The VN-Index has experienced three consecutive sessions of decline, with a total adjustment of nearly 55 points, pushing the index below the 1,700-point mark (closing session on December 11). The market has become increasingly unpredictable, as the upward trend primarily relies on the Vingroup stock group, while most other stocks fail to share in the gains.

However, when the Vingroup stocks decline, it was expected that investors would seek new opportunities. Yet, many stocks not only failed to maintain their prices but also plunged further, leaving investors further from recovery amidst the prevailing cautious sentiment.

With strong divergence, narrowing breadth, and widespread selling pressure, a critical question arises: What lies ahead for the market, and what is the most reasonable short-term scenario for the VN-Index?

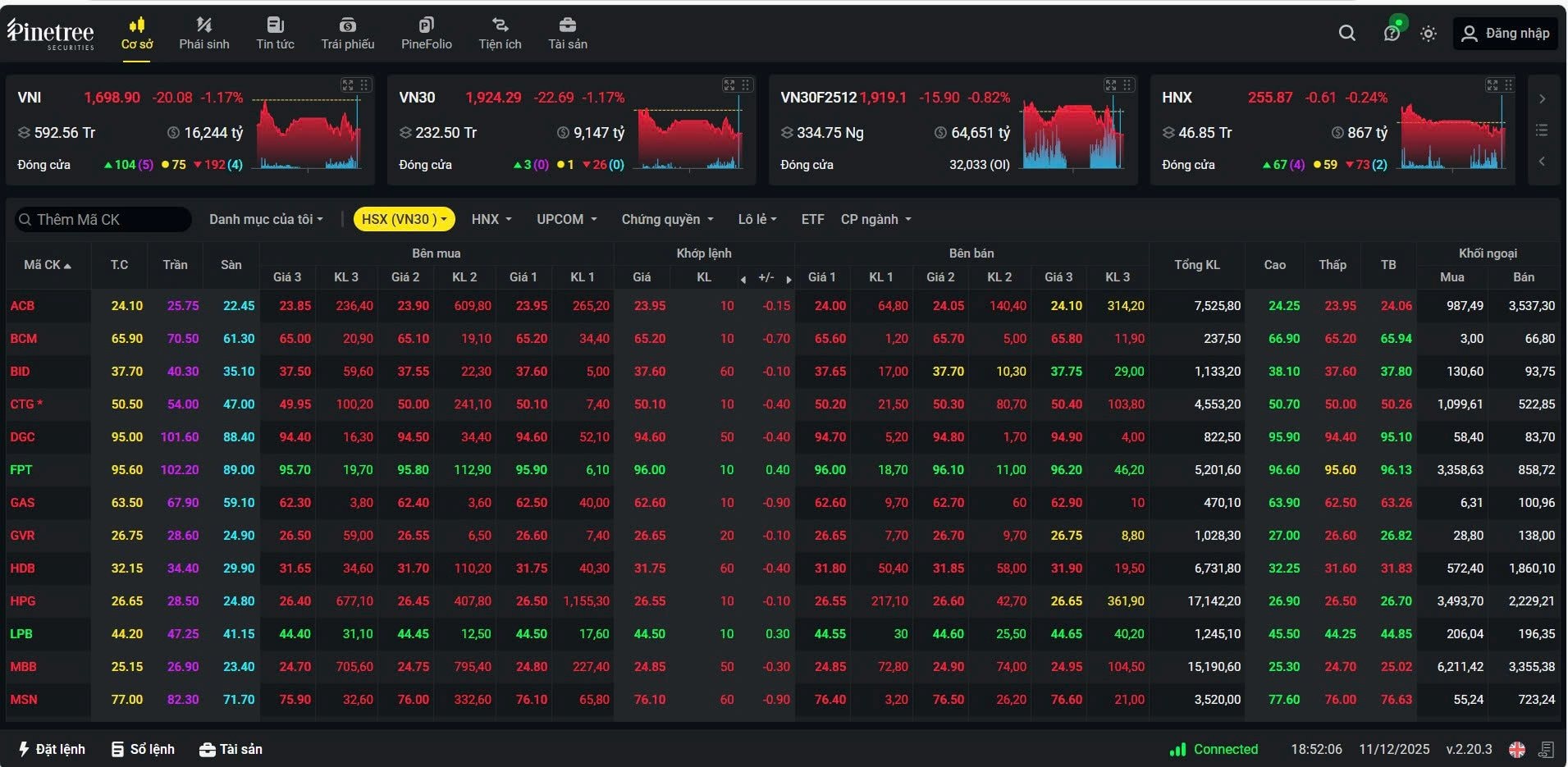

Pinetree Securities Stock Price Board

Commenting on market developments, Mr. Nguyễn Đức Khang, Head of Securities Analysis at Pinetree, pointed out that over the past month, despite the VN-Index’s strong gains, there has been a phenomenon of “green on the outside, red on the inside.”

“It can be said that the VN-Index’s upward movement does not accurately reflect the actual performance of the overall stock market,” the Pinetree expert stated.

From the bottom of the November 10 adjustment, the VN-Index has risen by over 166 points, from 1,580 to 1,747 points on December 9. However, upon closer examination, this increase is primarily driven by the Vingroup stock group. Specifically, VIC, VPL, and VHM contributed 137 points.

Market liquidity has remained around 600–700 million shares per session, indicating that capital flow is not abundant and is concentrated in a localized group of stocks. This has resulted in the VN-Index’s gains lacking broader market participation.

Excluding Vingroup Stocks, the Market Likely Near Bottom

At present, the expert believes the market is showing more positive signals. In terms of index points, the VN-Index’s recent adjustments are mainly due to the sharp decline in Vingroup stocks with increased liquidity. However, other stock groups have not witnessed panic selling.

This contrasts significantly with the late October decline, when the market lacked upward momentum, liquidity weakened, and VIC’s correction dragged the entire market down.

According to the expert, excluding the impact of Vingroup stocks on the index, the market is likely near its bottom. Additionally, with limited time left in the year, market liquidity is expected to remain at current levels.

Under a low liquidity scenario, stocks that saw explosive trading in September–November will face significant resistance due to many investors being trapped at high prices. These groups need more accumulation time, making end-of-year wave strategies in sectors like banking or securities less suitable.

Instead, the Pinetree expert suggests investors focus on stocks with breakout potential in late 2025 and early 2026, with moderate liquidity over the past three months. The two most promising groups are public investment and oil & gas, particularly public investment, as Q4 revenue and profit are expected to surge due to accelerated disbursement pressure.

A New Uptrend is Forming

Another critical factor influencing the market is interest rate movements.

Mr. Khang observed that as the year-end approaches, the market is showing less favorable signs as interest rates begin to rise again. After a prolonged period of high credit growth, banks are facing liquidity shortages and LDR ratio pressures, forcing many to raise deposit rates, especially for short-term deposits under 6 months.

The overnight interbank interest rate surpassing 7% highlights a clear “cash shortage,” making it challenging for stock market liquidity to surge amid restricted credit.

However, the expert anticipates that these constraints will gradually ease in 2026 as technical bottlenecks like exchange rates and credit growth are reset. This will provide the Government and the State Bank with more room to support the economy and monetary liquidity. Once these factors improve, the market could form a new uptrend in Q1, similar to recent years.

How Does Becamex IDC Secure Funding Without Selling Shares?

Becamex IDC sought to publicly offer 150 million BCM shares, but the proposal failed to gain shareholder approval. The company has consistently turned to bond issuance as a means to secure capital.

December 12: Ring and Bullion Gold Prices Surge as Global Gold Reaches Near 2-Month High

Global gold prices surged to their highest level in nearly two months, following the Federal Reserve’s decision to cut benchmark interest rates by an additional 0.25%. Domestically, gold prices rose sharply, climbing between 900,000 and 1.1 million VND per tael compared to yesterday’s closing levels.

Sprint to Disburse Public Investment Funds

As 2025 draws to a close, numerous public investment projects are racing against time to meet their deadlines. Amidst economic pressures, over 1 million billion VND in public investment capital is seen as a crucial catalyst to drive growth and unlock private sector resources.