After a remarkable nine-session rally, Vietnam’s stock market faced a correction as it approached its previous peak. The VN-Index experienced two consecutive sharp declines, dropping below 1,720 points. Notably, the 1.6% drop (over 28 points) on December 10th made Vietnam the worst-performing market in Asia that day.

The December 10th sell-off was concentrated on stocks that had recently surged, such as Vingroup, Vietjet (VJC), and Sabeco (SAB). Notably, four Vingroup-affiliated stocks (VIC, VHM, VPL, VRE) alone wiped out 27 points from the VN-Index. These stocks had previously led the market’s rally, making profit-taking inevitable.

However, investors remain optimistic that the correction will be moderate. Many blue-chip stocks have yet to see significant gains, with some trading at attractive levels after the previous peak’s pullback. Dip-buying activity is expected to resume unless negative news emerges.

SSI Research’s latest market strategy report highlights historical data showing positive market performance from December to March over the past three years. During this period, the probability of market gains reaches approximately 75%, significantly higher than the 50% average for the rest of the year. Average monthly returns are also superior.

SSI Research forecasts improved liquidity, albeit remaining moderate due to ongoing banking system liquidity constraints. However, the December listings of VPX and VCK could release investor capital. Additionally, the historical year-end decline in overnight interest rates is expected to support market liquidity.

While SSI Research doesn’t anticipate a significant December rally in both price and liquidity, recovery momentum observed in certain stock groups during November may spread to key sectors. Historical data indicates that banking and basic materials sectors typically outperform in December.

Long-term prospects remain positive, with Vietnam targeting double-digit GDP growth in 2026–2030, supported by structural reforms, robust FDI inflows, and accelerated infrastructure investment. These factors are expected to underpin sustainable stock market growth.

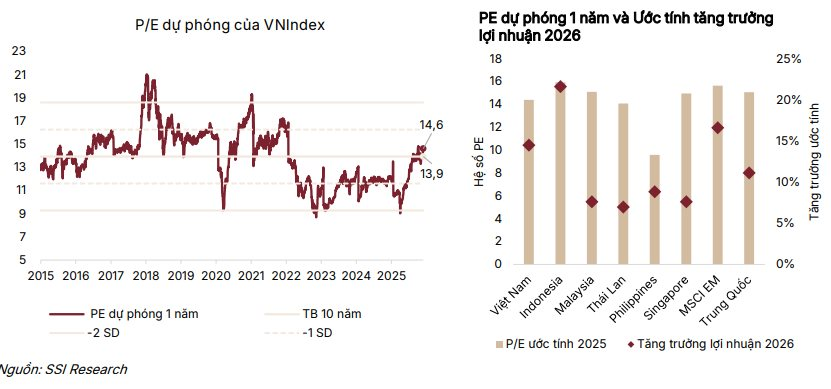

Consequently, SSI Research raised its 2026 VN-Index target to 1,920 points. Currently trading at a 2025 P/E of approximately 14.5x, in line with regional peers, Vietnam’s 2026 earnings growth outlook is superior (14.5% vs. 11.5% regional average). This results in an attractive PEG ratio of 0.96x, significantly below the regional average of 1.44x.

Dragon Capital shares this optimism, citing Vietnam’s strong fundamentals for continued growth in 2025–2026. Earnings of 80 tracked companies are projected to grow 21.3% in 2025 and 16.2% in 2026, exceeding expectations. Attractive valuations (2025 P/E: 12.5–13x; 2026 P/E: 11x) and superior earnings growth compared to regional peers further enhance the market’s appeal.

Vietnam’s upgrade from frontier to emerging market status is expected to trigger significant re-rating as substantial international capital inflows fuel a new growth cycle.

Even more bullish, Petri Deryng, head of PYN Elite Fund, believes macroeconomic policies are creating an increasingly favorable environment for Vietnam’s economic growth and listed company earnings. The fund has set an ambitious 3,200-point VN-Index target for 2028, assuming 18–20% average annual earnings growth.

VN-Index Projected to Hit 1,920 Points by 2026: Brokerages Highlight Key Sectors Poised to Attract Investment in the Coming Years

By 2026, SSI forecasts a projected P/E ratio of approximately 12.7 times, which remains below the 10-year historical average of 14 times. This valuation gap underscores the market’s continued attractiveness from a pricing perspective.

Vietnam’s Billionaire Pham Nhat Vuong Hits Record-Breaking 1.2 Quadrillion VND Milestone

Vingroup’s remarkable surge has propelled its market capitalization to nearly $52 billion, making it the first Vietnamese corporation to achieve this historic milestone.