Becamex Group (Industrial Investment and Development Corporation, Stock Code: BCM, Listed on HoSE) has officially announced the results of its bond issuance to the Hanoi Stock Exchange (HNX) and Ho Chi Minh City Stock Exchange (HoSE).

On December 8, 2025, Becamex Group successfully issued the BCM12504 bond series, comprising 9,000 bonds with a face value of VND 100 million each, totaling VND 900 billion. These bonds have a 3-year maturity and are expected to mature on December 8, 2028.

Illustrative Image

Additionally, from November 10 to November 11, 2025, Becamex Group completed the issuance of 6,600 BCM12503 bonds in the domestic market.

With a face value of VND 100 million per bond, this series raised a total of VND 660 billion, also with a 3-year maturity, set to mature on November 10, 2028.

Previously, Becamex Group’s Board of Directors approved the plan for the second private bond issuance of 2025, along with the allocation of proceeds.

The company plans to issue up to 20,000 bonds with a face value of VND 100 million each, aiming to raise VND 2,000 billion.

These non-convertible, asset-backed bonds will be issued in the domestic market through book-entry form, in up to 5 tranches. Each tranche will have a maturity ranging from 3 to 5 years, with the issuance scheduled between October and December 2025.

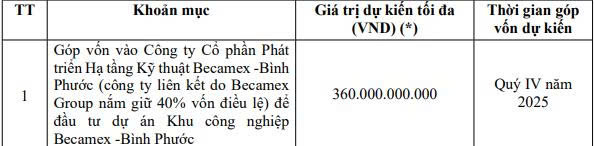

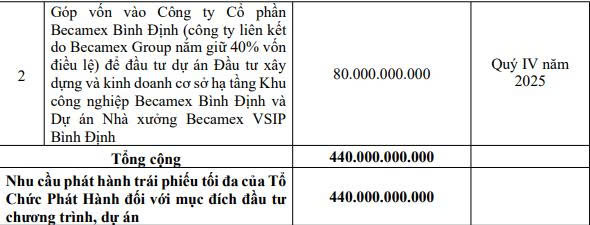

The primary purpose of this bond issuance is to restructure the company’s debt and fund various investment projects throughout 2025.

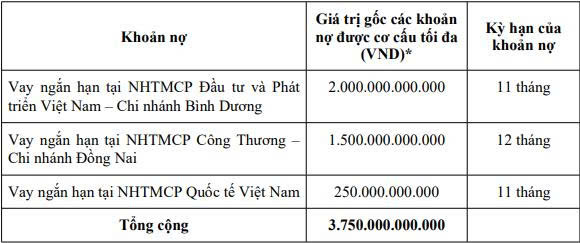

Specifically, Becamex Group intends to use the proceeds to settle principal and interest payments on the following debts:

Source: BCM

Source: BCM

Tam Trinh Construction Raises VND 2 Trillion via Bond Issuance in One Week

With the issuance of VND 1,100 billion in bonds under the code TAT32502, Tam Trinh Construction has successfully mobilized a total of VND 2,000 billion through the bond channel in just one week.

Billion-Dollar Bond Windfall Secured by TNR Stars Vinh Bao for Investors

May – Diêm Sài Gòn, the developer of TNR Stars Vĩnh Bảo, has successfully raised 1.000 billion VND through the issuance of the MSG32508 bond series.