At the Vietnam Real Estate Conference – VRES 2025, Mr. Đinh Minh Tuấn, Regional Director of the Southern Region at Batdongsan.com.vn, shared insights on the real estate market in 2025. He noted that while the market is recovering, it remains fragmented across regions and segments.

Mr. Đinh Minh Tuấn, Regional Director of the Southern Region at Batdongsan.com.vn

According to Batdongsan.com.vn’s data, interest in real estate sales nationwide has rebounded compared to Q1 2023. Prices continue to rise in areas with genuine housing demand or those benefiting from infrastructure development.

A Q4 2025 survey of real estate agents by Batdongsan.com.vn revealed a stark divide. While 48% reported a decline in transactions, only 14% noted an increase, and 35% observed stable activity.

Amid this landscape, apartments remain the market leader, with 37% of agents reporting increased transactions, reflecting sustained genuine demand. Single-family homes also performed well, with 26% of agents noting growth and over half reporting stability.

Conversely, land plots and villas showed signs of cooling, with approximately 40% of agents reporting decreased transactions. Townhouses also stagnated, with 29% of agents noting declines and half reporting a flat market.

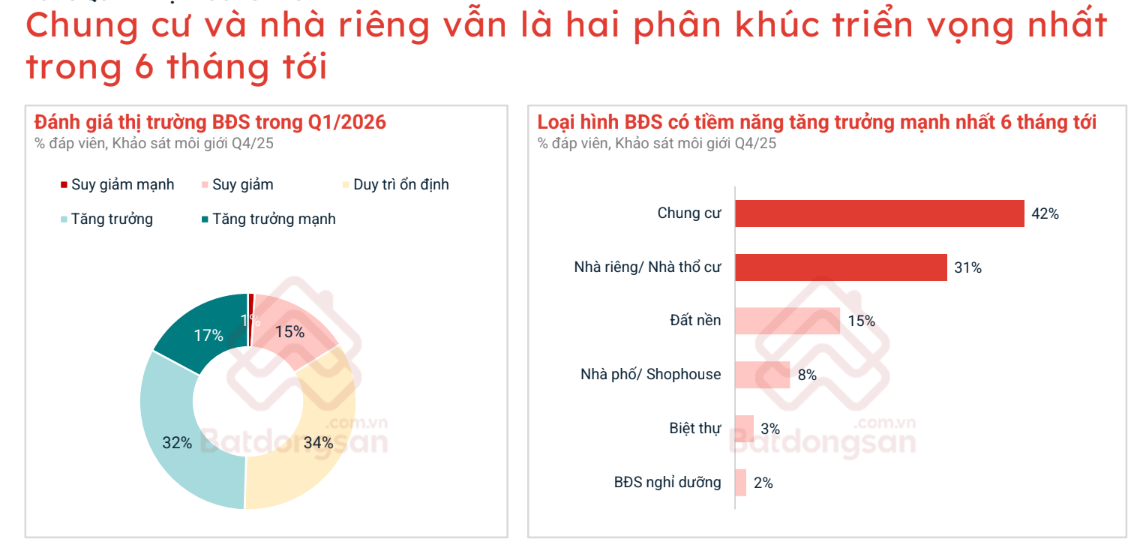

The survey highlighted a positive outlook: most agents believe apartments and single-family homes will continue to drive the market over the next six months.

Mr. Tuấn predicts apartment prices will rise further in early 2026, driven by high-end supply pushing up average prices. Genuine demand, rising land costs, construction expenses, and incomplete supply also contribute. Buyers are increasingly shifting from single-family homes to apartments with better infrastructure.

Single-family homes and residential land are projected to grow by 31% in 2026. Despite lower transaction volumes, prices in Q4 2025 remained high.

Analyzing Vietnam’s two largest markets, Mr. Đinh Minh Tuấn highlighted distinct recovery drivers. Hanoi’s resurgence is fueled by genuine demand in the inner city and the ripple effect of ring roads, boosting apartments and single-family homes. In contrast, Ho Chi Minh City’s market is driven by regional infrastructure projects and emerging satellite cities, catering to outward migration from the city center.

Mr. Nguyễn Quốc Anh, Deputy General Director of Batdongsan.com.vn, noted no widespread land speculation yet. Hotspots are tied to administrative boundary changes, while transactions focus on apartments and single-family homes in major cities.

“The market may remain cautious in the short term, but the recovery cycle began in 2024 and has room to grow. I expect 2026 to bring clearer segmentation and greater stability. A repeat of 2022’s volatility is highly unlikely,” Mr. Quốc Anh concluded.

Is Vietnam’s Real Estate Market Following in China’s Footsteps?

Amid the relentless surge in housing prices over recent years, investors are increasingly apprehensive as the government begins to implement more stringent tightening policies. This raises the question: Could Vietnam’s real estate market face a “black swan” event akin to China’s aftermath of the Evergrande Group crisis?

Skyrocketing Condo Prices Fueled by Weak Supply

Property prices in Hanoi and Ho Chi Minh City continue to soar, with many projects reaching 150–180 million VND per square meter. Experts attribute this surge not to speculation, but to a scarcity of supply, rising land costs, legal complexities, and a prolonged supply-demand imbalance.