VN-Index Projected to Reach 1,920 Points by 2026

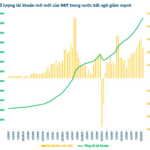

In a newly released market strategy report, SSI Securities (SSI Research) analyzed historical data from the past three years, revealing that the market typically performs positively between December and March. During this period, the probability of market gains stands at approximately 75%, significantly higher than the 50% observed from April to November. The average monthly return during December-March is 1.7%, notably outpacing the 0.5% monthly return from April to November.

SSI Research forecasts that liquidity may improve but will remain moderate. December liquidity is likely to mirror November levels due to persistent liquidity shortages in the banking system, as evidenced by high overnight interest rates. However, the listings of VPX and VCK in December could release investor capital. Additionally, the historical year-end cooling of overnight rates is expected to support market liquidity conditions.

While a significant surge in both index levels and liquidity is unlikely in December, recovery momentum observed in certain stock groups during November may extend to key sectors. Historical data indicates that banking and basic materials sectors typically outperform in December.

Vietnam aims for double-digit GDP growth between 2026 and 2030, supported by structural reforms, robust FDI inflows, and accelerated infrastructure investment. These factors are anticipated to establish a solid foundation for sustainable stock market growth.

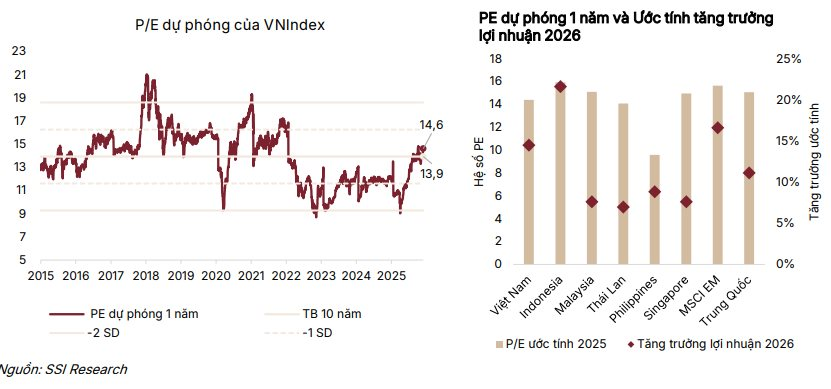

Consequently, SSI analysts have revised their 2026 VN-Index target upward to 1,920 points. Currently, the index trades at a 2025 P/E ratio of approximately 14.5 times, in line with regional markets, but with superior 2026 profit growth prospects (14.5% vs. 11.5% regional average). This positions the VN-Index’s PEG ratio at an attractive 0.96 times, significantly below the regional average of 1.44 times.

By 2026, the projected P/E ratio is around 12.7 times, still below the 10-year historical average of 14 times, further enhancing the market’s valuation appeal.

Capital Market Reforms with Breakthroughs

Alongside valuation dynamics, capital market reforms are pivotal in strengthening the market’s long-term growth foundation.

SSI reports that Vietnam is accelerating capital market reforms with significant breakthroughs, including: simplified trading account opening procedures, resolving pre-funding margin issues, and expanding access for global brokerage firms.

Furthermore, Decree 245/2025 strengthens the legal framework by prohibiting foreign ownership caps below legal thresholds and lays the groundwork for a Central Counterparty Clearing (CCP) mechanism, expected to launch in late 2026.

Notably, expanding global brokerage access through Straight-Through Processing (STP) systems automates securities trading and settlement, minimizes manual intervention, shortens settlement cycles, and streamlines operations to international standards.

With a credit-to-GDP ratio of approximately 140%, Vietnam urgently needs to deepen its capital markets to reduce reliance on bank credit and mobilize long-term funding for infrastructure and innovation. These reforms aim to enhance financial system integration and investor confidence.

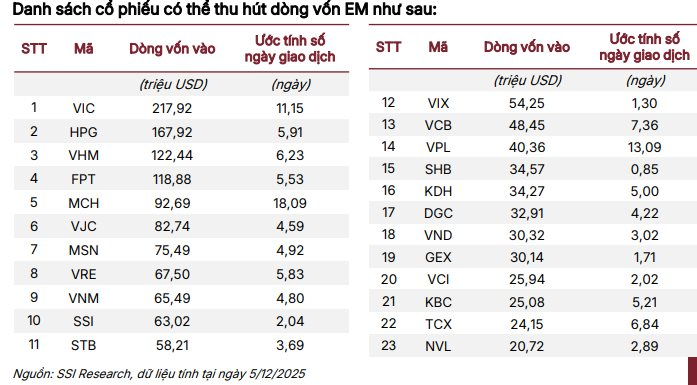

Following FTSE Russell’s upgrade of Vietnam to Emerging Market status, SSI estimates: “This could attract approximately $1.5 billion in passive ETF inflows.”

Key Sectors Poised to Attract Investment

Based on these insights, SSI analysts highlight five key investment themes:

Banking is expected to maintain stable growth, with projected 16% profit growth driven by real estate market recovery and sustained credit demand. SSI favors banks with strong growth prospects and attractive valuations.

Consumer Recovery: Consumer stocks are anticipated to sustain double-digit growth, fueled by retail network expansion, market share gains, and supportive policies, including the January 2026 tax threshold increase.

Real Estate and Public Investment will benefit from robust construction activity and increased infrastructure spending. SSI Research favors building materials over construction firms due to more attractive valuations. Real estate companies may face slower 2026 profit growth, making them better suited for short-term trading.

Policy Beneficiaries such as fertilizers and petroleum will gain from input VAT deduction mechanisms or new petroleum business regulations.

Information Technology may rebound in 2026 after a sluggish 2025, with current low valuations presenting attractive entry points.

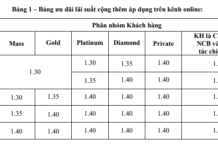

KBSV – Breakout Trading Season: Win Up to 729 Million VND

As the market enters its bustling year-end trading phase, individual investors are returning in force, seeking profitable opportunities. Seizing this momentum, KBSV launches the *Breakout Trading Season 2025* competition, running until January 30, 2026, with a total prize pool of 729 million VND. This exciting event is exclusively designed for individual traders using the KB Buddy app and KB Buddy WTS platform.