According to the announcement on December 5, 2025, the Board of Directors of Vinaconex issued Decision No. 2666/2025/QĐ-HĐQT, approving the acquisition of the entire share lot of the Vietnam Water and Environment Investment Corporation (stock code: VIW).

Specifically, Vinaconex plans to purchase 56,949,500 shares, equivalent to a 98.16% stake in Viwaseen’s charter capital. The Board has authorized the CEO to finalize and execute the necessary legal procedures to complete the transaction.

This move by Vinaconex follows the State Capital Investment Corporation (SCIC)’s earlier announcement of a public auction for the same share lot on October 20, 2025. SCIC set the starting price at over 1,231.2 billion VND, or 21,620 VND per share—approximately 86% higher than VIW’s market price on UPCoM at the time of the announcement.

Established in 1975, Viwaseen is a former state-owned enterprise specializing in construction, water supply, drainage, and real estate investment. Despite consistently generating annual revenues in the trillions of VND, the company’s profit margins remain slim.

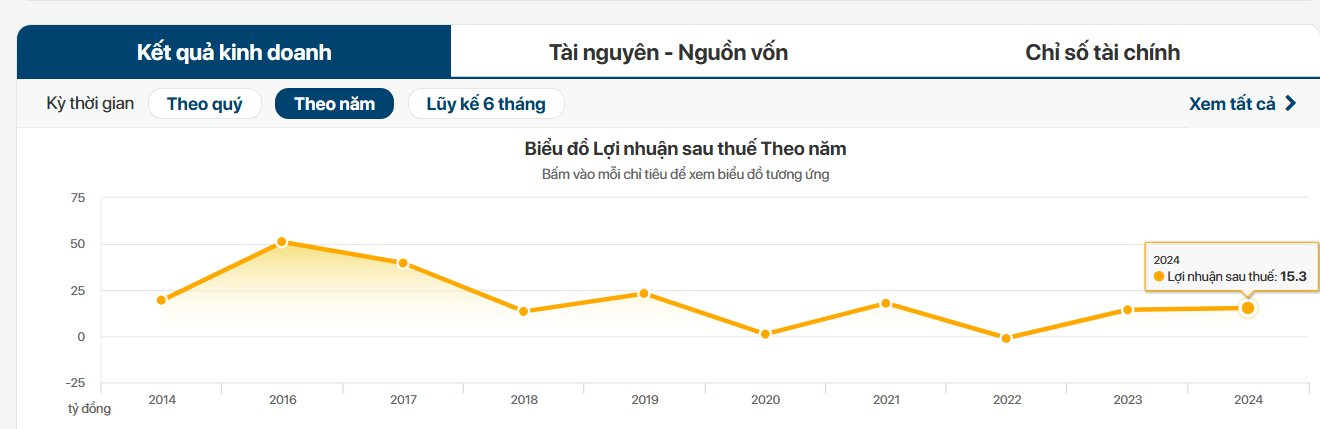

In 2020, Viwaseen reported a meager post-tax profit of just over 1 billion VND on revenue of 948 billion VND. After posting a loss in 2022, the company’s financial performance rebounded in the past two years, stabilizing at an annual profit of 14-15 billion VND.

However, Vinaconex, a construction and real estate giant, is not drawn to Viwaseen’s current financial metrics. Instead, its interest lies in the company’s prime land assets. According to Viwaseen’s prospectus, the company manages seven strategically located land plots in Hanoi and Hai Phong, totaling tens of thousands of square meters.

In Hanoi, Viwaseen’s portfolio includes a 10,270.5 m² plot in Ngoc Hoi Commune (Thanh Tri), an 8,209 m² plot at 48 To Huu Street (Dai Mo Ward), and a notable 12,555.7 m² plot at 56-58 Lane 85, Ha Dinh (Khương Dinh Ward). A standout asset is the 1,282 m² “golden land” plot at 52 Quoc Tu Giam, Dong Da District. In Hai Phong, the company oversees the Vong Hai residential area, spanning over 1.9 hectares, and industrial land plots in Dinh Vu.

Inside the $130 Million National Highway Upgrade Project in Can Tho

The Cần Thơ People’s Committee has directed relevant agencies and local authorities to prioritize land clearance for the upgrade and expansion of the first 7 km segment of National Highway 91, with a strict deadline of December 31.

SCIC’s Ambition to Become a Government Investment Fund: Learning from Temasek, Khazanah, or Danatara?

According to Mr. Nguyễn Chí Thành, Chairman of SCIC’s Board of Members, when granted sufficient authority and flexible mechanisms, SCIC will invest more professionally, transparently, and efficiently, gradually evolving into a Government Investment Fund model with an independent oversight system and transparent public information disclosure.

Skyrocketing 350% in One Month: Post-Divestment Rally Ahead of Extraordinary Shareholders’ Meeting

The stock’s price has surged an astonishing 350% over the past month, reaching an all-time high and marking a historic milestone in its trading history.