According to experts, reducing the number of tax brackets and widening the income gaps between them is a common trend in many countries. This approach simplifies procedures, enhances transparency, and reduces the risk of “bracket creep.” The new tax structure maintains the principle of vertical equity, ensuring that higher earners pay more taxes, but with a more reasonable progression, thereby easing the burden on workers.

While the average income of workers has significantly increased, the old tax brackets have remained unchanged for over a decade. This has led to many individuals with relatively low incomes still being subject to taxation. Therefore, adjusting the tax brackets by reducing their number and widening income gaps will alleviate the burden on middle-income workers, providing them with greater motivation to work.

Many workers will benefit from the new tax policy. (Photo: Government News)

Mr. Nguyễn Quang Huy, CEO of the Faculty of Finance and Banking at Nguyễn Trãi University, analyzed: “The National Assembly’s approval of the amended Personal Income Tax Law marks a significant step in modernizing the tax system, aligning it with the new economic development phase. In a context where production and business activities are increasingly diverse, labor capacity is expanding, and innovation is thriving, the new tax policy—with its simpler, more rational, and flexible structure—is expected to support individuals, households, and businesses in achieving stable and sustainable growth.”

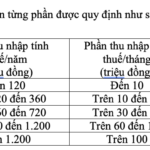

According to Mr. Huy, reducing the tax brackets from seven to five is not merely a technical adjustment but reflects innovative thinking in policy-making. It makes the system more accessible and easier to calculate, empowering individuals to plan their income more proactively. Lowering intermediate tax rates (from 15% to 10% and from 25% to 20%) directly benefits the middle-income group, which constitutes the largest and most dynamic workforce today.

“Widening the gaps between tax brackets helps reduce sudden tax increases as income rises. This humane approach encourages workers to enhance their skills, increase their income, and contribute more without excessive tax concerns,” Mr. Huy emphasized.

Calculations show that an individual with one dependent earning a monthly income of 20 million VND from wages previously paid 125,000 VND in taxes. Under the new policy, after applying the family deduction and the revised tax brackets, they will no longer need to pay taxes.

For those earning 25 million VND per month, the tax payable decreases from 448,000 VND to 34,000 VND, a reduction of 92%.

Similarly, individuals earning 30 million VND will see a 73% reduction in their tax liability.

In addition to low-to-middle-income workers, the Ministry of Finance notes that higher-middle-income earners will also benefit from reduced tax burdens.

Specifically, the 5% tax rate in bracket 1 applies to taxable income between 0 and 10 million VND per month, equivalent to a wage income of 20 to 35 million VND. The bracket 2 tax rate applies to taxable income between 10 and 30 million VND, equivalent to a wage income of 35 to 56 million VND…

“The new tax brackets will reduce the amount payable for all individuals while addressing the issue of sudden tax increases between brackets,” the Ministry of Finance affirmed.

According to Mrs. Nguyễn Thị Cúc, Chairwoman of the Vietnam Tax Consultancy Association, the design of the bracket gaps accurately reflects contribution capacity. Most salaried workers with moderate incomes now fall under brackets 2 and 3 in the new tax structure.

Increasing the family deduction means many workers will no longer be subject to taxation.

With the bracket 2 tax rate reduced from 15% to 10%, the group bearing the largest tax burden will see a significant decrease in their monthly tax payments.

Additionally, reducing the bracket 3 tax rate from 25% to 20% will provide financial flexibility for higher-income workers, who typically represent a large portion of the office, finance, technical, and technology sectors.

“The new tax structure aligns with international trends in improving the tax environment to support the middle-income class, a group crucial for consumption and economic growth,” Mrs. Cúc emphasized.

Attorney and tax expert Nguyễn Văn Được, CEO of Trọng Tín Accounting and Tax Consulting Company, also noted that the lower tax brackets have been adjusted to provide support, with brackets 1 and 2 maintained at 5% and 10%. Additionally, widening the income gaps between brackets 1 and 2 offers a dual benefit to taxpayers.

“This not only benefits low-income earners but also indirectly benefits higher-income individuals through increased tax thresholds. Therefore, maintaining a higher tax bracket to ensure the principle of ‘fiscal neutrality’ is essential,” Attorney Được stated.

Increased Family Deduction Threshold

Furthermore, starting from the next tax year, the family deduction for taxpayers will increase to 15.5 million VND per month, and the deduction for dependents will rise to 6.2 million VND per month. Individuals can deduct insurance payments, family deductions, allowances, and subsidies, with the remaining amount considered taxable income.

According to experts, with the new deduction, a taxpayer with no dependents will not be subject to tax if their income is 17 million VND per month and will only pay tax if their income exceeds 17.285 million VND per month.

For example, an individual earning 17 million VND per month contributes 10.5% of their salary to mandatory social insurance, including 8% for social insurance, 1.5% for health insurance, and 1% for unemployment insurance. This totals 1.785 million VND. Combined with the personal deduction of 15.5 million VND, the total deductions amount to 17.285 million VND, exceeding their income, so they are not subject to tax.

Similarly, with one dependent, the tax threshold increases to 24.22 million VND per month, and with two dependents, it rises to 31.155 million VND per month.

Mrs. Nguyễn Thị Cúc assessed: “Adjusting the family deduction this time is a correct move, reflecting the humane aspect of tax policy. Workers will face less pressure on expenses and have more savings, improving their quality of life and boosting consumption.”

According to Mrs. Cúc, as disposable income increases, people will spend more, thereby stimulating overall economic demand.

“Although state budget revenue may decrease in the short term, in the long run, the economy will become more vibrant, with production and business activities flourishing, leading to more sustainable budget revenue,” Mrs. Cúc emphasized.

Major Personal Income Tax Rate Changes Effective July 1, 2026

The Personal Income Tax (PIT) regime has undergone significant changes with the passage of the amended Personal Income Tax Law by the National Assembly during its 10th session.

When Capital Gains Tax Applies to Real Estate Transfers: Essential Information

The Ministry of Finance has announced that once sufficient digitized land data is linked to the VNeID system, it will gradually implement income tax collection on real estate transfer income, accurately reflecting its true nature. However, tax policies are not considered the primary or most effective tool to curb real estate speculation.

VIDEO: Dragon Capital Chairman Discusses Benefits of 5 Million Household Businesses Upgrading to Enterprises

The transformation of sole proprietorships into formal businesses has the potential to contribute a 1% annual increase to GDP over the next three years.