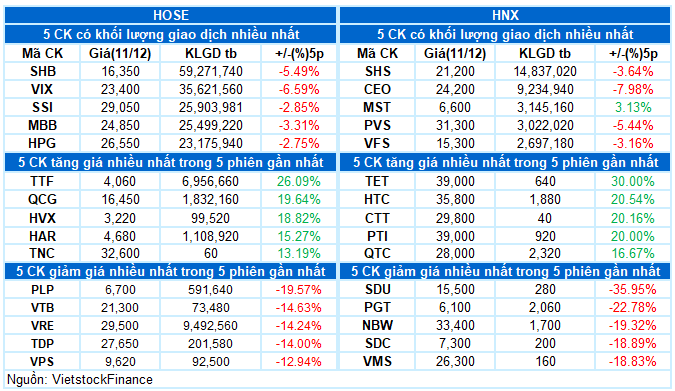

– Trading volume on the HOSE floor continued to decline by 4.1%, reaching just over 497 million units. In contrast, the HNX floor recorded 43 million matched units, a 14.5% increase compared to the previous session’s low.

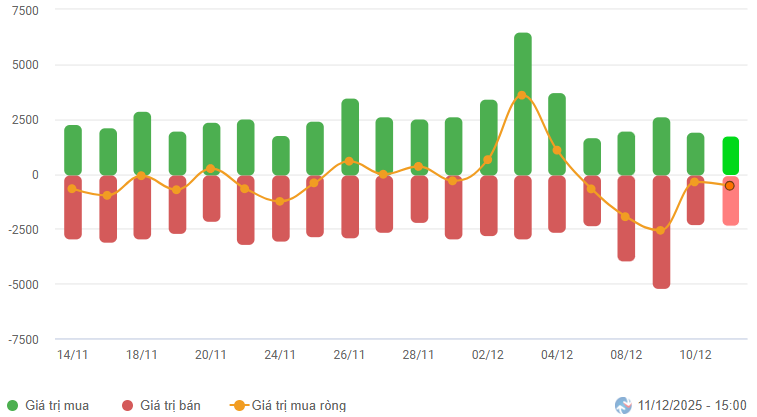

– Foreign investors continued to net sell, with a value of over 470 billion VND on the HOSE floor and 17 billion VND on the HNX floor.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

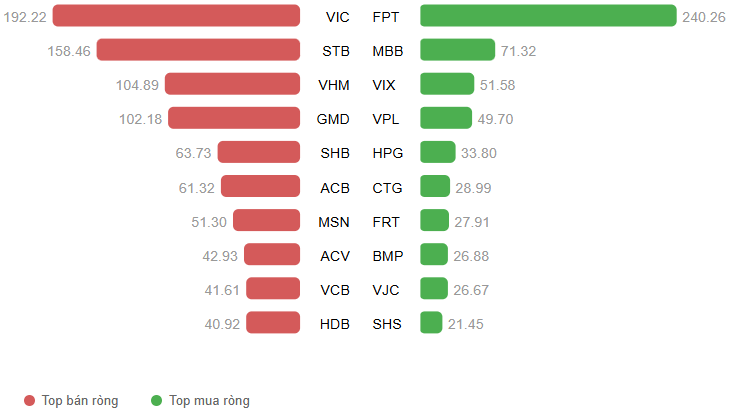

Net Trading Value by Stock Code. Unit: Billion VND

– The market extended its correction in the December 11 session under strong pressure from the pillar group right from the start. Vingroup stocks remained the dominant factor, weighing heavily on the VN-Index and making the recovery efforts of the rest seem fragile. The overall market remained polarized with a fairly balanced breadth, but liquidity continued to decline, reflecting investors’ cautious sentiment amid significant fluctuations in leading stocks. The VN-Index failed to hold the psychological threshold of 1,700 points, closing with a 1.17% decrease compared to the previous session, at 1,698.9 points.

– In terms of impact, VIC, VHM, and VPL were the most negatively influential, collectively deducting 7 points from the VN-Index. Meanwhile, no stock was strong enough to lead on the opposite side. The total contribution of the top 10 positive stocks only added a mere 1.5 points to the index.

Top Stocks Influencing the Index. Unit: Points

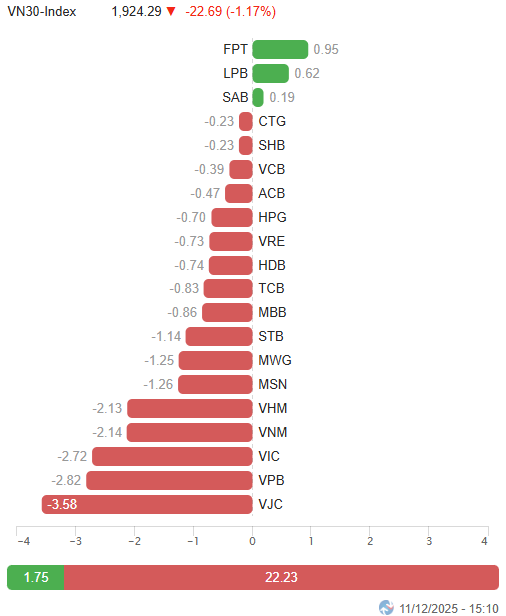

– The VN30-Index lost 22.69 points (-1.17%), closing at 1,924.29 points. The selling side dominated with 26 declining stocks, 3 advancing stocks, and 1 unchanged stock. Among these, VJC was the most negative, dropping sharply by 4.4%. Followed by VPB, VNM, and VHM, which all adjusted by more than 2%. In contrast, SAB was a bright spot, bucking the trend with a 1.6% increase, along with LPB and FPT maintaining slight gains.

Among sectors, non-essential consumer goods lagged with a 2.21% decline. This was primarily influenced by the adjustments in stocks such as VPL (-5.01%), MWG (-0.84%), HUT (-1.23%), DGW (-0.96%), VGG (-2.49%), SVC (-4.94%), and PET hitting the floor.

Large-cap groups such as real estate, finance, and industry also exerted significant pressure on the market, with numerous stocks declining by over 1%, including VIC, VHM, BCM, VRE, PDR, TAL; VCB, VPB, MBB, TCX, HDB, STB; VJC, GEE, SGP, HAH, and FCN. However, a few bright spots attracted good demand, such as QCG rising to the ceiling, KBC (+2.26%), HQC (+5%); VIX (+1.74%), ABB (+1.94%); ACV (+1.32%), and BMP, SHI, DRH, along with CC1 reaching their upper limits.

On the other hand, information technology and healthcare were the only sectors maintaining slight gains, primarily due to contributions from FPT (+0.42%), DLG (+4.29%), ITD (+1.35%); DVN (+1.97%), IMP (+0.62%), DHG (+0.49%), and DHD (+1.23%).

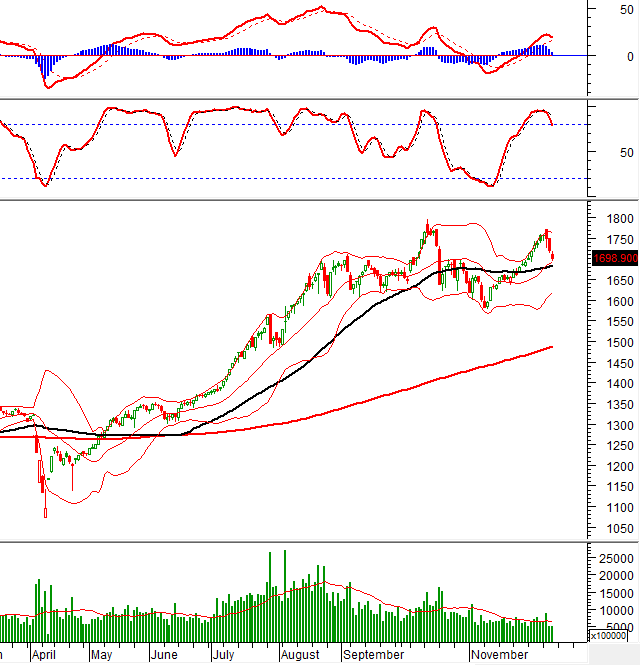

The VN-Index declined for the third consecutive session and is preparing to retest the Middle line of the Bollinger Bands. The Stochastic Oscillator indicator continues to decline after giving a sell signal and exiting the overbought zone. Simultaneously, the MACD is gradually narrowing its distance to the Signal line. The short-term outlook will become even more pessimistic if this indicator generates a sell signal in the upcoming sessions.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Preparing to Retest the Middle Line of the Bollinger Bands

The VN-Index declined for the third consecutive session and is preparing to retest the Middle line of the Bollinger Bands.

The Stochastic Oscillator indicator continues to decline after giving a sell signal and exiting the overbought zone. Simultaneously, the MACD is gradually narrowing its distance to the Signal line. The short-term outlook will become even more pessimistic if this indicator generates a sell signal in the upcoming sessions.

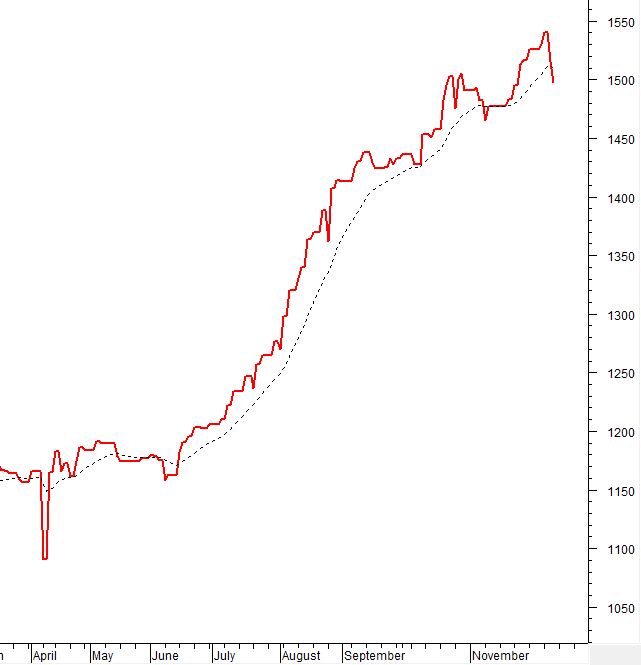

HNX-Index – Struggling at the November 2025 Low

The HNX-Index experienced a slight decline after struggling at the November 2025 low (equivalent to the 255-259 point range). Trading volume has consistently remained below the 20-day average, making it difficult to expect a significant breakthrough in the short term.

The index’s outlook remains bleak as the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index has crossed below the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign Capital Flow: Foreign investors continued to net sell in the December 11, 2025 trading session. If foreign investors maintain this action in the upcoming sessions, the situation will become even more pessimistic.

III. MARKET STATISTICS FOR DECEMBER 11, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:46 December 11, 2025

Tracking the Whale Money Flow on December 9th: Proprietary Traders and Foreign Investors Diverge, Vingroup Affiliates Grab Attention

The trading session on December 9th highlighted a stark contrast in the actions of foreign investors and securities company proprietary trading desks. Notably, Vingroup-affiliated stocks (VIC and VHM) took turns dominating both the net buying and net selling lists among major players.

Vietnam’s Stock Market Shows No Signs of a Bubble, with a 75% Probability of Gains in December

SSI Securities has revised its 2026 forecast for the VN-Index upward to 1,920 points, reinforcing its stance that Vietnam’s stock market is not in a bubble.